Personal Loan Paperwork Overview

Introduction to Personal Loan Paperwork

When considering a personal loan, it’s essential to understand the paperwork involved in the process. Personal loan paperwork can be overwhelming, but being prepared and knowledgeable about the required documents can make a significant difference in the loan application process. In this article, we will delve into the world of personal loan paperwork, exploring the necessary documents, the application process, and providing valuable tips for a smooth and successful loan experience.

Understanding Personal Loan Paperwork

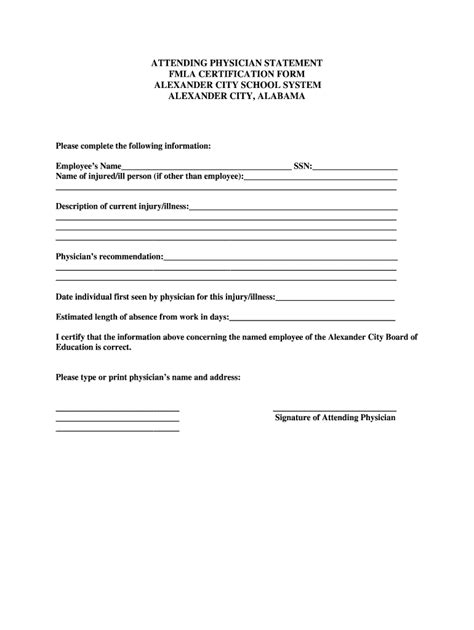

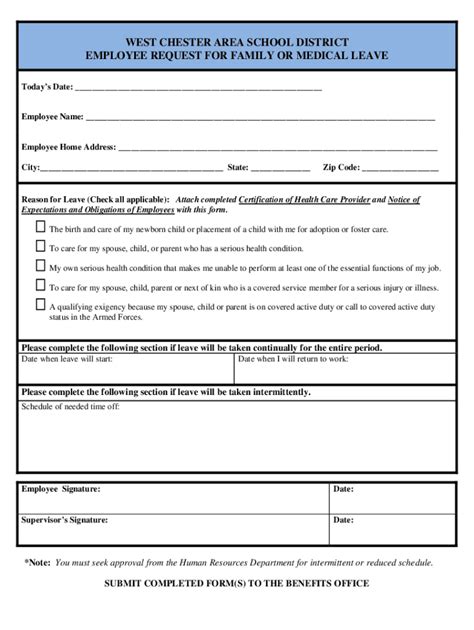

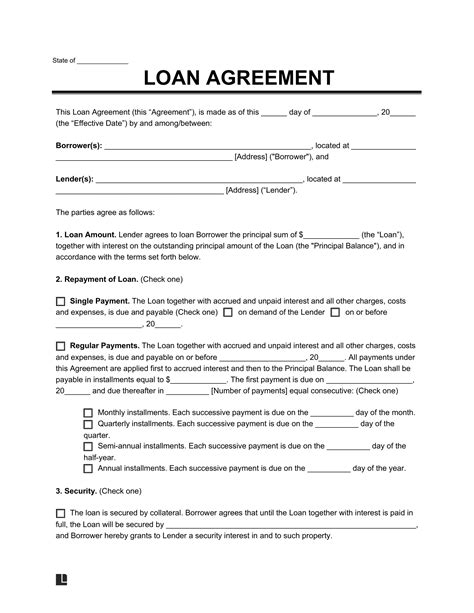

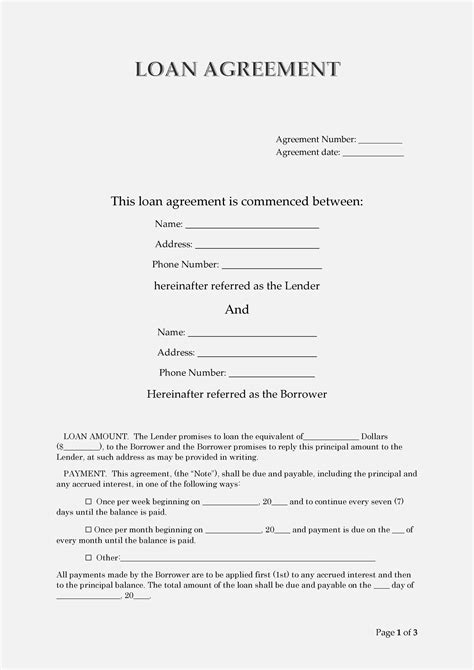

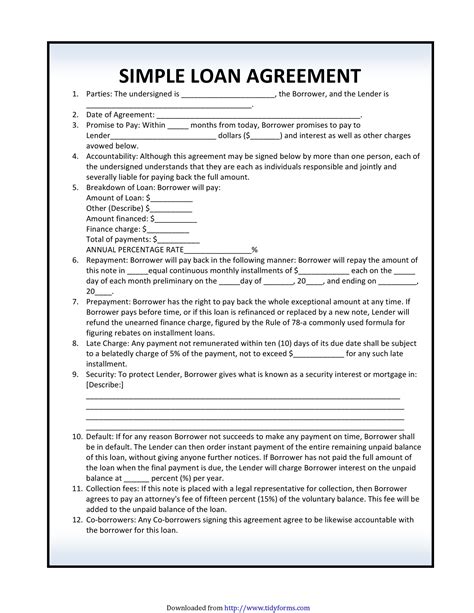

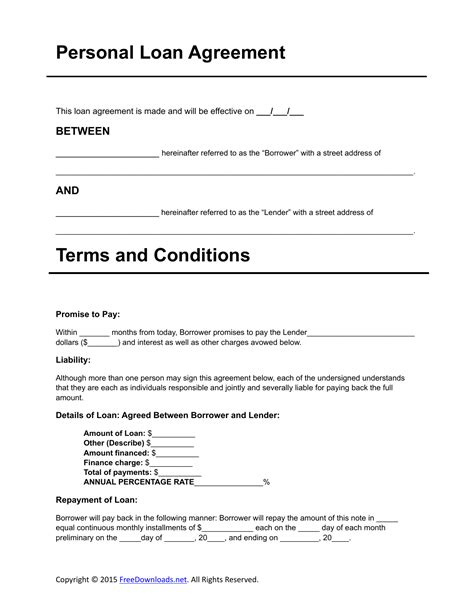

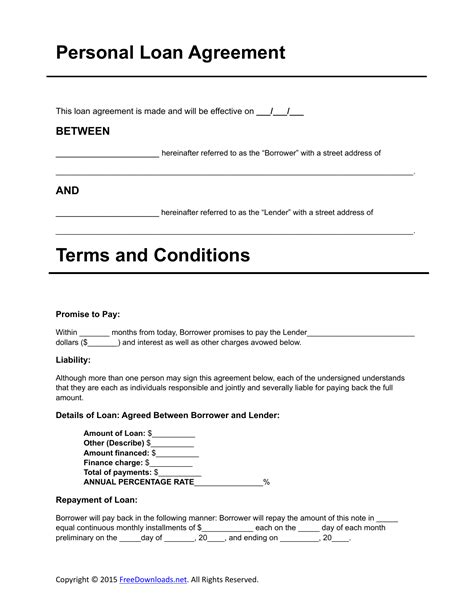

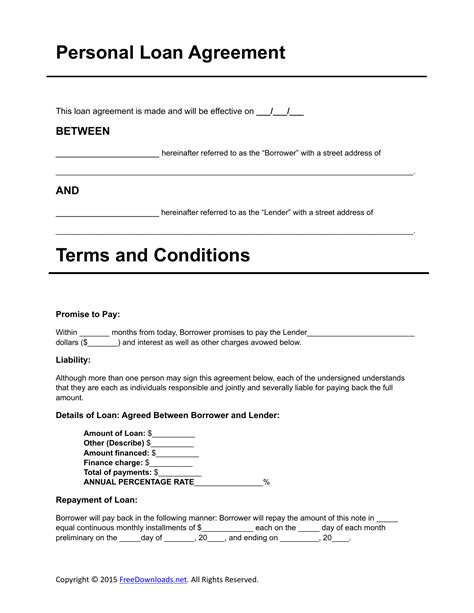

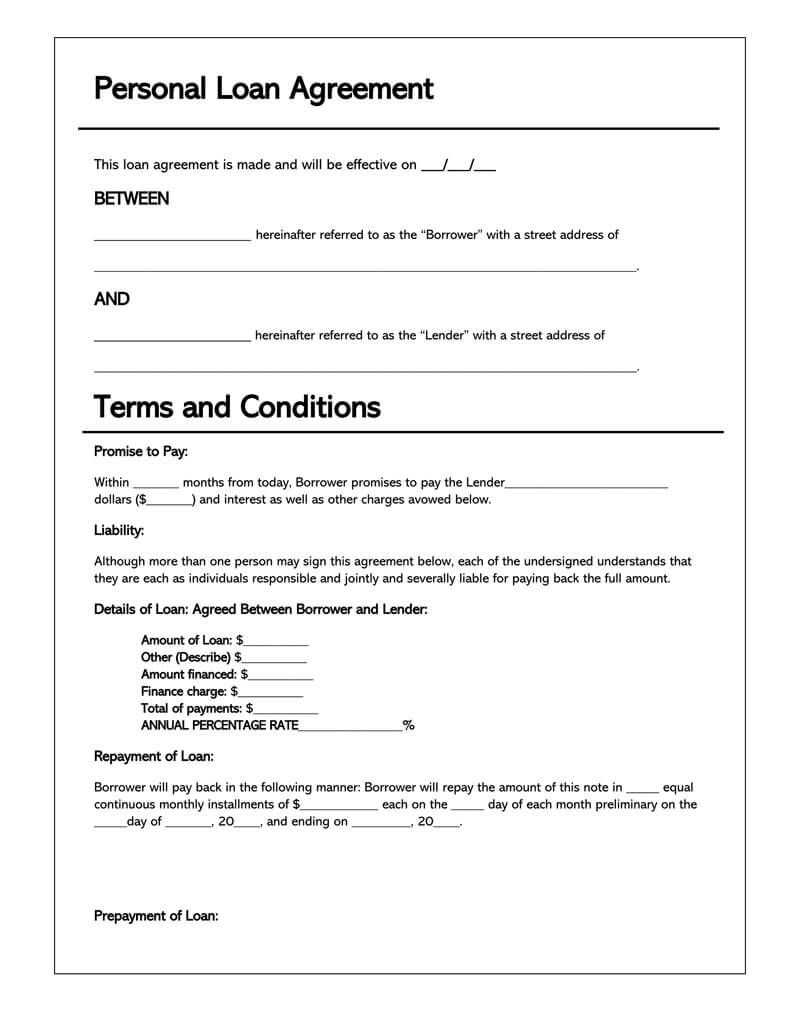

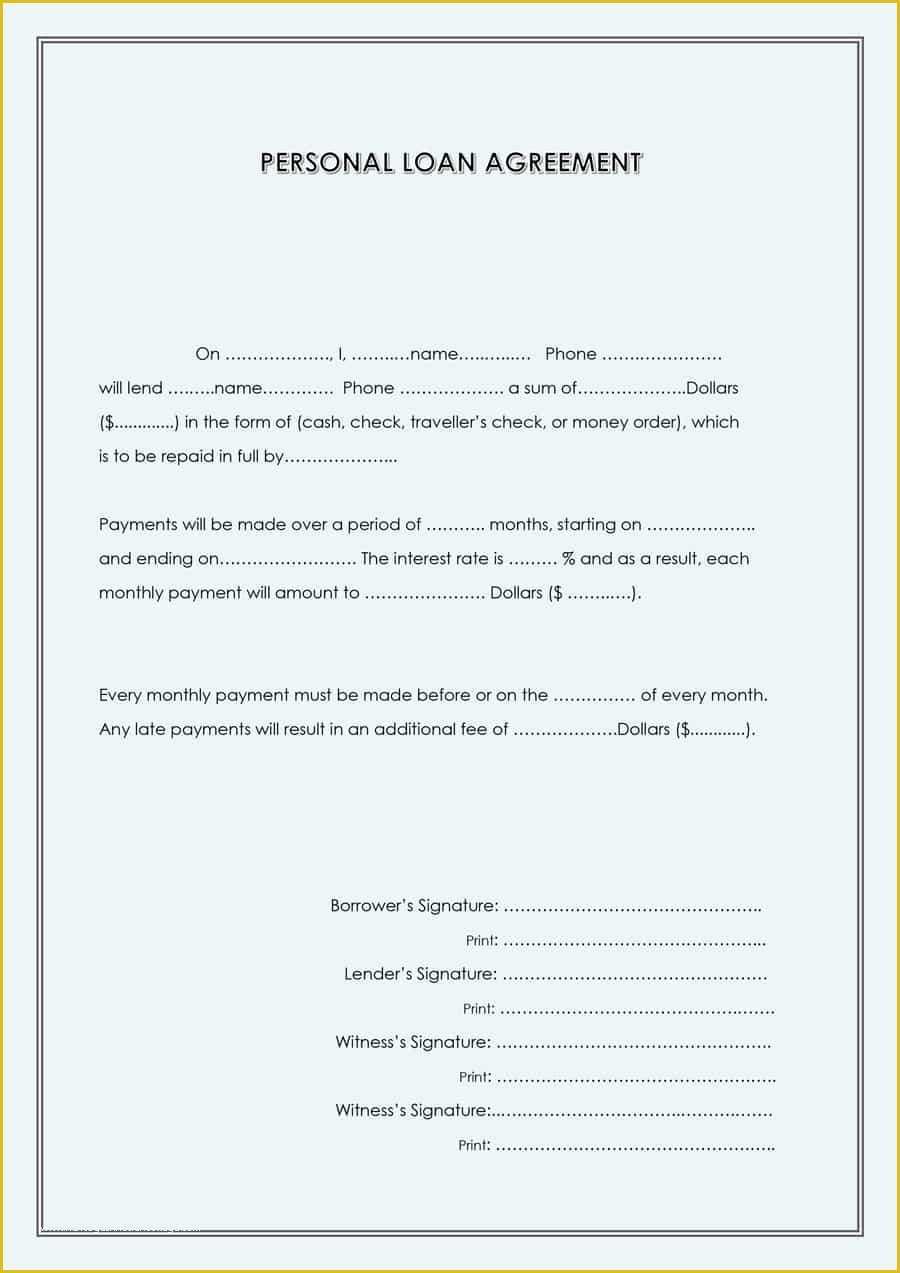

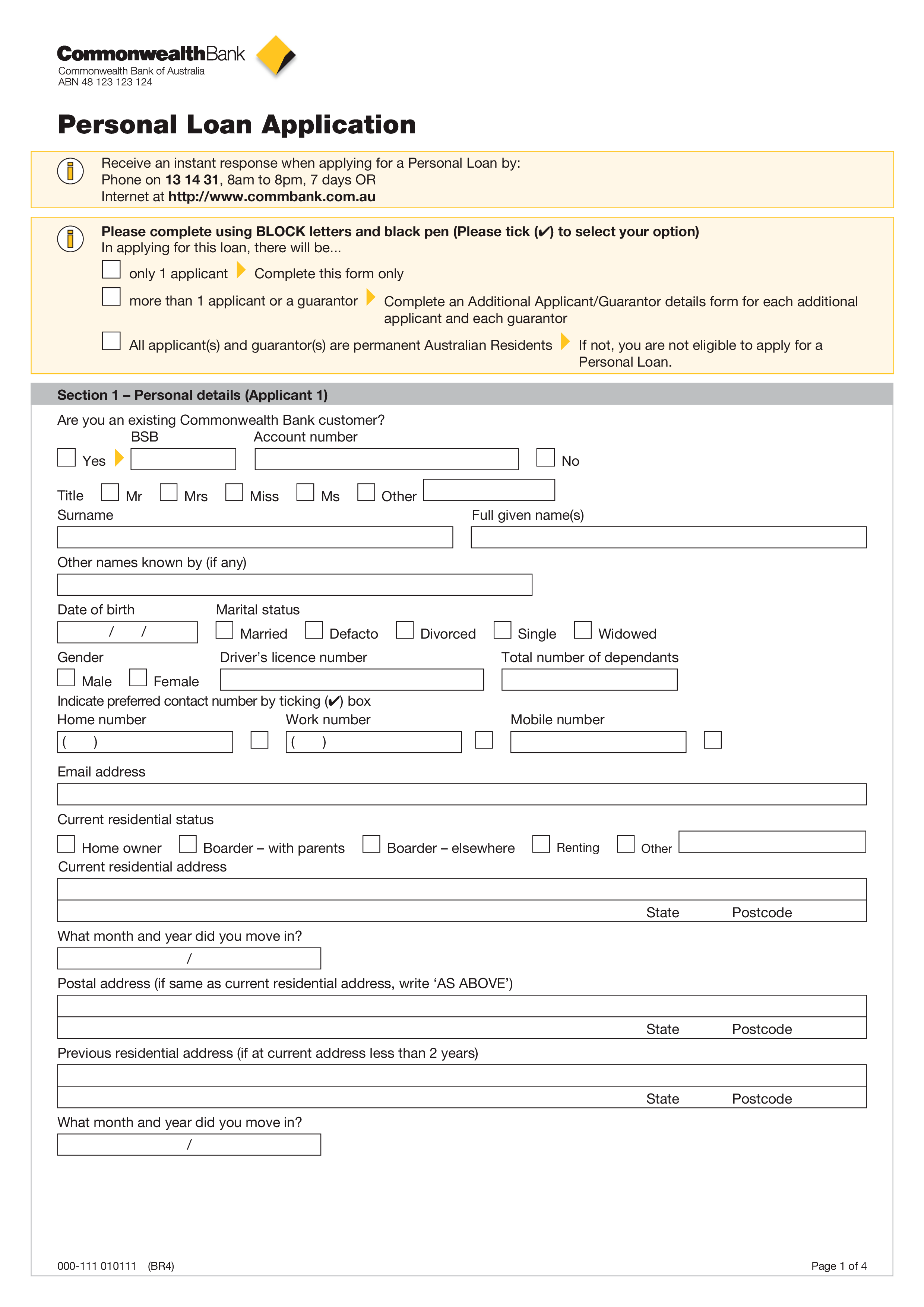

