Paperwork

Oklahoma LLC Paperwork Form

Introduction to Oklahoma LLC Paperwork

When forming a Limited Liability Company (LLC) in Oklahoma, it is essential to understand the necessary paperwork and filings required by the state. This process involves several steps, including choosing a business name, appointing a registered agent, and filing the Articles of Organization with the Oklahoma Secretary of State. In this article, we will guide you through the Oklahoma LLC paperwork form and the steps to follow for a successful LLC formation.

Choosing a Business Name

The first step in forming an Oklahoma LLC is to choose a unique and compliant business name. The name must include the phrase “Limited Liability Company” or the abbreviation “LLC” or “L.L.C.” It is also crucial to ensure that the name is not already in use by searching the Oklahoma Secretary of State’s business entity database. Oklahoma business name laws require that the name be distinguishable from other existing business names.

Appointing a Registered Agent

Every Oklahoma LLC must have a registered agent with a physical address in the state. The registered agent is responsible for receiving and handling important legal and tax documents on behalf of the LLC. This can be an individual or a business entity, such as a registered agent service. The agent must be available during regular business hours and have a physical address in Oklahoma, not a post office box.

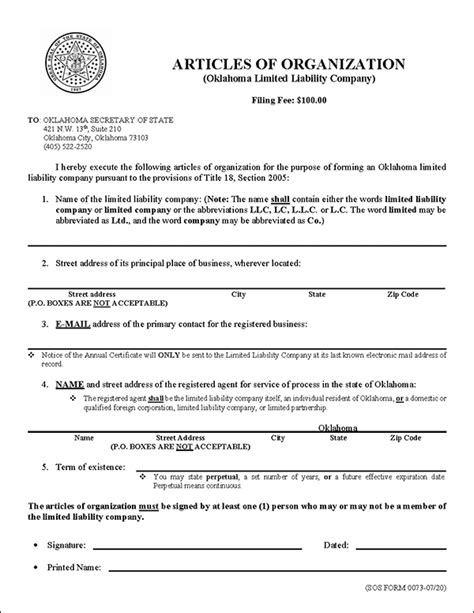

Filing the Articles of Organization

The Articles of Organization is the primary document filed with the Oklahoma Secretary of State to form an LLC. This document includes essential information about the LLC, such as: - The name and address of the LLC - The name and address of the registered agent - The purpose of the LLC - The name and address of at least one member or manager The Articles of Organization can be filed online or by mail, and there is a filing fee associated with the submission.

Obtaining an EIN

After filing the Articles of Organization, the next step is to obtain an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). The EIN is a unique identifier used for tax purposes and is required for opening a business bank account, hiring employees, and filing tax returns. The application for an EIN can be done online, by phone, or by mail.

