5 Tips Find Non Profit Paperwork

Introduction to Non-Profit Paperwork

When it comes to managing a non-profit organization, paperwork is an essential aspect that cannot be overlooked. From registration documents to financial reports, non-profits must maintain accurate and up-to-date records to ensure transparency, accountability, and compliance with regulatory requirements. In this article, we will explore five tips to help you find and manage non-profit paperwork efficiently.

Understanding the Types of Non-Profit Paperwork

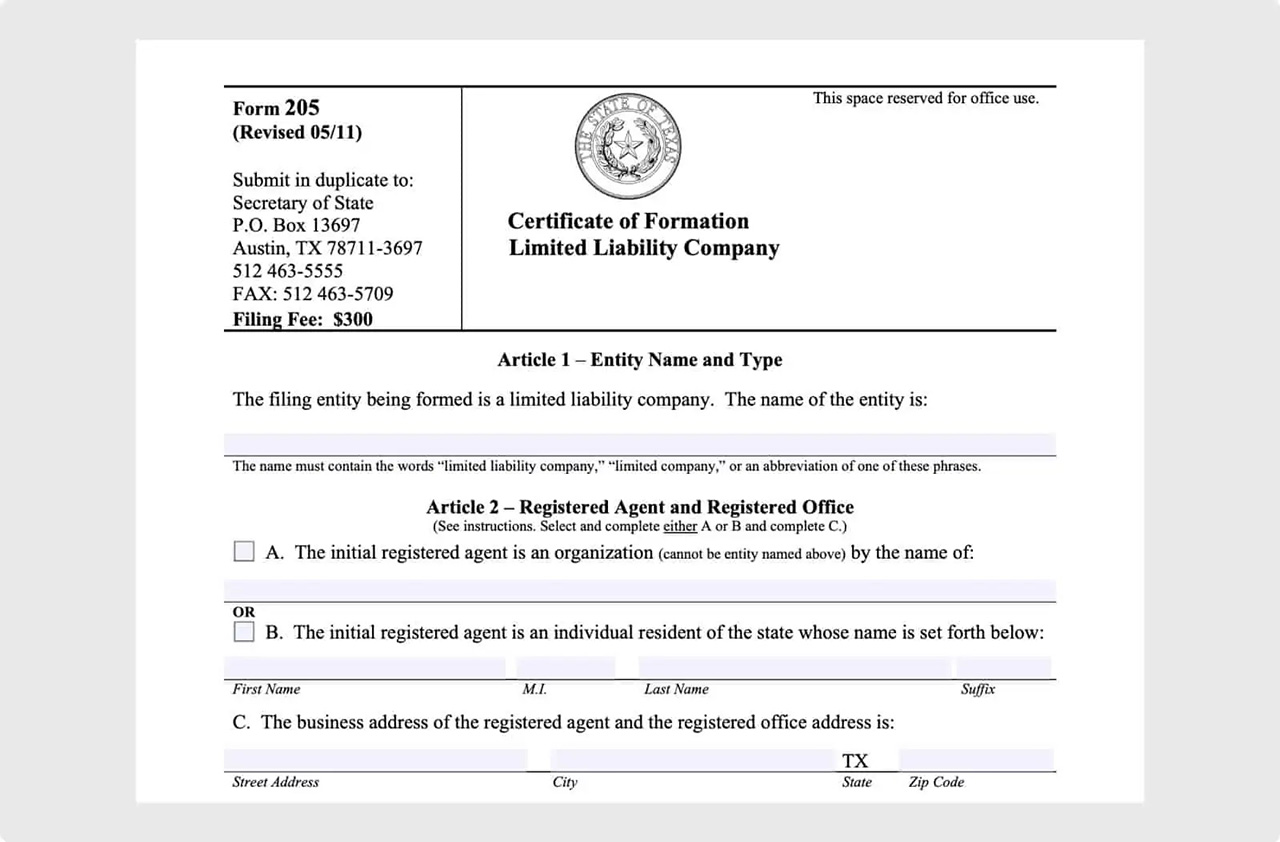

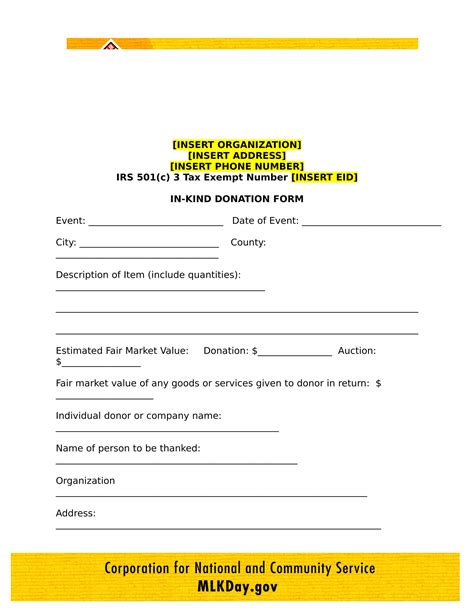

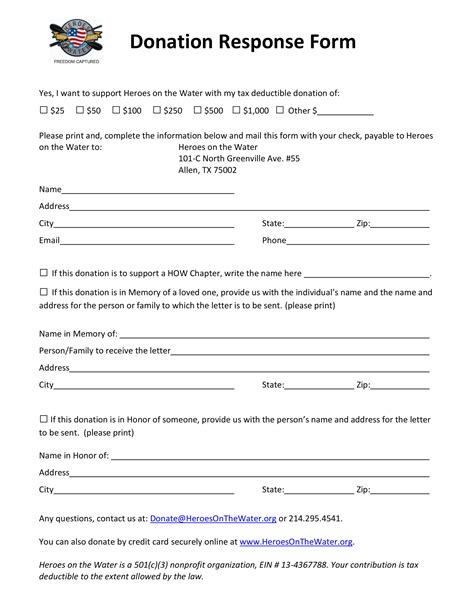

Before we dive into the tips, it’s essential to understand the different types of paperwork that non-profits need to maintain. These include: * Registration documents: Articles of incorporation, certificates of registration, and tax exemption certificates * Financial reports: Annual reports, balance sheets, income statements, and audit reports * Governance documents: Bylaws, board meeting minutes, and conflict of interest policies * Compliance documents: Tax returns, charitable solicitation licenses, and annual filings with state charity regulators * Program documents: Grant proposals, program reports, and evaluation metrics

