Paperwork

Legal Aid for Nonprofit Paperwork Filing

Introduction to Nonprofit Paperwork Filing

Filing paperwork for a nonprofit organization can be a daunting task, especially for those who are new to the process. With numerous forms to complete and deadlines to meet, it’s easy to feel overwhelmed. However, navigating the complexities of nonprofit paperwork filing is crucial for ensuring the success and legitimacy of the organization. In this article, we will delve into the world of nonprofit paperwork filing, exploring the various requirements, best practices, and available resources for obtaining legal aid.

Understanding Nonprofit Paperwork Requirements

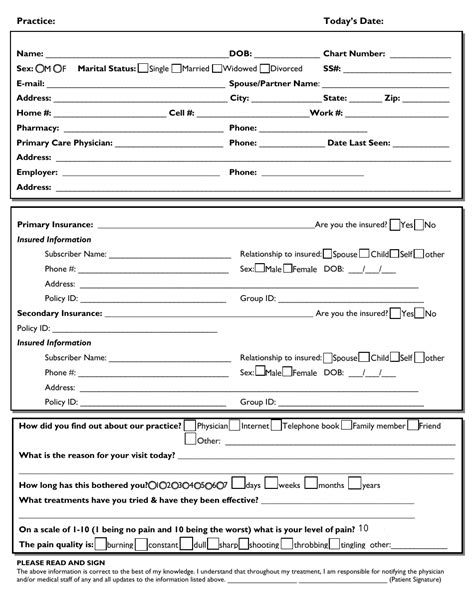

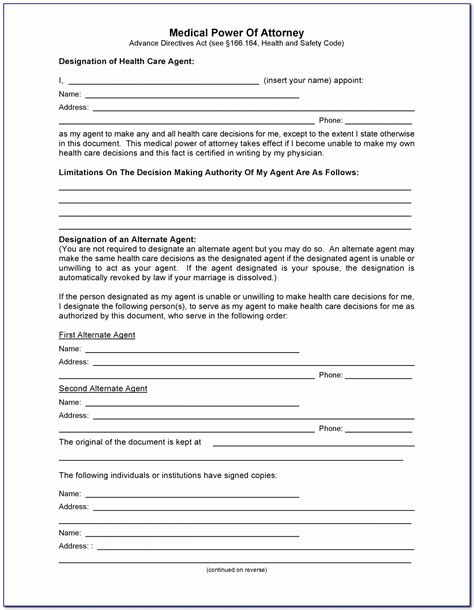

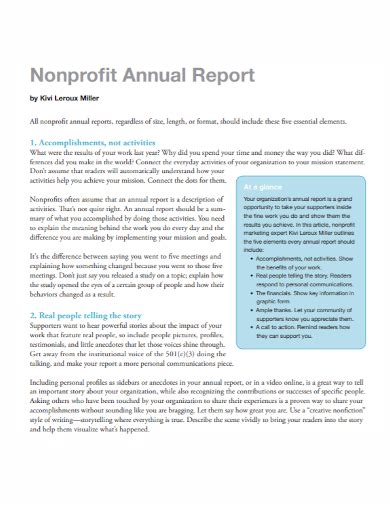

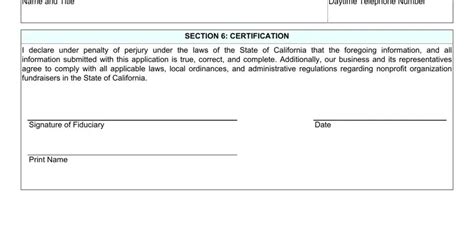

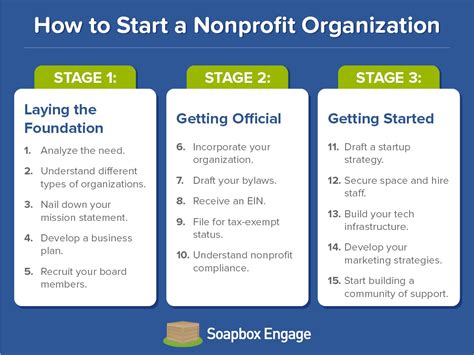

Nonprofit organizations are required to file various documents with the state and federal governments to maintain their tax-exempt status. The most critical documents include: * Articles of Incorporation: This document establishes the nonprofit as a corporation and outlines its purpose, structure, and powers. * Bylaws: The bylaws outline the rules and procedures for the nonprofit’s internal governance, including the roles and responsibilities of its board members and officers. * Form 1023: This application is submitted to the Internal Revenue Service (IRS) to obtain tax-exempt status under Section 501©(3) of the Internal Revenue Code. * Annual Reports: Nonprofits must file annual reports with the state and federal governments, providing information on their financial activities, governance, and programs.

