Get Power of Attorney Paperwork

Understanding the Importance of Power of Attorney

When it comes to managing one’s affairs, whether due to illness, injury, or simply planning for the future, having the right legal documents in place is crucial. One of the most important documents for ensuring that your wishes are respected and your affairs are managed according to your preferences is the Power of Attorney (POA). This document grants another person, known as the agent or attorney-in-fact, the authority to act on your behalf in legal and financial matters. In this article, we will delve into the world of Power of Attorney paperwork, exploring its types, benefits, and how to obtain it.

Types of Power of Attorney

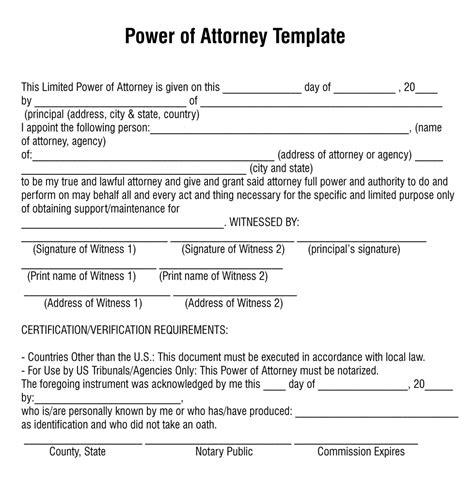

There are several types of Power of Attorney documents, each designed to serve specific needs and situations. Understanding these types is essential to choosing the right one for your circumstances.

