Paperwork

Stop Finance Paperwork Now

Introduction to Streamlining Financial Processes

The world of finance is often associated with complexity and paperwork. However, with the advent of technology and digital solutions, it’s possible to significantly reduce the amount of paperwork involved in financial transactions and management. This shift not only enhances efficiency but also contributes to a more environmentally friendly approach to finance. In this article, we will explore the ways to minimize finance paperwork, the benefits of digital financial management, and how individuals and businesses can make the transition to a more streamlined and paperless financial system.

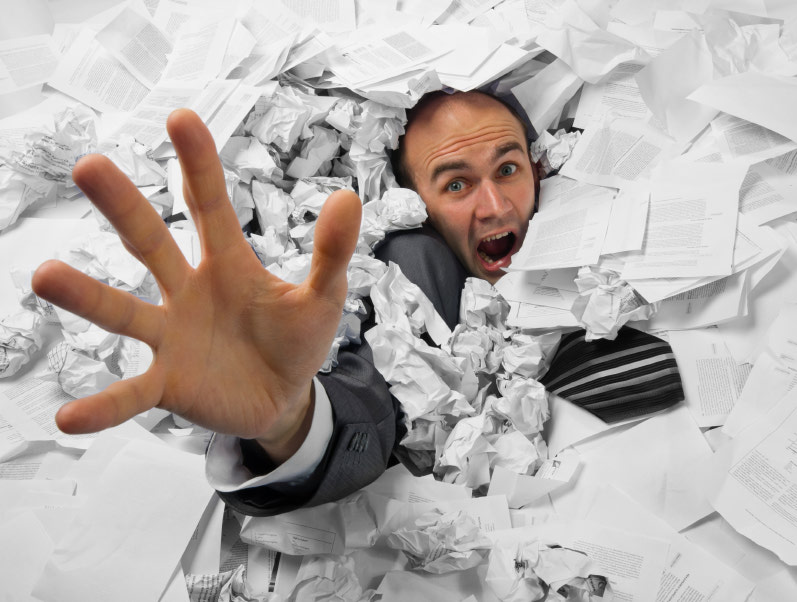

Understanding the Need for Reduction in Paperwork

The traditional financial system relies heavily on physical documents, from receipts and invoices to contracts and bank statements. This reliance on paper not only contributes to deforestation and waste but also increases the risk of document loss, theft, or damage. Moreover, managing paper documents can be time-consuming and prone to errors. Digitalization offers a solution to these problems by providing a secure, efficient, and environmentally friendly alternative to traditional paperwork.

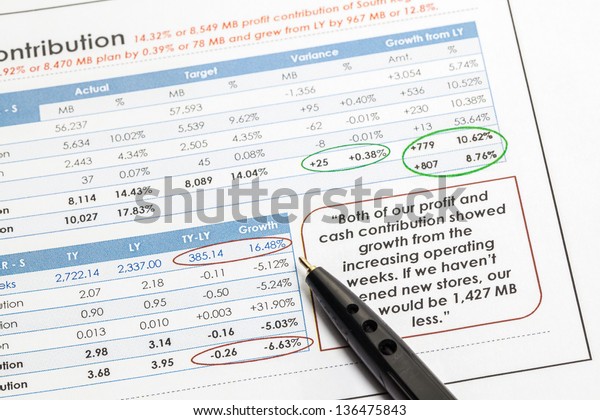

Benefits of Digital Financial Management

The benefits of moving towards a digital financial management system are numerous: - Increased Efficiency: Digital documents can be easily stored, retrieved, and shared, saving time and reducing the physical space required for storage. - Enhanced Security: Digital files can be encrypted and password-protected, reducing the risk of unauthorized access or data breaches. - Environmental Sustainability: Reducing the use of paper contributes to a more sustainable environment. - Cost Savings: Minimizing paperwork can lead to significant cost savings on paper, printing, and storage.

Steps to Minimize Finance Paperwork

Making the transition to a paperless financial system involves several steps: - Adopt Digital Banking: Utilize online banking services for transactions, bill payments, and account management. - Implement Digital Invoicing and Billing: Use electronic invoices and bills to reduce paper waste and enhance payment efficiency. - Use Cloud Storage: Store financial documents securely in the cloud for easy access and sharing. - Invest in Financial Management Software: Utilize software designed for financial management to streamline tasks such as budgeting, invoicing, and expense tracking.

💡 Note: When transitioning to digital financial management, it's crucial to ensure that all digital platforms and tools are secure and compliant with financial regulations to protect sensitive information.

Tools and Technologies for Digital Financial Management

Several tools and technologies are available to facilitate the move to a paperless financial system: - Digital Wallets: Services like Apple Pay, Google Pay, and PayPal allow for contactless payments and reduce the need for physical cash and cards. - Financial Apps: Applications such as Mint, Personal Capital, and You Need a Budget (YNAB) offer comprehensive financial management solutions, including budgeting, tracking expenses, and setting financial goals. - Cloud Accounting Software: Platforms like QuickBooks, Xero, and Sage provide businesses with efficient ways to manage finances, including invoicing, payroll, and tax compliance.

Challenges and Solutions

While transitioning to a digital financial system offers many benefits, there are also challenges to consider: - Security Concerns: The risk of cyberattacks and data breaches is a significant concern. Implementing robust security measures, such as two-factor authentication and encryption, can mitigate these risks. - Accessibility: Not all individuals or businesses have equal access to digital technologies. Investing in digital literacy programs and ensuring that digital financial services are accessible can help address this issue.

Future of Digital Finance

The future of finance is undoubtedly digital. As technology continues to evolve, we can expect even more innovative solutions to emerge, further reducing the need for paperwork and enhancing financial management efficiency. Blockchain technology, for example, promises to revolutionize financial transactions by providing a secure, transparent, and efficient way to conduct transactions without the need for intermediaries.

Embracing Digital Financial Management

In conclusion, embracing digital financial management is a step towards a more efficient, secure, and sustainable financial future. By understanding the benefits, adopting the right tools and technologies, and addressing the challenges, individuals and businesses can significantly reduce finance paperwork and thrive in a digital financial landscape.

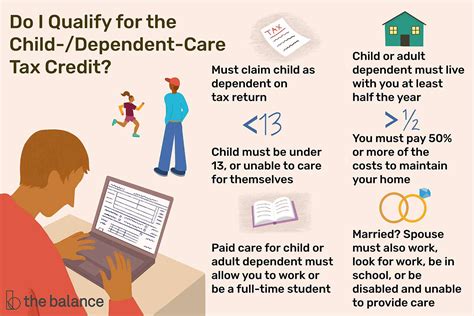

What are the primary benefits of digital financial management?

+

The primary benefits include increased efficiency, enhanced security, environmental sustainability, and cost savings.

How can individuals and businesses ensure the security of their digital financial data?

+

By implementing robust security measures such as two-factor authentication, encryption, and regularly updating software and systems.

What role does blockchain technology play in the future of digital finance?

+

Blockchain technology promises to revolutionize financial transactions by providing a secure, transparent, and efficient way to conduct transactions without the need for intermediaries.