5 Ways Tax Car

Understanding Tax Cars and Their Benefits

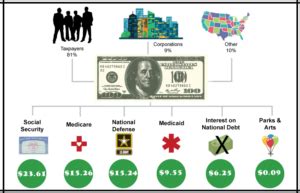

When it comes to managing finances, especially for businesses or individuals with high mileage for work-related purposes, understanding the concept of tax cars is crucial. A tax car, in simple terms, refers to a vehicle used for business purposes where the expenses related to its operation can be deducted from taxable income, thus reducing the overall tax liability. This concept is particularly beneficial for self-employed individuals, freelancers, and companies that heavily rely on vehicle usage for their operations. In this article, we will delve into the world of tax cars, exploring what they are, how they can be beneficial, and the steps to claim tax deductions on vehicle expenses.

What are Tax Cars?

Tax cars are vehicles used for business, and the costs associated with their use can be claimed as a tax deduction. This includes not just the purchase price or lease payments but also operational costs like fuel, maintenance, insurance, and registration. The key to benefiting from tax cars is to accurately track and document the business use percentage of the vehicle, as only this portion can be claimed as a tax deduction.

Benefits of Tax Cars

The primary benefit of tax cars is the reduction in taxable income through the deduction of business-related vehicle expenses. This can significantly lower the tax liability, especially for those with high business mileage. Additionally, tax cars can provide a financial incentive for businesses to invest in newer, more fuel-efficient vehicles, which can also lead to cost savings over time due to lower fuel and maintenance costs.

5 Ways to Utilize Tax Cars for Financial Benefits

Here are five key strategies to maximize the financial benefits of using tax cars:

- Accurate Record Keeping: Maintaining detailed records of business trips, including dates, distances, and purposes, is essential. This can be done using a logbook or mobile apps designed for tracking business mileage.

- Choosing the Right Vehicle: Selecting a vehicle that is fuel-efficient and has lower operating costs can increase the overall savings when claiming tax deductions.