Tips to Find Non-Profit Paperwork

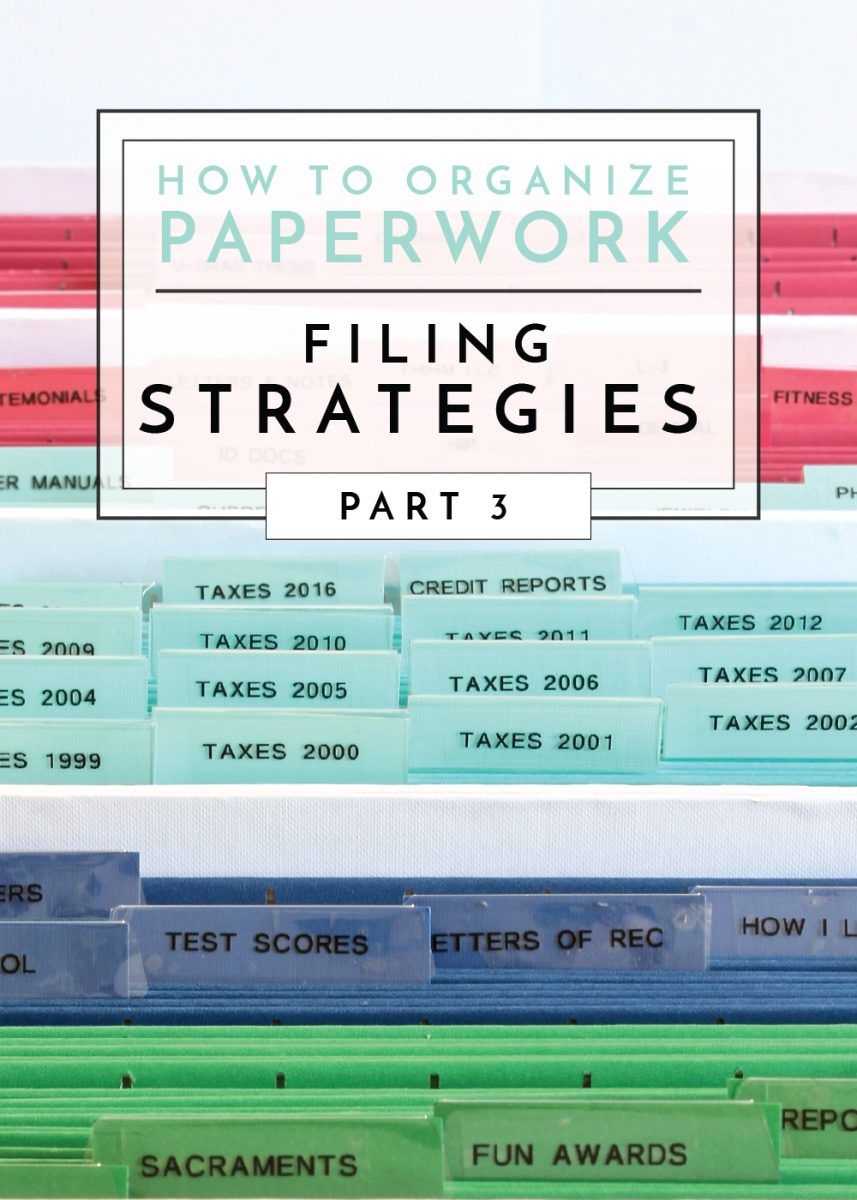

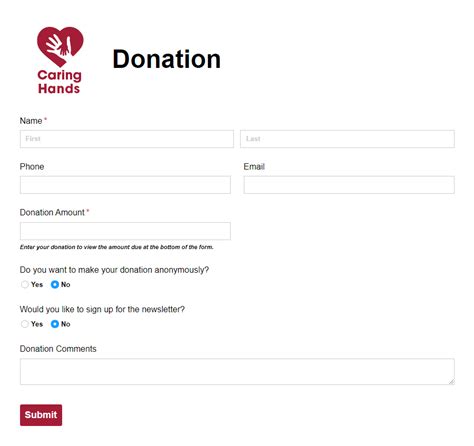

Here are five tips to help you find and manage non-profit paperwork: * Tip 1: Create a Centralized Filing System: Designate a specific location, either physical or digital, to store all non-profit paperwork. This could be a file cabinet, a cloud storage service, or a document management system. Ensure that all team members have access to the filing system and know how to use it. * Tip 2: Use Keyword Search: When searching for specific documents, use keywords related to the document type, such as “annual report” or “tax exemption certificate.” This will help you quickly locate the desired document. * Tip 3: Utilize Online Resources: Take advantage of online resources, such as the Internal Revenue Service (IRS) website, to access non-profit paperwork templates, guidelines, and tutorials. You can also use online platforms, like GuideStar or Foundation Center, to research non-profit organizations and access their publicly available documents. * Tip 4: Consult with Experts: Reach out to experienced non-profit professionals, such as lawyers, accountants, or consultants, who can provide guidance on non-profit paperwork management. They can help you navigate complex regulatory requirements and ensure that your organization is in compliance. * Tip 5: Implement a Document Management Policy: Develop a policy that outlines procedures for creating, storing, and disposing of non-profit paperwork. This policy should include guidelines for document retention, confidentiality, and access controls.

📝 Note: It's essential to regularly review and update your non-profit paperwork to ensure accuracy and compliance with changing regulatory requirements.

Best Practices for Non-Profit Paperwork Management