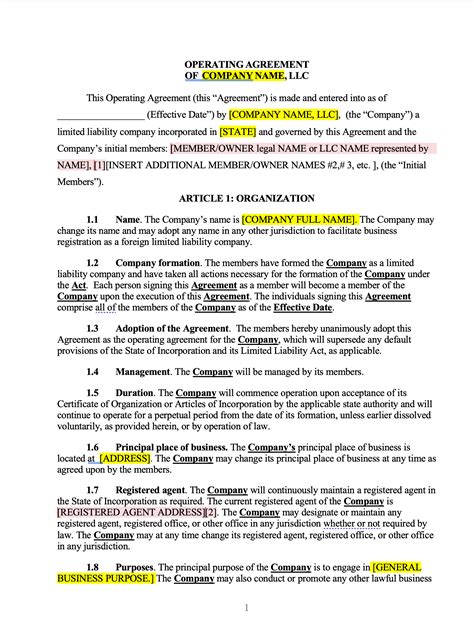

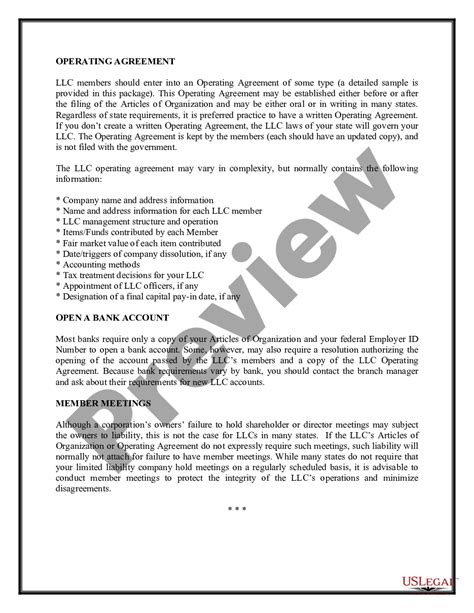

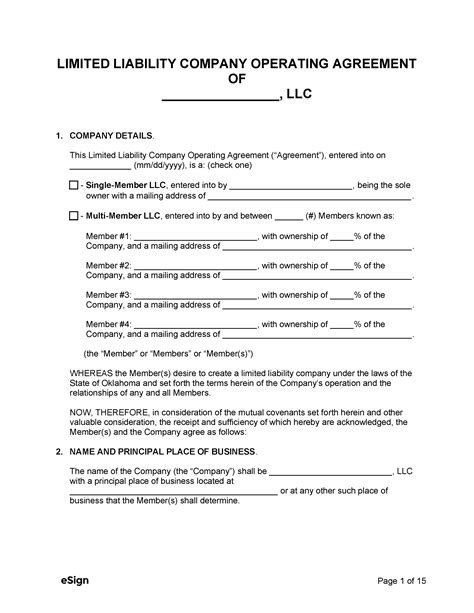

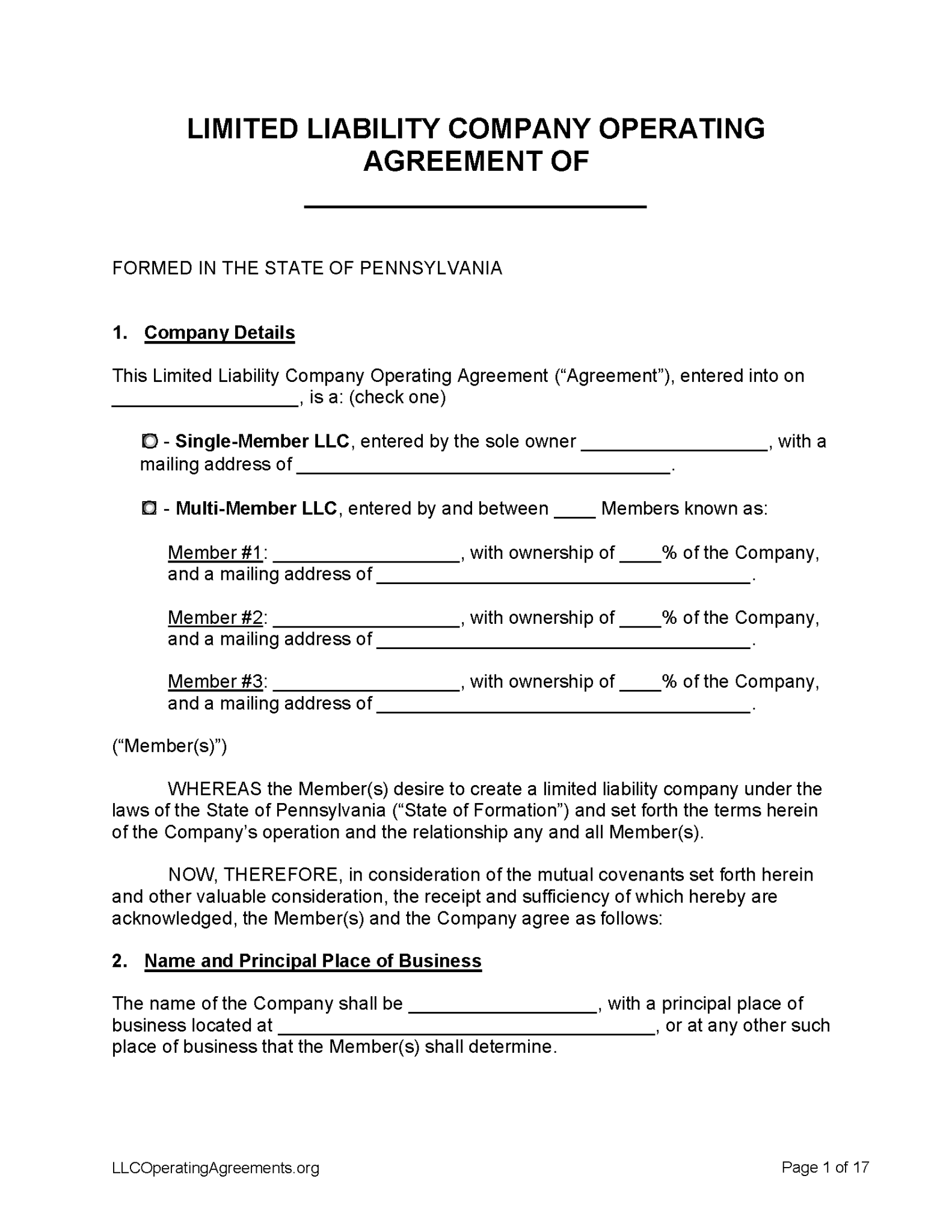

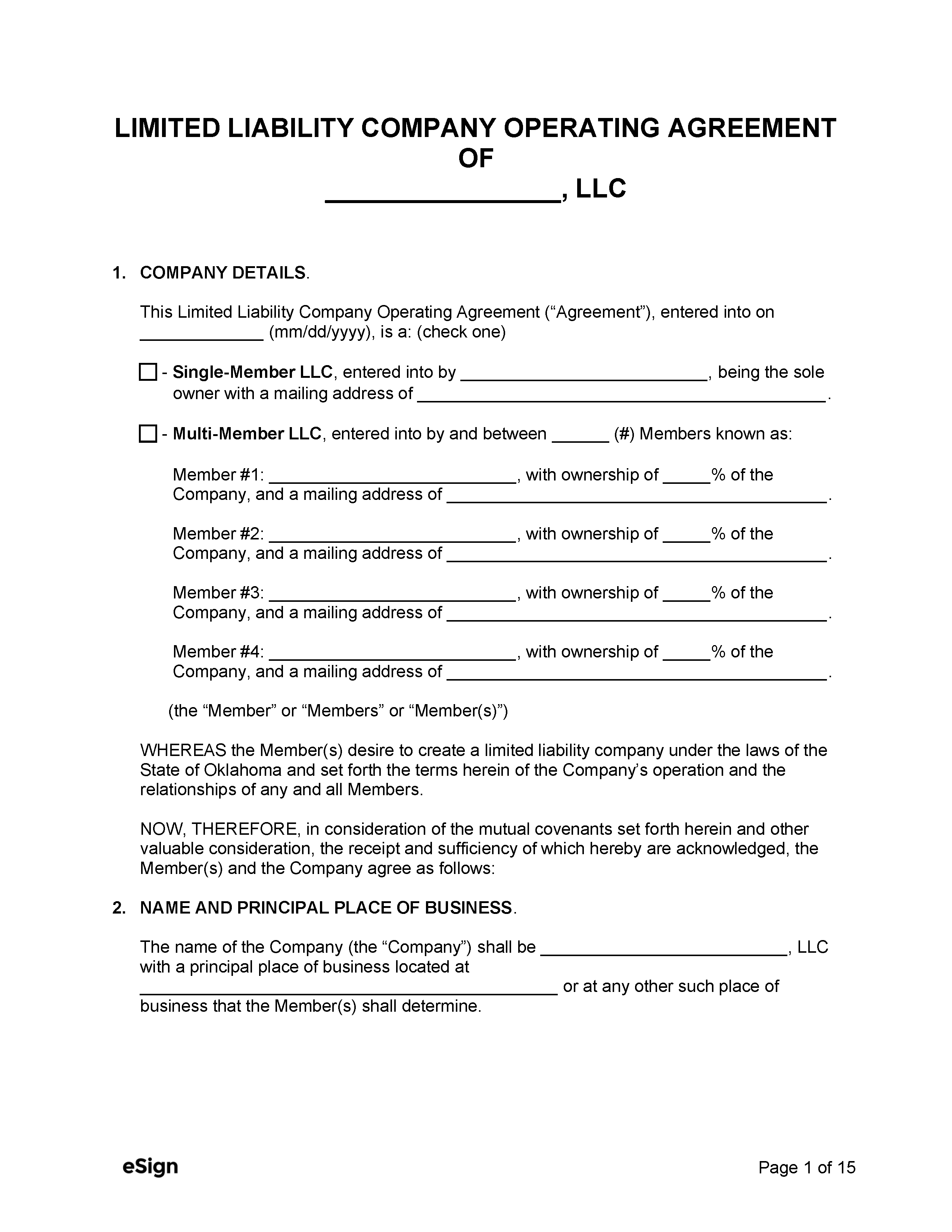

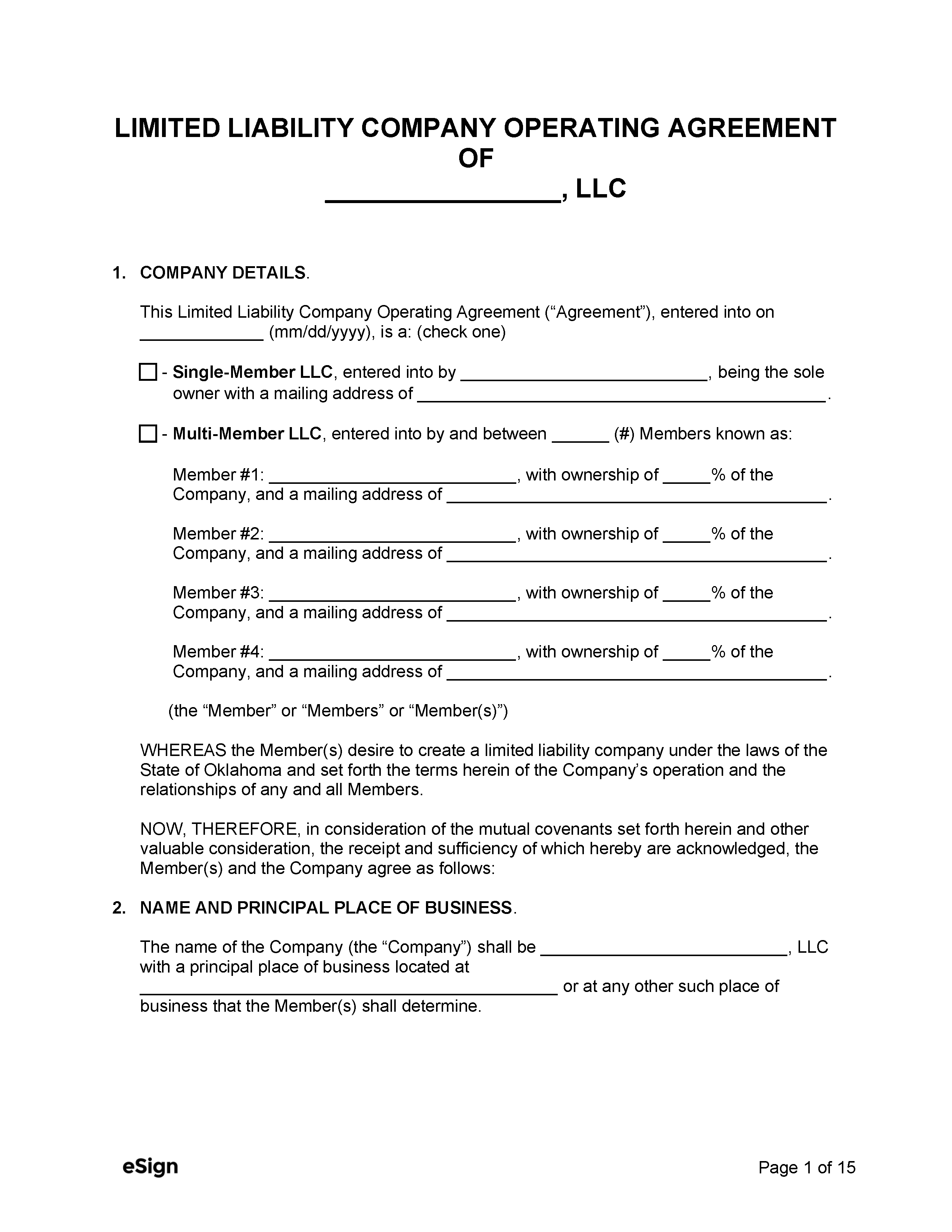

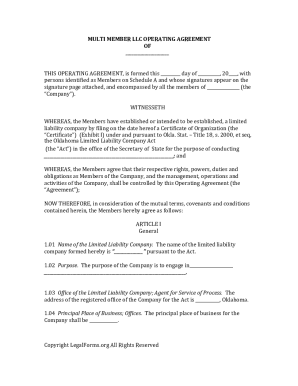

Creating an Operating Agreement

Although not required by the state, it is highly recommended that Oklahoma LLCs create an operating agreement. This document outlines the ownership, management, and operation of the LLC, including the roles and responsibilities of members and managers. The operating agreement helps prevent disputes and ensures that all members are on the same page regarding the business’s direction.

