Paperwork

Get 2018 Tax Paperwork Copies

Introduction to Obtaining 2018 Tax Paperwork Copies

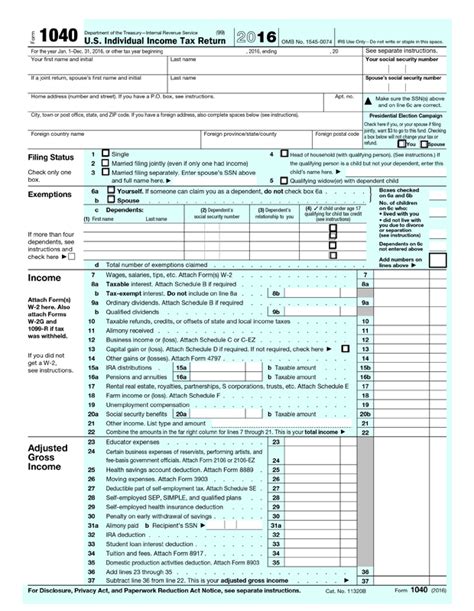

The process of obtaining copies of your 2018 tax paperwork can be straightforward if you know where to look and what steps to take. Whether you’re looking to retrieve a copy of your tax return for personal records, to apply for a loan, or for any other reason, having access to your past tax documents is crucial. In this guide, we’ll walk through the methods you can use to get copies of your 2018 tax paperwork, including contacting the IRS, using online services, and reaching out to your tax preparer or accountant.

Why You Might Need Copies of Your 2018 Tax Paperwork

There are several reasons why you might need copies of your 2018 tax paperwork. These can include: - Applying for a mortgage or loan: Financial institutions often require copies of your recent tax returns to verify your income. - Applying for financial aid: Colleges and universities may request tax returns as part of the financial aid application process. - Immigration purposes: In some cases, copies of tax returns are required for immigration applications. - Personal records: It’s a good idea to keep copies of your tax returns for your personal records, in case you need to refer back to them.

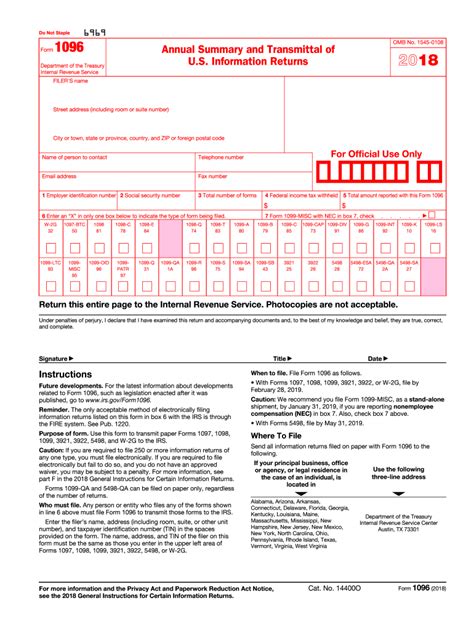

Method 1: Contacting the IRS

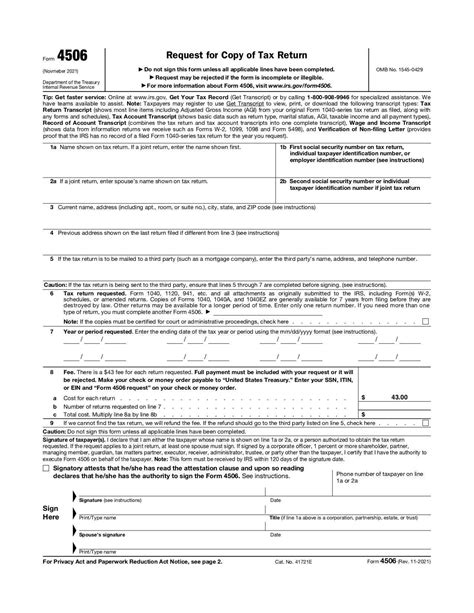

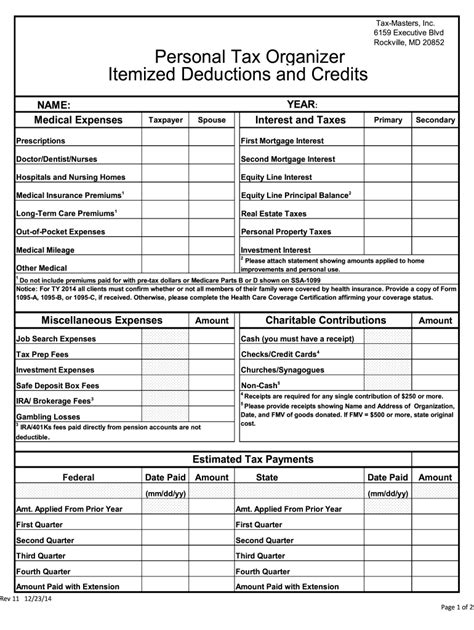

The Internal Revenue Service (IRS) provides several ways for you to obtain copies of your tax returns. Here are the steps to follow: - Call the IRS: You can call the IRS at 1-800-829-1040. Be prepared to provide your Social Security number, date of birth, and the tax year you’re requesting. - Use the IRS Website: Visit the IRS website and use their online tool to order a transcript of your tax return. You’ll need to create an account or log in if you already have one. - Complete Form 4506: You can also complete Form 4506, Request for Copy of Tax Return, and mail or fax it to the IRS. There’s a fee for this service, which you can pay by check or money order.

