5 Cobra Paperwork Tips

Introduction to Cobra Paperwork

When it comes to managing health insurance, especially in situations involving job loss or significant life changes, understanding and navigating Cobra paperwork is essential. The Consolidated Omnibus Budget Reconciliation Act (COBRA) of 1985 allows certain former employees, retirees, spouses, former spouses, and dependent children to temporarily continue health coverage at group rates. However, dealing with Cobra paperwork can be daunting due to its complexity and the critical nature of the decisions involved. In this article, we will delve into the world of Cobra paperwork, providing you with 5 crucial tips to ensure you make the most out of this provision without getting lost in the bureaucracy.

Understanding Cobra Eligibility

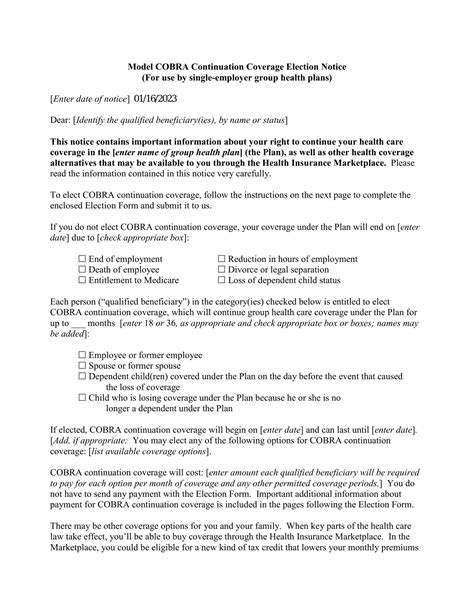

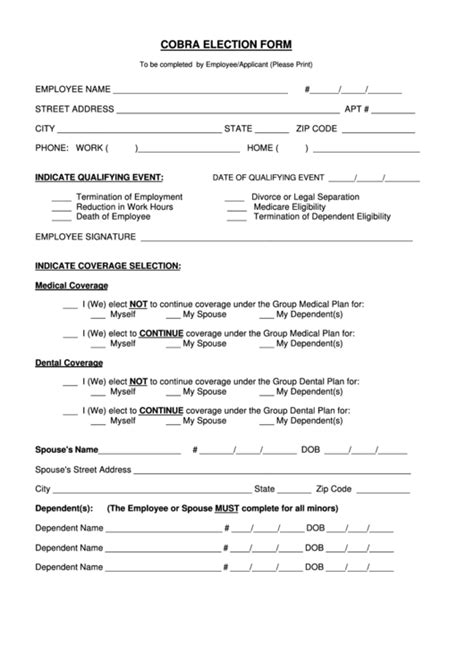

Before diving into the paperwork, it’s vital to understand who is eligible for Cobra benefits. Generally, individuals who experience a qualifying event such as job loss, reduction in work hours, death of the covered employee, divorce, or a child losing dependent status may be eligible. However, the specifics can vary, and not all employers are required to offer Cobra coverage. Understanding your eligibility is the first step in managing your Cobra paperwork effectively.

Tips for Managing Cobra Paperwork

Here are five tips to help you navigate the complex world of Cobra paperwork:

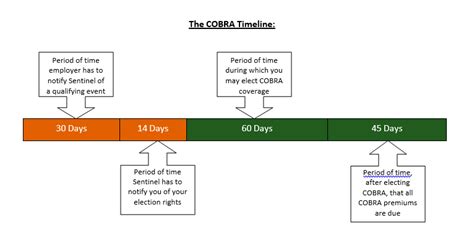

- Act Promptly: When you experience a qualifying event, you typically have 60 days to elect Cobra coverage. Missing this deadline can result in the loss of your right to continue your health insurance. It’s essential to act quickly and not procrastinate when dealing with Cobra paperwork.

- Understand Your Costs: Cobra coverage can be expensive because you’ll be responsible for the full premium amount that your employer previously paid on your behalf, plus a possible 2% administrative fee. Make sure you understand the costs involved and plan your finances accordingly.

- Review Your Alternatives: While Cobra provides temporary relief, it might not always be the most cost-effective option. Research alternative health insurance plans, such as those offered through the Health Insurance Marketplace or spouse’s employer, to find the best fit for your needs and budget.

- Keep Detailed Records: Maintaining detailed records of all correspondence, payments, and decisions related to your Cobra coverage is crucial. This documentation can be invaluable in case of disputes or if you need to prove your coverage status.

- Seek Professional Advice: If you’re finding the process overwhelming, don’t hesitate to seek advice from a health insurance professional or a financial advisor. They can provide personalized guidance and help you make informed decisions about your health insurance options.