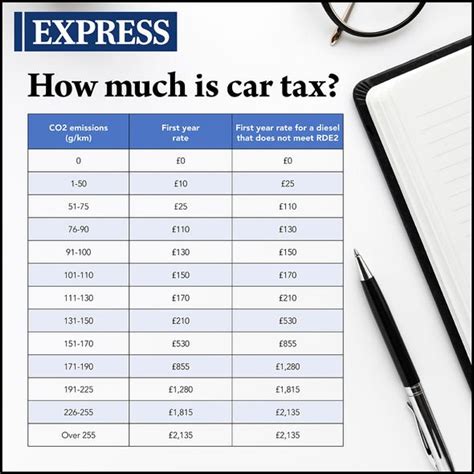

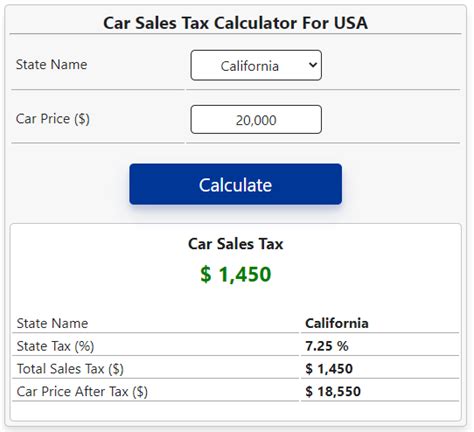

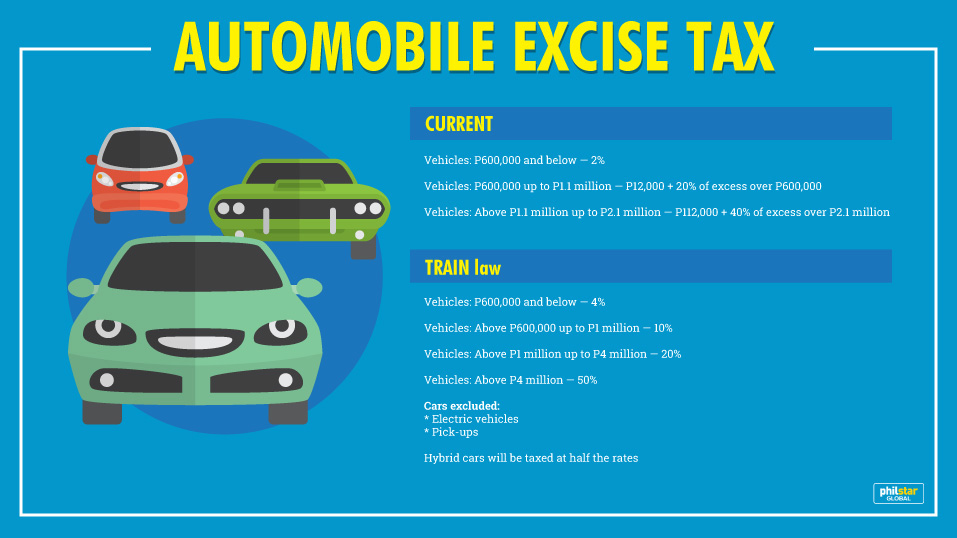

- Understanding Tax Laws: Staying updated with the current tax laws and regulations regarding vehicle expenses is crucial. This includes knowing the depreciation limits, fuel prices, and any other deductible expenses.

- Leasing vs. Buying: Deciding whether to lease or buy a vehicle depends on various factors, including the expected business use percentage, the need for new vehicles, and the available budget. Leasing can provide the benefit of using a new vehicle every few years without the long-term commitment of ownership.

- Claiming Depreciation: For owned vehicles, claiming depreciation as a tax deduction can provide significant savings. The depreciation method used (straight-line or accelerated) can affect the amount of deduction claimed each year.

Steps to Claim Tax Deductions on Vehicle Expenses

To claim tax deductions on vehicle expenses, follow these steps:

- Determine Business Use Percentage: Calculate the percentage of the vehicle used for business purposes. This can be done by dividing the total business miles by the total miles driven.

- Calculate Total Vehicle Expenses: Add up all the expenses related to the vehicle, including fuel, maintenance, insurance, registration, and depreciation or lease payments.

- Apply Business Use Percentage: Multiply the total vehicle expenses by the business use percentage to find the deductible amount.

- Keep Detailed Records: Ensure all receipts, invoices, and logs are kept to support the tax deduction claim in case of an audit.

📝 Note: It's essential to consult with a tax professional to ensure compliance with all tax laws and regulations regarding vehicle expenses.

Common Mistakes to Avoid

When dealing with tax cars, there are several common mistakes to avoid:

- Inaccurate Record Keeping: Failing to keep accurate and detailed records of business use can lead to disallowed deductions.

- Misunderstanding Tax Laws: Not being aware of the current tax laws and regulations can result in missed deductions or incorrect claims.

- Insufficient Documentation: Not having sufficient documentation to support the tax deduction claim can lead to issues during an audit.

Embedding Images for Better Understanding

Utilizing Tables for Clear Comparisons

| Vehicle Type | Business Use Percentage | Annual Mileage | Total Expenses |

|---|---|---|---|

| Sedan | 80% | 20,000 miles | 10,000</td> </tr> <tr> <td>Truck</td> <td>90%</td> <td>30,000 miles</td> <td>15,000 |

In summary, understanding and utilizing tax cars effectively can lead to significant financial benefits for individuals and businesses. By accurately tracking business use, choosing the right vehicle, and staying informed about tax laws, one can maximize the deductions on vehicle expenses, thereby reducing the overall tax liability. It’s always recommended to consult with a tax professional to ensure compliance with all tax regulations and to explore the best strategies tailored to specific situations.

What is the main benefit of using a tax car?

+

The main benefit of using a tax car is the reduction in taxable income through the deduction of business-related vehicle expenses, which can significantly lower the tax liability.

How do I calculate the business use percentage of my vehicle?

+

You calculate the business use percentage by dividing the total business miles by the total miles driven. This percentage is then applied to the total vehicle expenses to find the deductible amount.

What expenses can be claimed as tax deductions for a tax car?

+

Expenses that can be claimed as tax deductions for a tax car include fuel, maintenance, insurance, registration, and depreciation or lease payments, provided they are related to the business use of the vehicle.