Paperwork

5 Ways To Get Bankruptcy Paperwork

Introduction to Bankruptcy Paperwork

When considering bankruptcy, one of the most critical steps is gathering and completing the necessary paperwork. This process can be overwhelming, especially for those who are not familiar with legal documents. The primary goal of bankruptcy paperwork is to provide a comprehensive overview of an individual’s or business’s financial situation, including debts, assets, income, and expenses. In this article, we will explore five ways to obtain the necessary bankruptcy paperwork, ensuring that you are well-prepared for the bankruptcy filing process.

Understanding the Importance of Accurate Paperwork

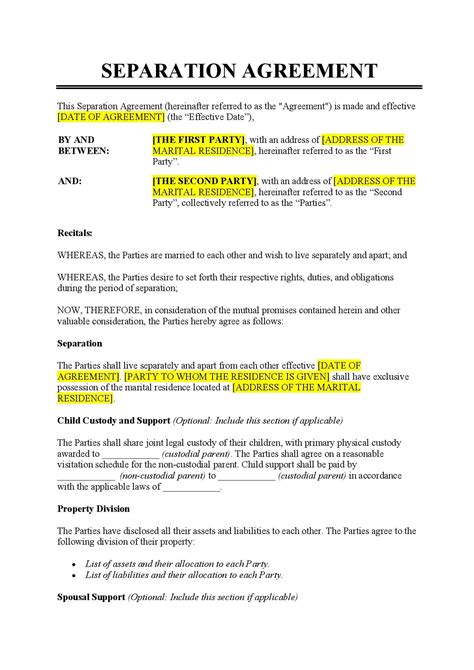

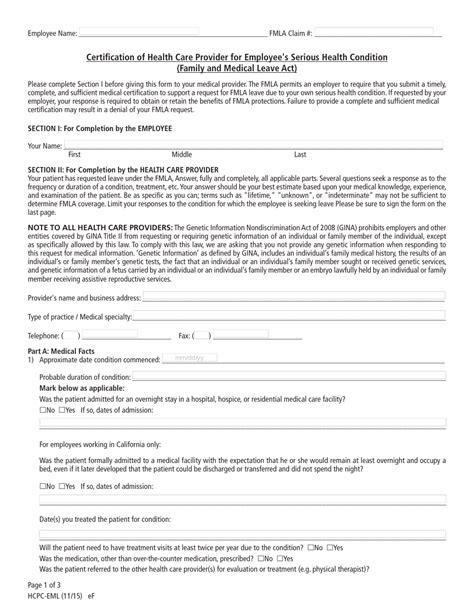

Accurate and complete bankruptcy paperwork is crucial for a successful bankruptcy filing. Inaccurate or incomplete paperwork can lead to delays, additional costs, or even dismissal of the bankruptcy case. It is essential to ensure that all paperwork is thoroughly reviewed and completed before submission to the bankruptcy court. This includes providing detailed information about debts, such as creditor names, account numbers, and balances, as well as a comprehensive list of assets, including property, vehicles, and personal belongings.

