Paperwork

Get 2020 Tax Return Paperwork

Introduction to Tax Return Paperwork

When it comes to managing your finances, one of the most critical tasks is dealing with tax return paperwork. The year 2020 brought about its own set of challenges, especially with the COVID-19 pandemic affecting economies worldwide. Understanding how to navigate through the process of obtaining and filing your 2020 tax return is essential for compliance with tax laws and to ensure you receive any refunds you’re eligible for. This guide will walk you through the steps and considerations for getting your 2020 tax return paperwork in order.

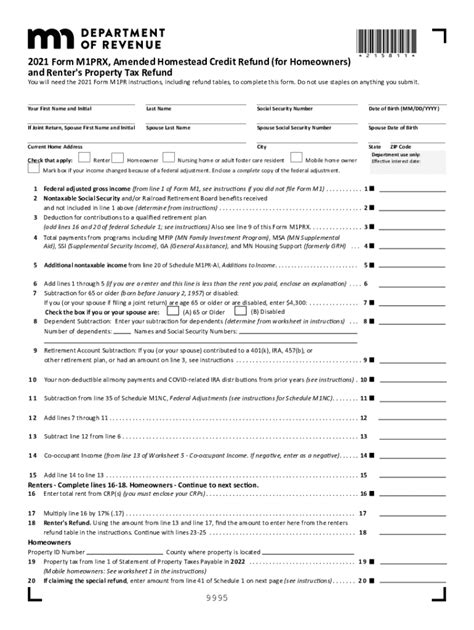

Understanding Tax Return Forms