Method 2: Using Online Services

Several online services allow you to access and download copies of your tax returns, including: - TurboTax: If you used TurboTax to file your 2018 taxes, you can log in to your account and download a copy of your return. - H&R Block: Similarly, if you used H&R Block, you can access your account to retrieve a copy of your return. - TaxAct: TaxAct also allows you to access and download copies of your tax returns from their website.

Method 3: Contacting Your Tax Preparer or Accountant

If you used a tax preparer or accountant to file your 2018 taxes, they may have a copy of your return on file. Here are the steps to follow: - Call or Email Your Tax Preparer: Reach out to your tax preparer or accountant and ask if they have a copy of your 2018 tax return. - Check Their Website: Some tax preparers and accountants may have online portals where you can access and download copies of your tax returns.

Additional Tips

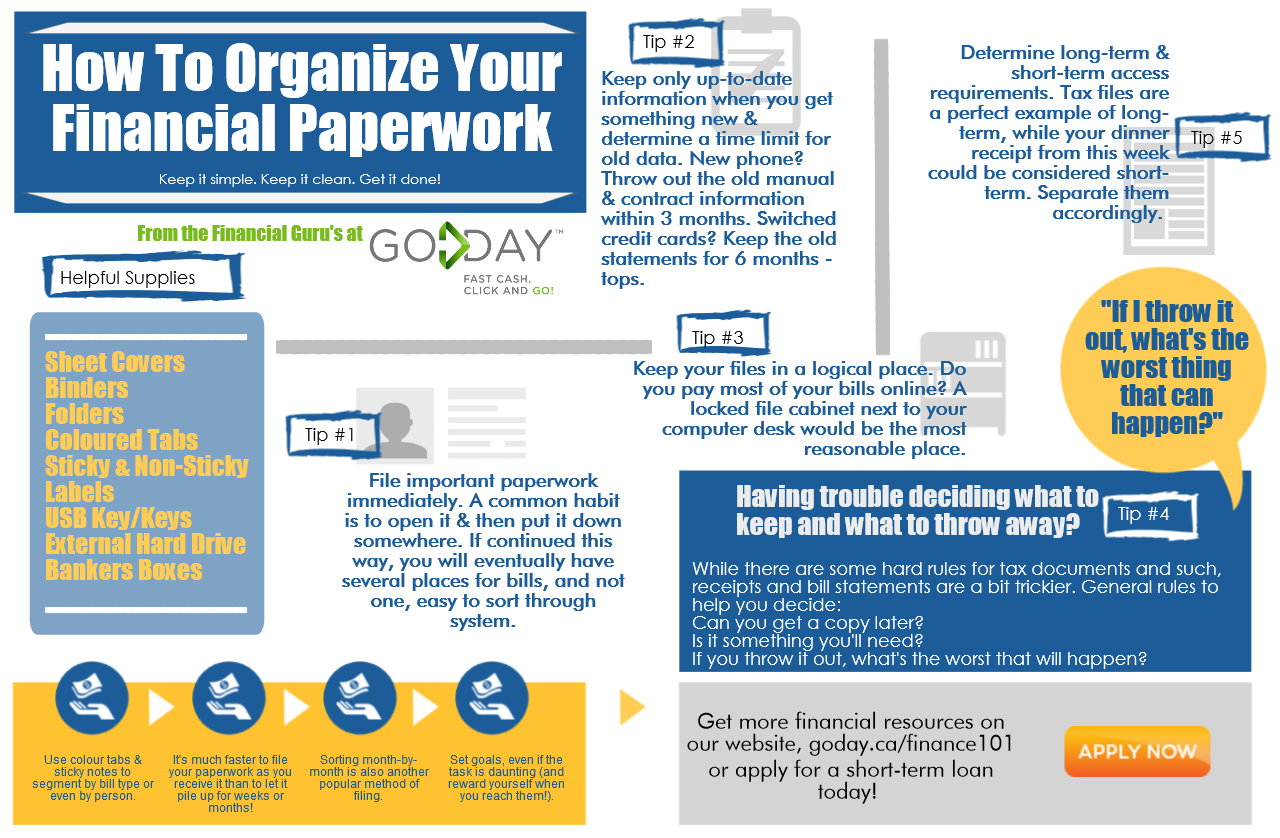

When obtaining copies of your 2018 tax paperwork, keep the following tips in mind: - Be Patient: It may take some time to receive your tax return copies, especially if you’re requesting them through the mail. - Keep Your Copies Safe: Once you receive your tax return copies, make sure to keep them in a safe and secure location. - Check for Accuracy: Review your tax return copies to ensure they’re accurate and complete.

📝 Note: Always verify the authenticity of any website or service you use to obtain copies of your tax returns, to protect your personal and financial information.

Conclusion and Final Thoughts

Obtaining copies of your 2018 tax paperwork is a relatively straightforward process, thanks to the various methods available. Whether you choose to contact the IRS, use online services, or reach out to your tax preparer or accountant, make sure to follow the steps carefully and keep your copies safe. Remember to always prioritize the security of your personal and financial information when accessing or requesting copies of your tax returns.

How long does it take to receive copies of my tax returns from the IRS?

+

The time it takes to receive copies of your tax returns from the IRS can vary, but it’s typically within 10-15 business days if you’re requesting them by mail.

Can I obtain copies of my tax returns online for free?

+

Yes, you can obtain copies of your tax returns online for free through the IRS website, using their online tool to order a transcript of your tax return.

What information do I need to provide to obtain copies of my tax returns?

+

To obtain copies of your tax returns, you’ll typically need to provide your Social Security number, date of birth, and the tax year you’re requesting.