5 Ways to Get Bankruptcy Paperwork

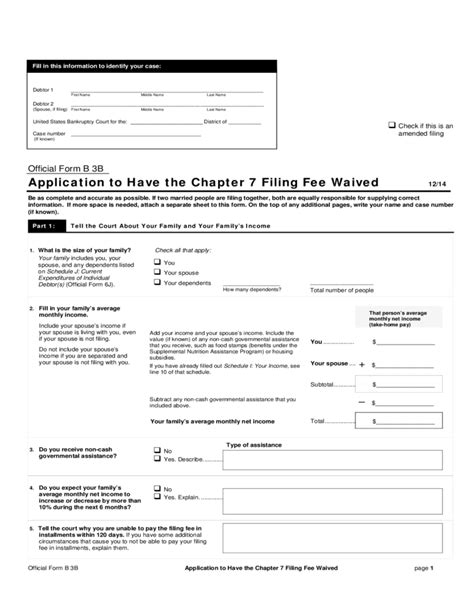

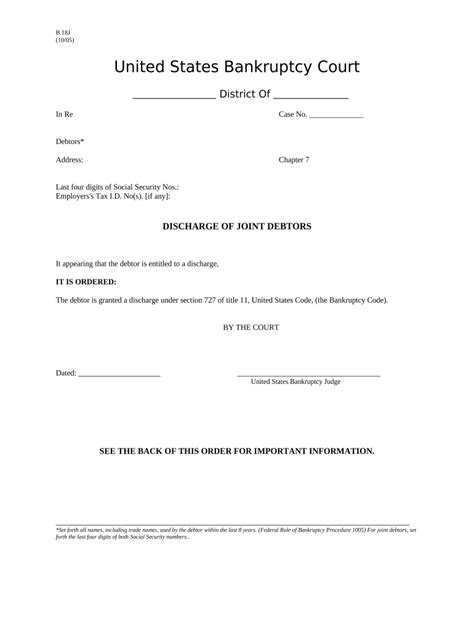

There are several ways to obtain bankruptcy paperwork, each with its own advantages and disadvantages. Here are five common methods: * Bankruptcy Court Website: The official website of the bankruptcy court where you plan to file provides free access to the necessary forms and instructions. These forms are available for download and can be completed electronically or printed and filled out manually. * US Courts Website: The official website of the US Courts (uscourts.gov) offers a range of bankruptcy forms, including the voluntary petition, schedules, and statements. These forms are available in PDF format and can be downloaded and completed as needed. * Bankruptcy Software: Specialized bankruptcy software, such as TurboBankruptcy or Bankruptcy201, can guide you through the paperwork process and help ensure accuracy and completeness. These programs often include templates and examples to assist with form completion. * Bankruptcy Attorney: Hiring a bankruptcy attorney can provide access to expert guidance and support throughout the paperwork process. An attorney can help ensure that all necessary forms are completed accurately and submitted on time. * Local Bankruptcy Forms: Many local courts and legal aid organizations offer free or low-cost bankruptcy forms and instructions. These resources can be especially helpful for individuals who are unable to access the internet or prefer in-person support.

Additional Resources

In addition to these methods, there are several other resources available to help with bankruptcy paperwork:

| Resource | Description |

|---|---|

| Bankruptcy Trustee | A court-appointed official who oversees the bankruptcy process and can provide guidance on paperwork and procedures. |

| Legal Aid Organizations | Non-profit organizations that offer free or low-cost legal assistance, including help with bankruptcy paperwork. |

| Online Forums and Support Groups | Online communities where individuals can connect with others who have experienced bankruptcy and gain insight into the paperwork process. |

💡 Note: It is essential to carefully review and understand all paperwork before submission to the bankruptcy court. Inaccurate or incomplete paperwork can lead to delays or dismissal of the bankruptcy case.

Preparing for the Bankruptcy Filing Process

Once you have obtained the necessary bankruptcy paperwork, it is essential to carefully review and complete each form. This includes: * Gathering financial documents: Collecting pay stubs, bank statements, tax returns, and other financial records to support the information provided in the bankruptcy paperwork. * Completing schedules and statements: Accurately completing the schedules and statements that accompany the voluntary petition, including detailed information about debts, assets, income, and expenses. * Reviewing and signing the paperwork: Carefully reviewing each form to ensure accuracy and completeness, and signing the paperwork as required.

Finalizing the Bankruptcy Paperwork

After completing the bankruptcy paperwork, it is essential to: * Review the paperwork for accuracy: Double-checking each form to ensure that all information is accurate and complete. * Sign the paperwork: Signing the paperwork as required, using a blue ink pen to avoid any potential issues with signature verification. * Submit the paperwork: Submitting the completed paperwork to the bankruptcy court, either in person or by mail, depending on the court’s requirements.

In summary, obtaining the necessary bankruptcy paperwork is a critical step in the bankruptcy filing process. By understanding the importance of accurate paperwork and exploring the various methods for obtaining the necessary forms, individuals can ensure a successful bankruptcy filing. Whether using online resources, bankruptcy software, or seeking the guidance of a bankruptcy attorney, it is essential to carefully review and complete each form to avoid any potential issues or delays.

Related Terms:

- California bankruptcies Records

- Chapter 7 filing fee

- Chapter 7 discharge letter