Personal loan paperwork typically includes a variety of documents that lenders require to assess an individual’s creditworthiness and ability to repay the loan. The primary documents involved in personal loan paperwork are: * Identification documents: A valid government-issued ID, such as a driver’s license, passport, or state ID, is required to verify the borrower’s identity. * Income documents: Pay stubs, W-2 forms, or tax returns are necessary to demonstrate the borrower’s income and employment status. * Credit reports: Lenders will review the borrower’s credit report to evaluate their credit history and score. * Bank statements: Bank statements may be required to verify the borrower’s account information and financial stability. * Loan application: The loan application form, which includes personal and financial information, is the foundation of the personal loan paperwork process.

Application Process for Personal Loans

The personal loan application process typically involves the following steps: * Pre-qualification: The borrower submits basic information to determine their eligibility for a personal loan. * Application submission: The borrower completes and submits the loan application, providing the necessary documents. * Verification and review: The lender reviews and verifies the submitted documents to assess the borrower’s creditworthiness. * Approval and funding: If the loan is approved, the lender will disburse the funds to the borrower’s account.

Types of Personal Loans

There are various types of personal loans, each with its unique characteristics and requirements. Some common types of personal loans include: * Unsecured personal loans: These loans do not require collateral and are based on the borrower’s creditworthiness. * SMS loans: These loans are typically small, short-term loans that are repaid in a single payment. * Peer-to-peer loans: These loans are funded by individual investors rather than traditional lenders. * Secured personal loans: These loans require collateral, such as a vehicle or property, to secure the loan.

Table: Comparison of Personal Loan Types

| Loan Type | Collateral Required | Interest Rate | Repayment Term |

|---|---|---|---|

