5 Ways Find Tax Return

Understanding the Importance of Finding Your Tax Return

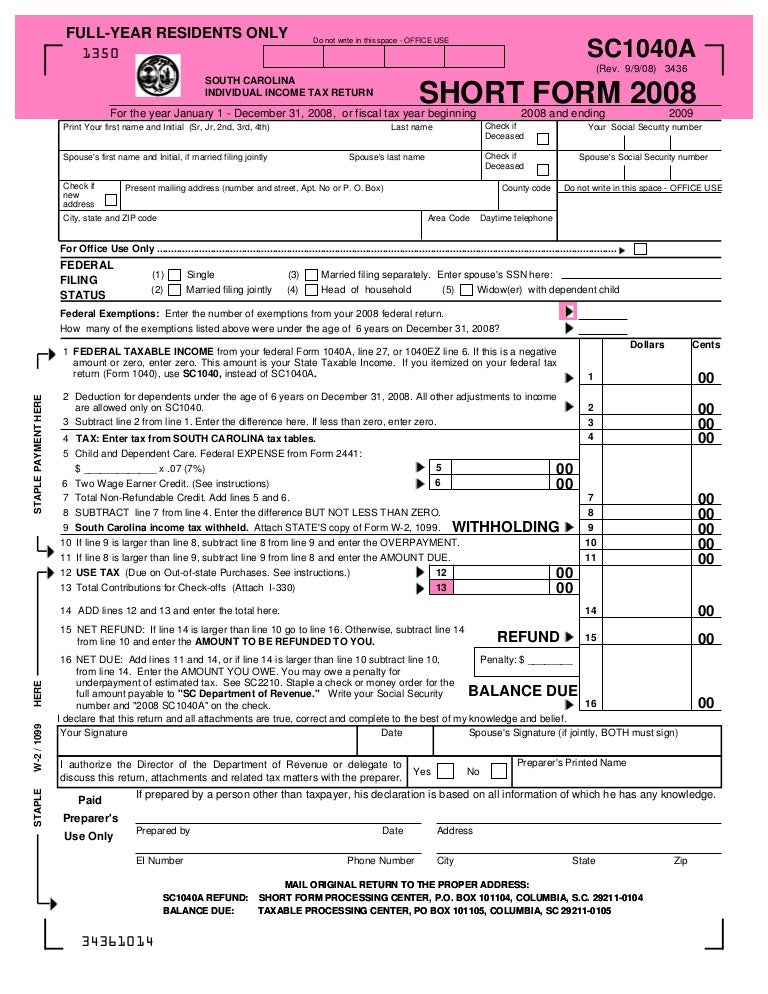

Finding your tax return is a crucial task for individuals and businesses alike, as it provides a summary of your income, deductions, and tax payments made during the year. The tax return contains vital information that can be used for various purposes, such as applying for loans, credit cards, or even renting an apartment. In this article, we will explore five ways to find your tax return, highlighting the significance of each method and providing step-by-step instructions to help you retrieve your tax return efficiently.

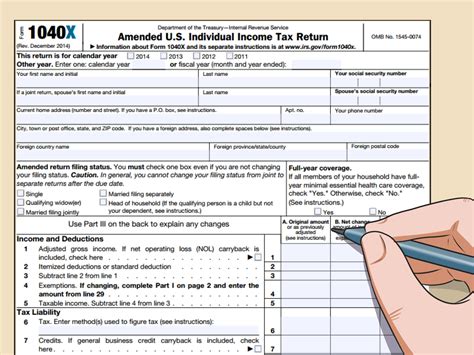

Method 1: Checking with the IRS

The Internal Revenue Service (IRS) is the primary source for obtaining your tax return. You can contact the IRS directly to request a copy of your tax return. Here’s how: * Visit the IRS website at www.irs.gov and navigate to the “Get Transcript” page. * Select the type of transcript you need, which can be either a tax return transcript or a tax account transcript. * Fill out the required information, including your Social Security number, date of birth, and address. * Choose the delivery method, either online or by mail.

📝 Note: Make sure you have your identification documents ready, as the IRS may request them to verify your identity.