In addition to the tips mentioned above, here are some best practices to keep in mind: * Regularly review and update non-profit paperwork to ensure accuracy and compliance * Use secure and reliable storage methods, such as encrypted cloud storage or locked file cabinets * Limit access to sensitive documents, such as financial reports or personnel records * Use version control to track changes to documents and maintain a record of updates * Consider implementing a document management system to streamline paperwork management

| Document Type | Retention Period | Storage Method |

|---|---|---|

| Registration documents | Permanent | Secure file cabinet or encrypted cloud storage |

| Financial reports | 7 years | Locked file cabinet or secure online storage |

| Governance documents | Permanent | Secure file cabinet or encrypted cloud storage |

In summary, managing non-profit paperwork requires a strategic approach to ensure accuracy, compliance, and transparency. By creating a centralized filing system, using keyword search, utilizing online resources, consulting with experts, and implementing a document management policy, you can streamline your non-profit paperwork management and reduce the risk of non-compliance.

What is the purpose of non-profit paperwork?

+

The purpose of non-profit paperwork is to ensure transparency, accountability, and compliance with regulatory requirements. It helps non-profits maintain accurate records, demonstrate their mission and activities, and build trust with stakeholders.

How long should non-profits retain financial reports?

+

Non-profits should retain financial reports for at least 7 years, as required by the Internal Revenue Service (IRS). However, some states may require longer retention periods, so it’s essential to check with state charity regulators for specific guidelines.

What is the best way to store non-profit paperwork?

+

The best way to store non-profit paperwork is to use a secure and reliable storage method, such as encrypted cloud storage or a locked file cabinet. This will help protect sensitive documents from unauthorized access, theft, or damage.