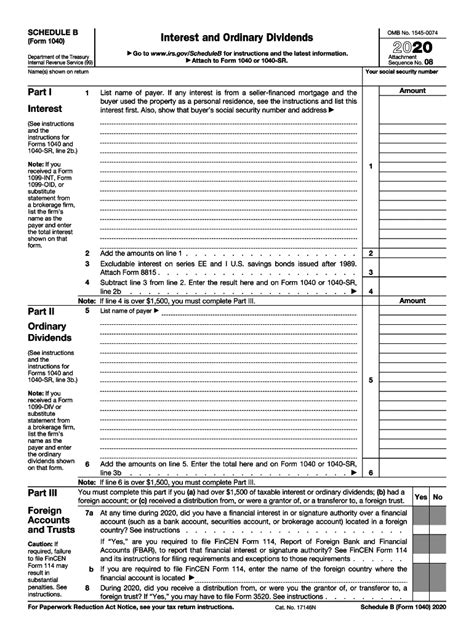

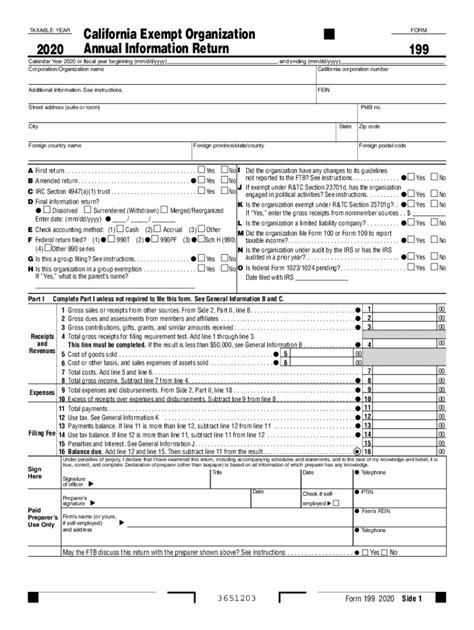

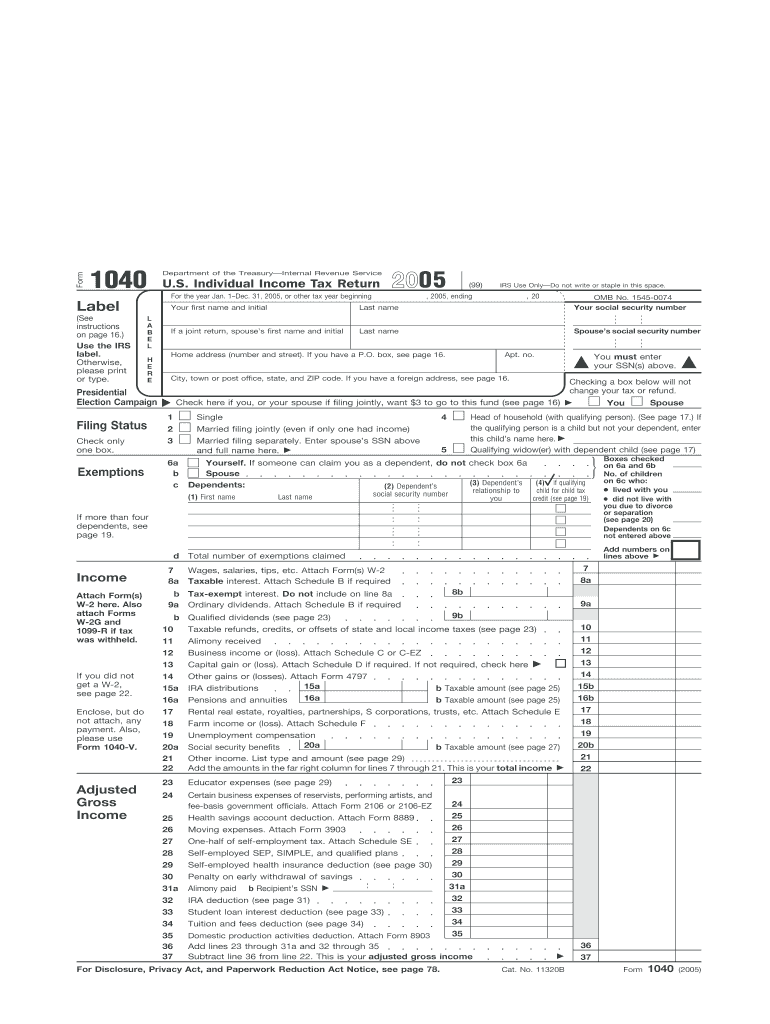

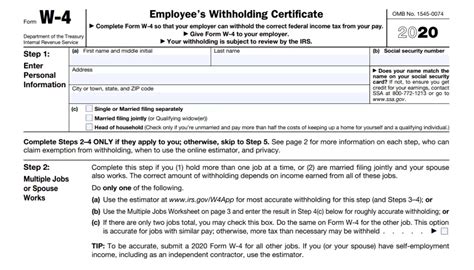

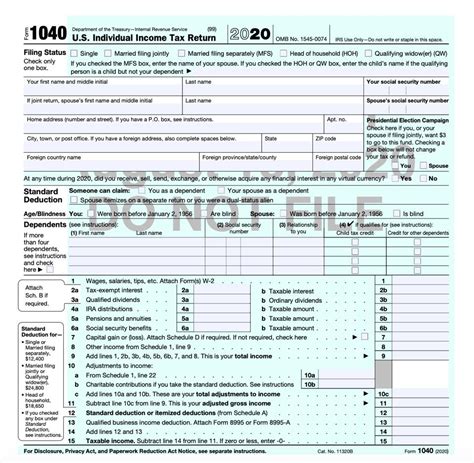

The first step in getting your tax return paperwork is to understand which forms you need. The most common form for personal income tax is the Form 1040. This form is used by U.S. taxpayers to file an annual income tax return. For the 2020 tax year, you would use the 2020 Form 1040. There are also several schedules that may be required depending on your specific situation, such as Schedule 1 for additional income and adjustments to income, Schedule 2 for additional taxes, and Schedule 3 for additional credits and payments.

