Send New Hire Paperwork to Employer

Introduction to New Hire Paperwork

When starting a new job, it’s essential to complete and submit all required new hire paperwork to your employer. This paperwork is a crucial step in the hiring process, as it provides your employer with necessary information to process your employment, benefits, and tax withholding. In this article, we will guide you through the process of sending new hire paperwork to your employer, highlighting the importance of accuracy and timeliness.

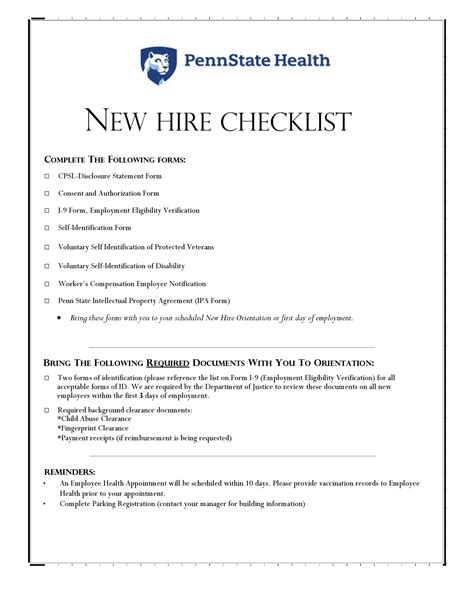

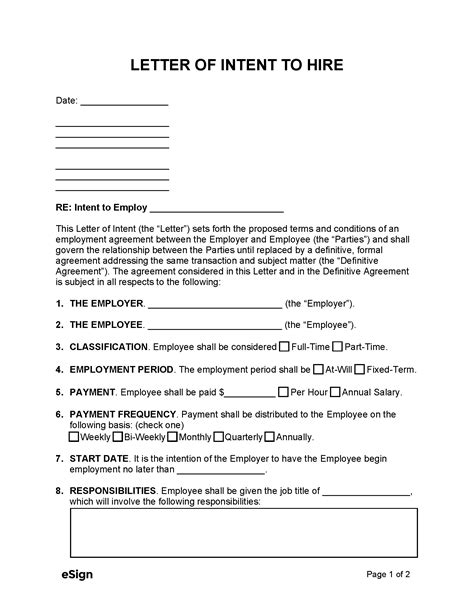

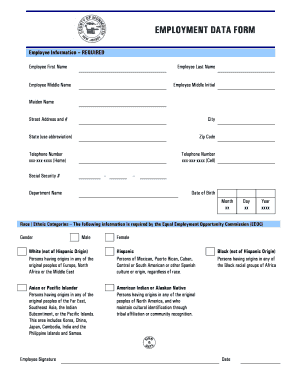

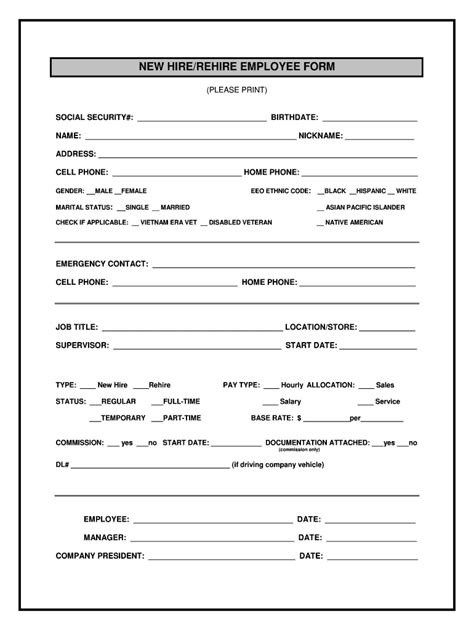

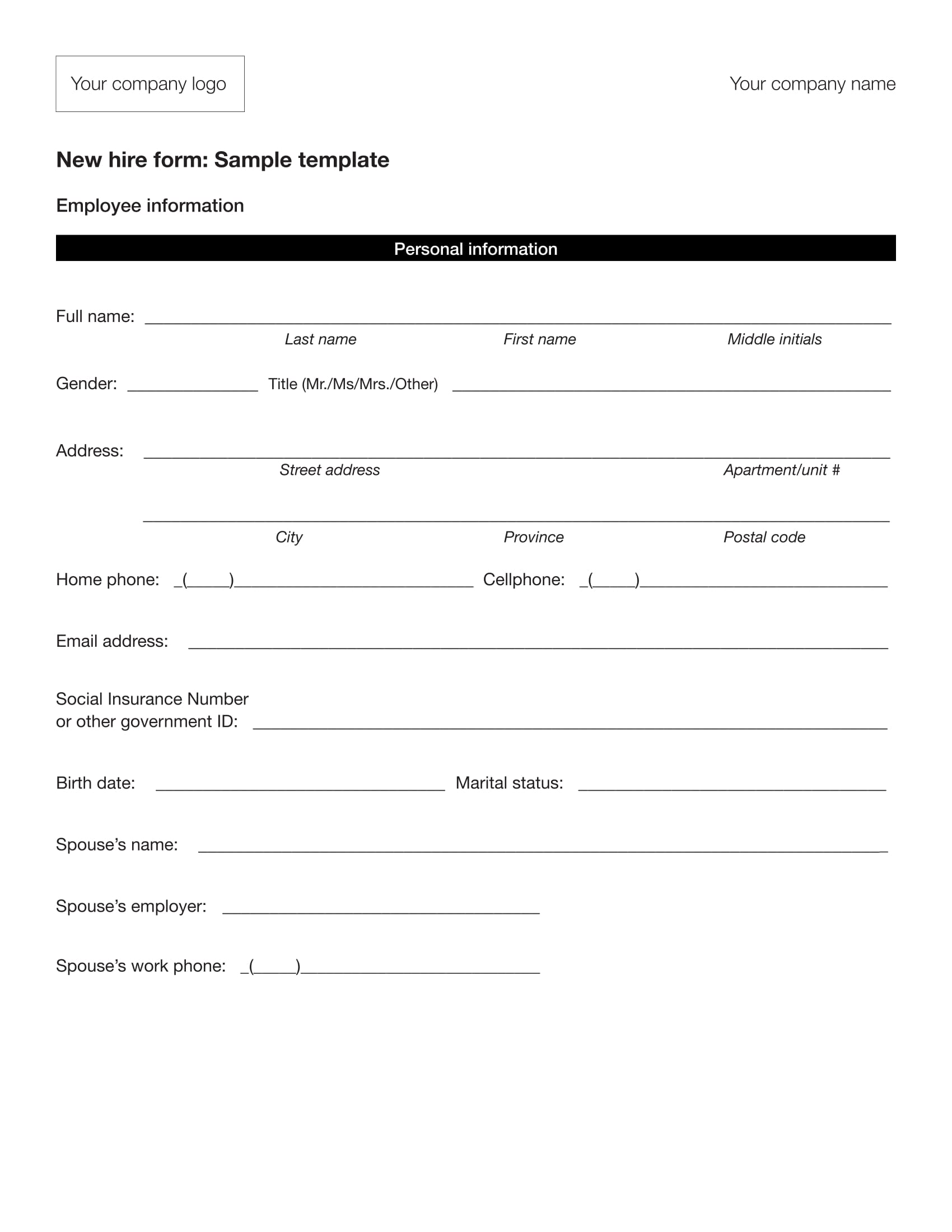

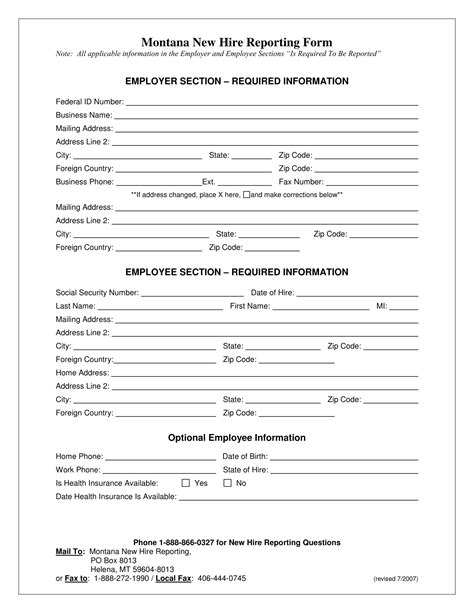

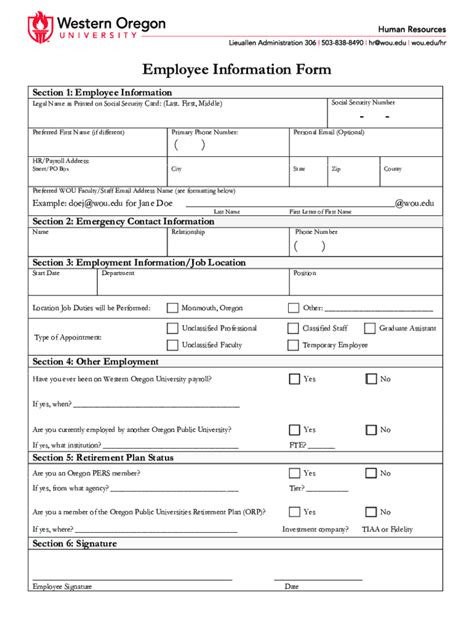

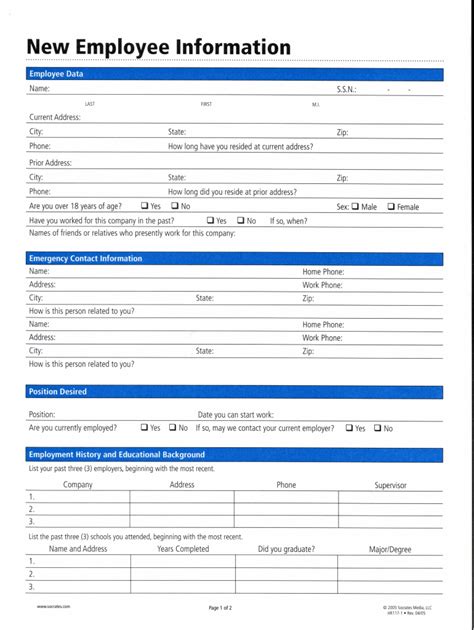

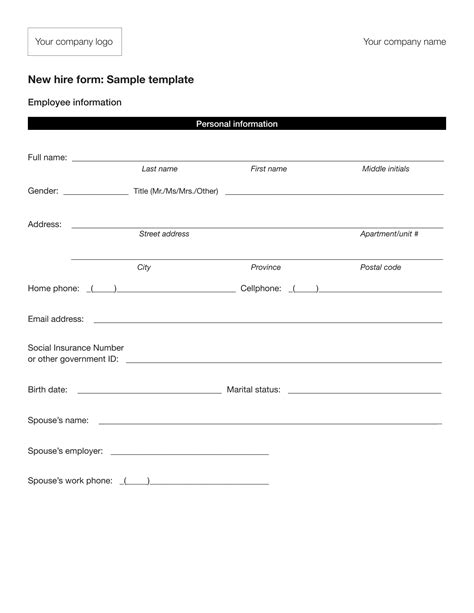