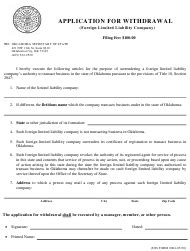

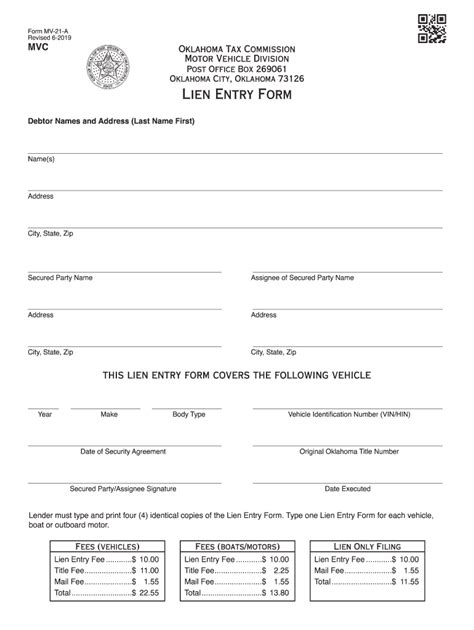

Compliance and Ongoing Requirements

After the initial formation, Oklahoma LLCs must comply with ongoing requirements, such as: - Annual Reports: LLCs must file an annual report with the Oklahoma Secretary of State, which includes updated information about the business. - Tax Filings: LLCs must file tax returns with the IRS and the Oklahoma Tax Commission. - Business Licenses: Depending on the type of business, LLCs may need to obtain business licenses and permits from the state or local government.

📝 Note: It is essential to stay compliant with all requirements to avoid penalties, fines, or even dissolution of the LLC.

Conclusion and Final Thoughts

Forming an Oklahoma LLC involves several steps, from choosing a business name to filing the Articles of Organization and obtaining an EIN. Compliance with ongoing requirements, such as annual reports and tax filings, is also crucial for the success and longevity of the business. By following these guidelines and understanding the necessary paperwork, entrepreneurs can ensure a smooth LLC formation process in Oklahoma.

What is the filing fee for the Articles of Organization in Oklahoma?

+

The filing fee for the Articles of Organization in Oklahoma is currently 100 for online filings and 100 for mail filings, plus an additional $25 for certified copies.

Do I need to file an operating agreement with the state of Oklahoma?

+

No, you do not need to file an operating agreement with the state of Oklahoma. However, it is highly recommended that you create one to outline the ownership, management, and operation of your LLC.

How long does it take to form an LLC in Oklahoma?

+

The processing time for LLC formations in Oklahoma can vary depending on the method of filing. Online filings are typically processed immediately, while mail filings can take several days to several weeks.