Method 2: Contacting Your Tax Preparer

If you hired a tax preparer to file your taxes, they may have a copy of your tax return on file. Reach out to your tax preparer and ask if they can provide you with a copy of your tax return. Be sure to have your identification documents ready, as they may require them to verify your identity. Some benefits of contacting your tax preparer include: * Faster access to your tax return * Ability to ask questions about your tax return * Potential to identify and correct any errors on your tax return

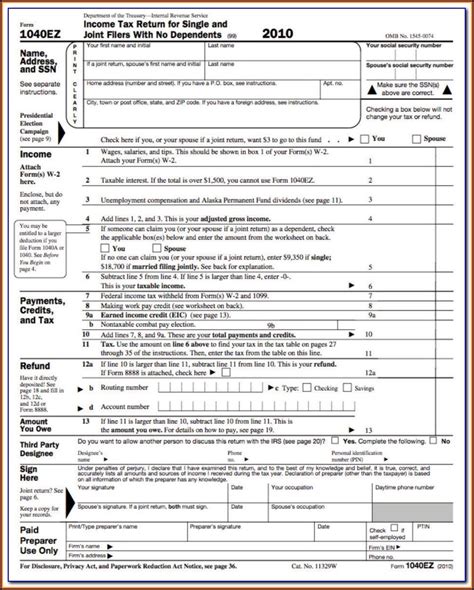

Method 3: Using Tax Preparation Software

Tax preparation software, such as TurboTax or H&R Block, often provides users with access to their tax returns. If you used tax preparation software to file your taxes, you can log in to your account and retrieve a copy of your tax return. Here’s how: * Log in to your tax preparation software account * Navigate to the “My Account” or “My Tax Returns” section * Select the tax year for which you want to retrieve your tax return * Download or print a copy of your tax return

Method 4: Checking with Your Employer or Financial Institution

Your employer or financial institution may have a copy of your tax return on file, especially if you gave them permission to access your tax information. You can contact your employer’s HR department or your financial institution’s customer service to ask if they have a copy of your tax return. Some benefits of checking with your employer or financial institution include: * Convenience, as you may already have a relationship with them * Potential to obtain other financial documents, such as W-2 forms or 1099 forms * Ability to ask questions about your tax return and other financial matters

Method 5: Visiting a Local IRS Office

If you prefer to obtain your tax return in person, you can visit a local IRS office. Here’s how: * Find a local IRS office near you by visiting the IRS website * Call the IRS office to confirm their hours of operation and required documents * Bring the required documents, including your identification and Social Security number * Meet with an IRS representative to request a copy of your tax return

| Method | Benefits | Drawbacks |

|---|---|---|

| Checking with the IRS | Official source, free of charge | May take several days to receive |

| Contacting Your Tax Preparer | Faster access, potential to correct errors | May require identification documents |

| Using Tax Preparation Software | Convenient, easy to use | May require subscription or login credentials |

| Checking with Your Employer or Financial Institution | Convenient, potential to obtain other documents | May not have a copy of your tax return |

| Visiting a Local IRS Office | Official source, in-person assistance | May require waiting in line, limited hours |

In summary, finding your tax return is a relatively straightforward process that can be done through various methods. By understanding the benefits and drawbacks of each method, you can choose the one that best suits your needs and obtain your tax return efficiently. Whether you prefer to contact the IRS, your tax preparer, or use tax preparation software, the key is to stay organized and have your identification documents ready. By doing so, you can ensure a smooth and hassle-free experience when retrieving your tax return.

What is the best way to find my tax return?

+

The best way to find your tax return depends on your personal preferences and needs. You can contact the IRS, your tax preparer, use tax preparation software, check with your employer or financial institution, or visit a local IRS office.

How long does it take to receive my tax return from the IRS?

+

The time it takes to receive your tax return from the IRS may vary, but it typically takes several days to several weeks. You can check the status of your request on the IRS website or contact the IRS directly for an update.

Can I obtain a copy of my tax return from my employer or financial institution?

+

Yes, you can obtain a copy of your tax return from your employer or financial institution, but only if you gave them permission to access your tax information. You can contact your employer’s HR department or your financial institution’s customer service to ask if they have a copy of your tax return.