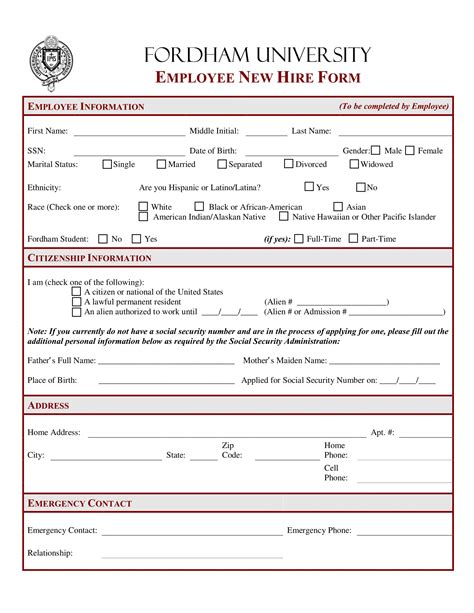

Types of New Hire Paperwork

The types of paperwork required may vary depending on the company, location, and job type. However, some common documents included in new hire paperwork are: * W-4 form: Used to determine federal income tax withholding * I-9 form: Verifies your identity and eligibility to work in the United States * Benefits enrollment forms: For health insurance, retirement plans, and other benefits * Direct deposit authorization: Allows your employer to deposit your paycheck directly into your bank account * Emergency contact information: Provides your employer with contact details in case of an emergency

How to Complete New Hire Paperwork

To complete your new hire paperwork, follow these steps: * Carefully review each document to ensure you understand what information is required * Fill out the forms accurately and completely, using black ink and printing clearly * Sign and date each document as required * Make a copy of the completed paperwork for your records * Submit the paperwork to your employer by the designated deadline

Submitting New Hire Paperwork

Once you’ve completed your new hire paperwork, submit it to your employer using one of the following methods: * In-person: Bring the paperwork to your employer’s office or HR department * Email: Scan and attach the completed documents to an email, sending it to the designated contact * Online portal: Upload the documents to your employer’s online platform, if available * Mail: Send the paperwork via mail, using a trackable shipping method to ensure delivery

📝 Note: Be sure to keep a record of when and how you submitted your new hire paperwork, in case your employer needs to verify receipt.