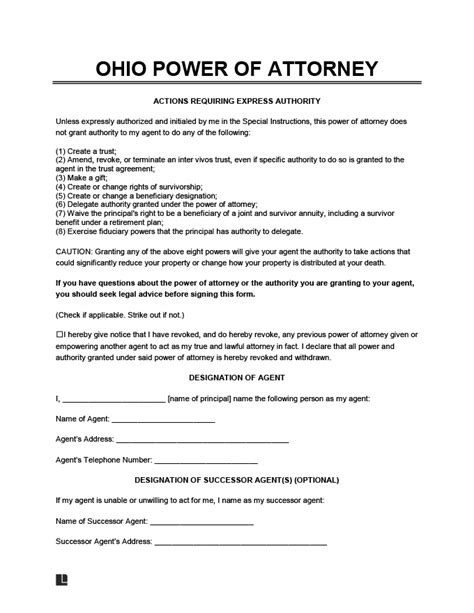

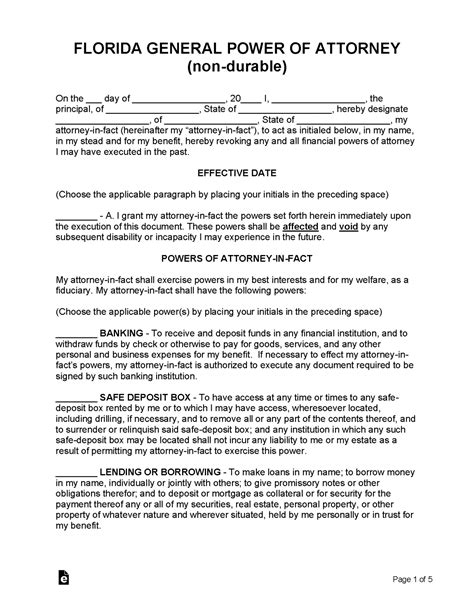

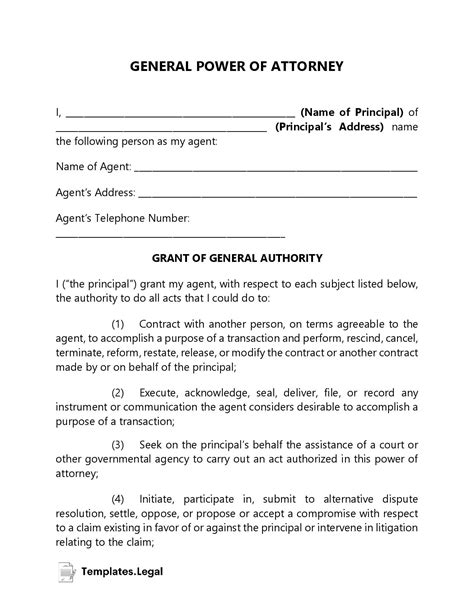

- General Power of Attorney: This type grants broad powers to the agent, allowing them to manage all aspects of your financial and legal affairs. It is often used for convenience, allowing someone else to handle tasks such as paying bills or managing investments when you are unavailable or prefer not to.

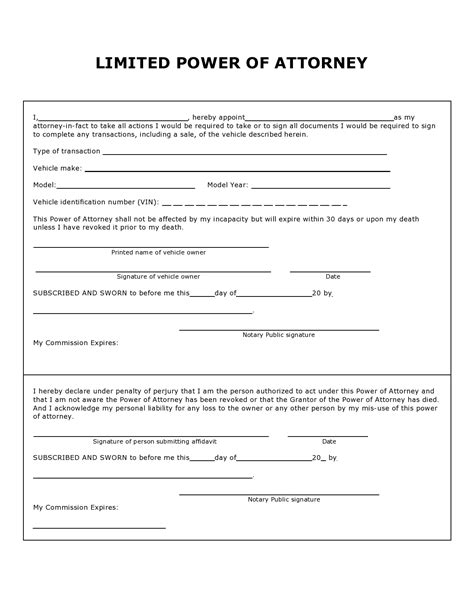

- Special Power of Attorney: Also known as a limited Power of Attorney, this document grants powers that are limited to specific tasks or periods. For example, you might grant someone the power to sell a particular piece of property on your behalf.

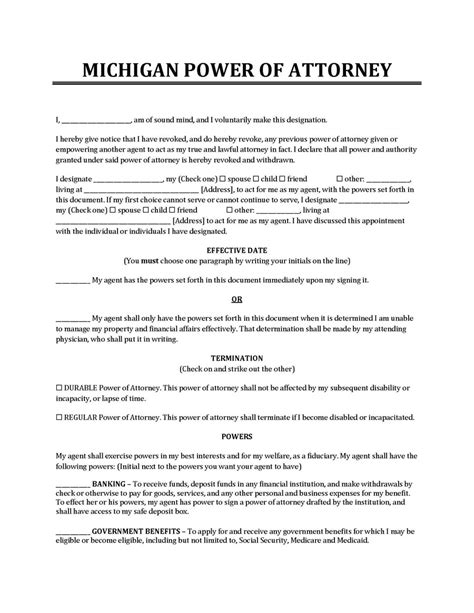

- Durable Power of Attorney: This remains in effect even if you become incapacitated and cannot make decisions for yourself. It is a powerful tool for planning for the future, especially in the context of aging or potential health issues.

- Springing Power of Attorney: This type becomes effective only upon your incapacitation, as certified by a doctor. It is useful for those who want to maintain control over their affairs as long as they are able but have a safety net in place.

Benefits of Having a Power of Attorney

The benefits of having a Power of Attorney are numerous and significant. Some of the key advantages include:

- Convenience: It allows someone you trust to handle your affairs when you are unable or prefer not to, making it easier to manage your life and ensure continuity.

- Peace of Mind: Knowing that your affairs are in order and will be managed according to your wishes, even if you are unable to make decisions, can provide a great sense of security and peace of mind.

- Flexibility: Depending on the type of POA you choose, you can tailor the level of authority granted to your agent, ensuring that your needs are met without compromising your autonomy.

- Protection: In the event of incapacitation, a durable Power of Attorney can protect you from exploitation and ensure that your financial and legal matters are handled responsibly.