Common Challenges and Solutions

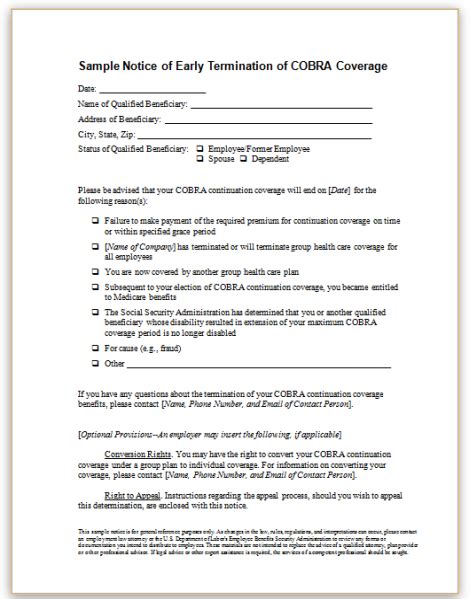

Despite the benefits Cobra offers, individuals often face challenges when dealing with the paperwork. Some common issues include delays in receiving election notices, difficulty in understanding the costs and benefits, and confusion about the enrollment process. To overcome these challenges, it’s essential to stay informed, ask questions, and seek help when needed. Understanding your rights and the processes involved can empower you to make the best decisions for your health insurance needs.

📝 Note: Always ensure you receive and review all relevant documents and notices from your employer or plan administrator to avoid missing critical deadlines or details about your Cobra coverage.

Conclusion and Future Planning

In conclusion, navigating Cobra paperwork requires attention to detail, timely action, and a clear understanding of your options. By following the tips outlined above and staying proactive, you can ensure that you make the most out of the Cobra provision and maintain uninterrupted health insurance coverage during significant life changes. Remember, health insurance is a critical aspect of your overall financial and personal well-being, and being informed is the first step in securing your future.

What is the primary purpose of Cobra paperwork?

+

The primary purpose of Cobra paperwork is to facilitate the continuation of health insurance coverage for eligible individuals who experience a qualifying event, such as job loss or divorce, ensuring they can maintain their health insurance without interruption.

How long do I have to elect Cobra coverage after a qualifying event?

+

Typically, you have 60 days from the date of the qualifying event or the date you receive the Cobra election notice, whichever is later, to elect Cobra coverage.

Can I cancel my Cobra coverage at any time?

+

Yes, you can cancel your Cobra coverage at any time, but it’s crucial to understand the implications of this decision on your health insurance status and any potential future eligibility for Cobra or other health insurance plans.

Related Terms:

- haven t received cobra paperwork

- haven t received cobra paperwork

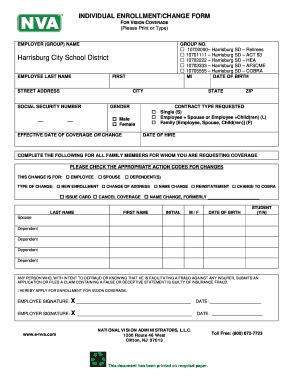

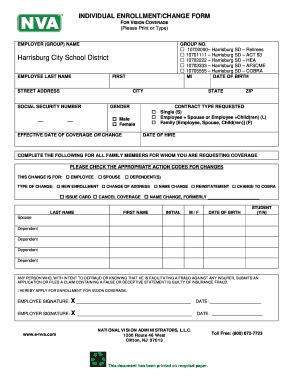

- COBRA paperwork for terminated employees

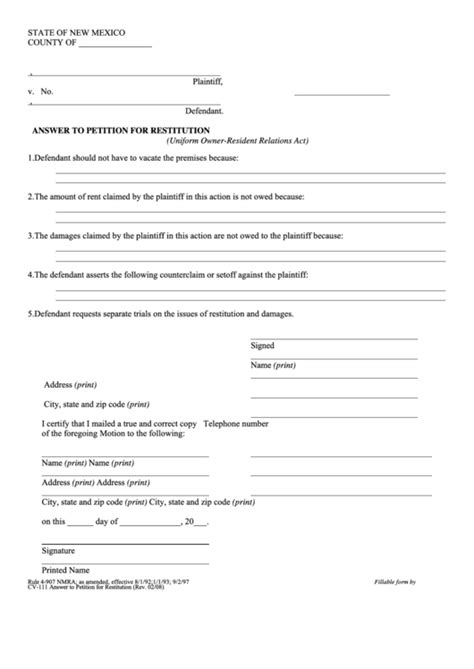

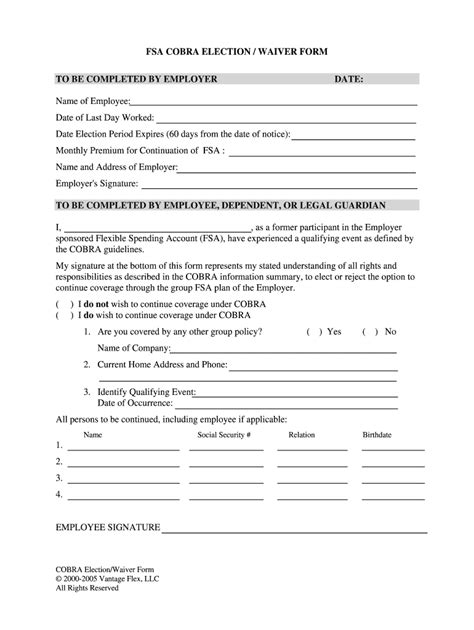

- COBRA Election Form pdf

- COBRA paperwork Timeline

- COBRA Election Form template