| Unsecured Personal Loan | No | Variable | 1-5 years |

| Secured Personal Loan | Yes | Fixed | 1-10 years |

| Peer-to-Peer Loan | No | Variable | 1-5 years |

💡 Note: The interest rates and repayment terms may vary depending on the lender and the borrower's creditworthiness.

Tips for a Smooth Personal Loan Experience

To ensure a smooth and successful personal loan experience, consider the following tips: * Check your credit report: Review your credit report to ensure it is accurate and up-to-date. * Gather necessary documents: Make sure you have all the required documents ready before submitting your loan application. * Compare lenders: Research and compare different lenders to find the best interest rates and terms. * Read the fine print: Carefully review the loan agreement to understand the terms and conditions.

As we have explored the world of personal loan paperwork, it is essential to remember that being prepared and knowledgeable about the process can make a significant difference in your loan experience. By understanding the necessary documents, application process, and types of personal loans, you can navigate the process with confidence and make informed decisions about your financial future. The key to a successful personal loan experience is to be aware of the requirements, compare lenders, and carefully review the loan agreement. By doing so, you can ensure a smooth and successful loan experience that meets your financial needs.

What are the typical documents required for personal loan paperwork?

+

The typical documents required for personal loan paperwork include identification documents, income documents, credit reports, bank statements, and the loan application form.

How long does the personal loan application process typically take?

+

The personal loan application process can take anywhere from a few minutes to several days, depending on the lender and the complexity of the application.

What is the difference between a secured and unsecured personal loan?

+

A secured personal loan requires collateral, such as a vehicle or property, to secure the loan, while an unsecured personal loan does not require collateral and is based on the borrower’s creditworthiness.