How to Obtain Power of Attorney Paperwork

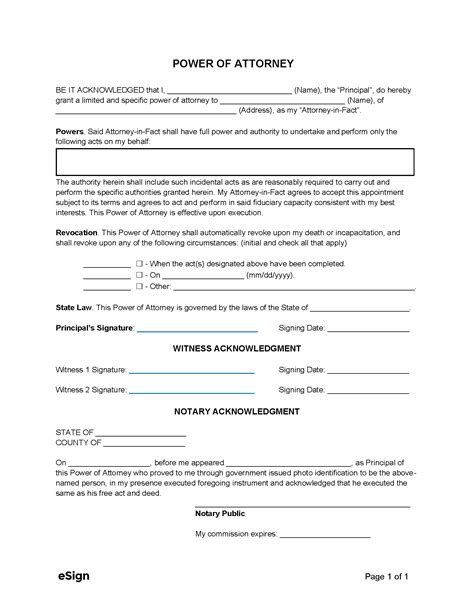

Obtaining a Power of Attorney involves several steps, including drafting the document, signing it, and potentially having it notarized. Here’s a simplified guide to the process:

- Determine the Type of POA Needed: Based on your situation and goals, decide which type of Power of Attorney is most suitable.

- Choose an Agent: Select someone you trust to act as your agent. This person should be reliable, responsible, and willing to carry out your wishes.

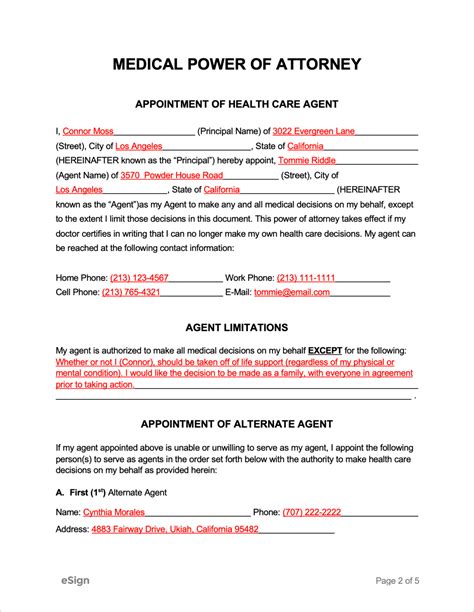

- Draft the Document: You can either use a pre-made template or consult with an attorney to draft a Power of Attorney document tailored to your needs. Ensure it includes your name, the agent’s name, the powers granted, and any limitations or conditions.

- Sign the Document: Sign the document in the presence of a notary public or as required by your state’s laws. Some states may also require the agent’s signature.

- Distribute Copies: Provide copies of the signed document to your agent, any relevant institutions (such as banks), and store the original in a safe place.

📝 Note: Laws regarding Power of Attorney vary by state, so it's essential to familiarize yourself with the specific requirements and regulations in your area.

Conclusion of Power of Attorney Process

In conclusion, the Power of Attorney is a vital document that offers a range of benefits, from convenience and peace of mind to protection in times of need. By understanding the different types of POA, their benefits, and how to obtain one, you can ensure that your affairs are managed according to your wishes, even when you are unable to make decisions yourself. Whether you are planning for the future, managing current responsibilities, or facing unexpected challenges, having a Power of Attorney in place can make a significant difference.

What is the primary purpose of a Power of Attorney?

+

The primary purpose of a Power of Attorney is to grant another person the legal authority to act on your behalf in financial and legal matters, ensuring that your affairs are managed according to your wishes even when you are unable to make decisions yourself.

How do I choose the right agent for my Power of Attorney?

+

Choosing the right agent involves selecting someone you trust implicitly, who is responsible, and capable of managing your affairs. Consider factors such as their reliability, financial responsibility, and willingness to carry out your wishes as outlined in the Power of Attorney document.

Can I revoke a Power of Attorney if I change my mind or the circumstances change?

+

Yes, you can revoke a Power of Attorney. To do so, you typically need to notify your agent and any institutions that have been given a copy of the POA document. The process may involve creating a revocation document, which should be signed, notarized, and distributed appropriately.