Importance of Timely Submission

Submitting your new hire paperwork in a timely manner is crucial to avoid delays in your employment, benefits, and pay. Failure to submit the paperwork by the deadline may result in: * Delayed start date * Incomplete benefits enrollment * Inaccurate tax withholding * Other administrative issues

Best Practices for New Hire Paperwork

To ensure a smooth onboarding process, follow these best practices: * Review and understand each document before signing * Keep a copy of the completed paperwork for your records * Submit the paperwork by the designated deadline * Follow up with your employer to confirm receipt and processing

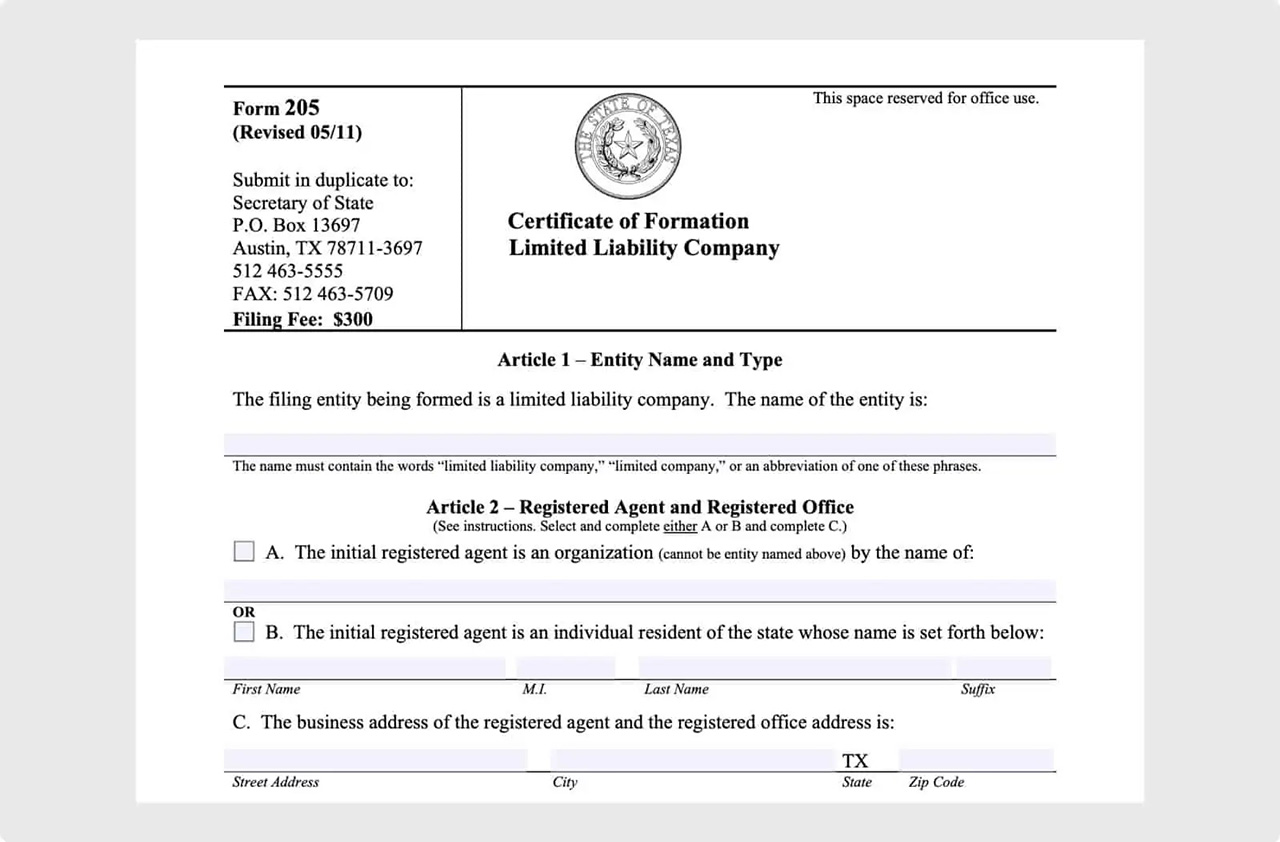

| Document | Purpose |

|---|---|

| W-4 form | Federal income tax withholding |

| I-9 form | Identity and work eligibility verification |

| Benefits enrollment forms | Enrollment in health insurance, retirement plans, and other benefits |

As you complete and submit your new hire paperwork, remember that accuracy and timeliness are essential. By following the steps and best practices outlined in this article, you’ll be well on your way to a successful onboarding experience. In summary, sending new hire paperwork to your employer is a critical step in the hiring process, and it’s crucial to get it right to avoid delays and administrative issues.

What is the purpose of the W-4 form?

+

The W-4 form is used to determine federal income tax withholding.

How do I submit my new hire paperwork?

+

You can submit your new hire paperwork in-person, via email, online portal, or mail.

What happens if I don’t submit my new hire paperwork on time?

+

Failure to submit your new hire paperwork by the deadline may result in delayed start date, incomplete benefits enrollment, inaccurate tax withholding, and other administrative issues.