Gathering Necessary Documents

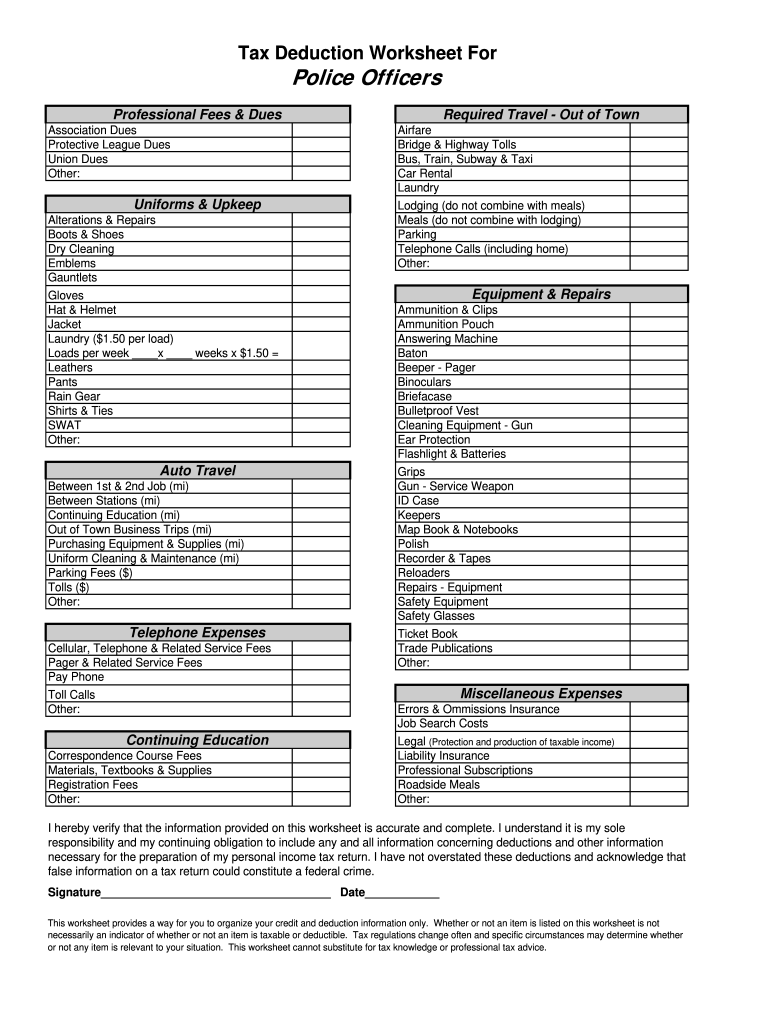

To fill out your tax return forms accurately, you’ll need to gather several documents. These include: - W-2 forms from your employer(s), showing your income and taxes withheld. - 1099 forms for any freelance work, interest, dividends, or capital gains. - Receipts for deductions, such as charitable donations, medical expenses, and business expenses. - Information about your dependents, including their Social Security numbers. - Last year’s tax return, if you have it, can be helpful for comparison and ensuring you don’t miss any deductions.

Where to Get Tax Forms and Instructions

You can obtain the necessary tax forms and instructions from several sources: - IRS Website: The official website of the Internal Revenue Service (IRS) offers downloadable forms and detailed instructions. - IRS Taxpayer Assistance Centers: These centers provide face-to-face help with tax issues and can provide forms. - IRS Phone Line: You can also call the IRS to request forms be mailed to you. - Local libraries and post offices may carry basic tax forms.

Filing Your Tax Return

Once you have all your documents and forms, you can proceed to fill them out. Ensure you follow the instructions carefully to avoid mistakes. You can file your tax return in one of two main ways: - E-filing: Electronic filing is faster and more accurate than paper filing. You can use tax software like TurboTax or H&R Block, or the IRS Free File program if you qualify. - Paper Filing: If you prefer or need to file a paper return, fill out your forms legibly and mail them to the address listed in the instructions for your area.

Important Dates for the 2020 Tax Year

Keep in mind the following dates for the 2020 tax year: - April 15, 2021: The deadline for filing your 2020 tax return or requesting an extension. - October 15, 2021: If you requested an extension, this is the deadline to file your return.

📝 Note: Always check the IRS website for the most current information, as dates and procedures can change.

Tax Credits and Deductions for 2020

The 2020 tax year includes several tax credits and deductions you might be eligible for, such as: - The Earned Income Tax Credit (EITC) for low-to-moderate income workers. - The Child Tax Credit for families with qualifying children. - Education credits like the American Opportunity Tax Credit or the Lifetime Learning Credit. - Charitable donation deductions for contributions to qualified organizations.

Conclusion and Final Thoughts

In conclusion, managing your 2020 tax return paperwork requires attention to detail, understanding of the necessary forms, and awareness of the deadlines. By gathering all your documents, carefully filling out your tax forms, and filing on time, you can ensure compliance with tax laws and potentially receive a refund. Remember, tax laws and available credits can change, so staying informed is key to navigating the process smoothly.

What is the deadline for filing the 2020 tax return?

+

The deadline for filing your 2020 tax return was April 15, 2021. However, if you requested an extension, your deadline would be October 15, 2021.

How do I get a copy of my 2020 W-2 form if I lost it?

+

You can contact your employer to request a replacement W-2. If your employer is no longer available, you can contact the IRS for assistance.

Can I file my 2020 tax return electronically if I owe taxes?

+

Yes, you can e-file your tax return even if you owe taxes. You will need to arrange for payment by the tax filing deadline to avoid penalties and interest.