Obtaining Legal Aid for Nonprofit Paperwork Filing

Given the complexity of nonprofit paperwork filing, it’s essential to seek legal aid to ensure compliance with all relevant laws and regulations. There are several options available for obtaining legal aid, including: * Pro Bono Services: Many law firms offer pro bono services, providing free or low-cost legal assistance to nonprofit organizations. * Nonprofit Support Organizations: Organizations like the National Council of Nonprofits and the Nonprofit Leadership Alliance offer resources, training, and guidance on nonprofit paperwork filing. * Online Resources: Websites like the IRS website, the National Association of State Charity Officials, and the Nonprofit Coordinating Committee of New York provide valuable information and guidance on nonprofit paperwork filing.

📝 Note: When seeking legal aid, it's crucial to ensure that the provider has experience in nonprofit law and is familiar with the specific requirements of your organization.

Best Practices for Nonprofit Paperwork Filing

To ensure successful nonprofit paperwork filing, it’s essential to follow best practices, including: * Plan Ahead: Allow sufficient time to complete and submit all required documents, taking into account deadlines and potential delays. * Seek Professional Advice: Consult with an attorney or experienced nonprofit professional to ensure compliance with all relevant laws and regulations. * Keep Accurate Records: Maintain detailed and organized records of all paperwork filing, including receipts, correspondence, and submission confirmation. * Stay Up-to-Date: Regularly review and update paperwork to reflect changes in the organization’s structure, governance, or programs.

Common Challenges in Nonprofit Paperwork Filing

Despite the importance of nonprofit paperwork filing, many organizations face challenges in completing the process. Common issues include: * Lack of Resources: Insufficient funding, staff, or expertise can hinder an organization’s ability to complete paperwork filing. * Complexity of Requirements: The numerous and often complex requirements for nonprofit paperwork filing can be overwhelming, especially for small or newly established organizations. * Deadline Pressures: Missing deadlines can result in penalties, fines, or even loss of tax-exempt status, emphasizing the need for careful planning and time management.

| Document | Purpose | Deadline |

|---|---|---|

| Articles of Incorporation | Establishes the nonprofit as a corporation | Varies by state |

| Bylaws | Outlines internal governance and procedures | No specific deadline |

| Form 1023 | Applies for tax-exempt status under Section 501(c)(3) | No specific deadline, but recommended within 27 months of incorporation |

| Annual Reports | Provides information on financial activities, governance, and programs | Varies by state and federal government |

Conclusion and Future Directions

In conclusion, nonprofit paperwork filing is a critical aspect of establishing and maintaining a legitimate and successful nonprofit organization. By understanding the requirements, seeking legal aid, and following best practices, organizations can navigate the complexities of paperwork filing and ensure compliance with all relevant laws and regulations. As the nonprofit sector continues to evolve, it’s essential for organizations to stay informed and adapt to changes in requirements and regulations, ultimately ensuring the long-term success and impact of their mission.

What is the purpose of filing Form 1023?

+

Form 1023 is an application submitted to the Internal Revenue Service (IRS) to obtain tax-exempt status under Section 501©(3) of the Internal Revenue Code.

What are the consequences of missing a deadline for nonprofit paperwork filing?

+

Missing deadlines can result in penalties, fines, or even loss of tax-exempt status, emphasizing the need for careful planning and time management.

Where can I find resources and guidance on nonprofit paperwork filing?

+

Resources and guidance on nonprofit paperwork filing can be found through organizations like the National Council of Nonprofits, the Nonprofit Leadership Alliance, and the IRS website.