Paperwork

Keep Tax Paperwork How Far Back

Understanding the Importance of Keeping Tax Paperwork

When it comes to tax paperwork, many individuals are unsure about how long they should keep their documents. The length of time you should keep your tax paperwork depends on various factors, including the type of tax return, the tax authority’s requirements, and any potential audits or disputes. In this article, we will explore the guidelines for keeping tax paperwork and provide tips on how to manage your documents effectively.

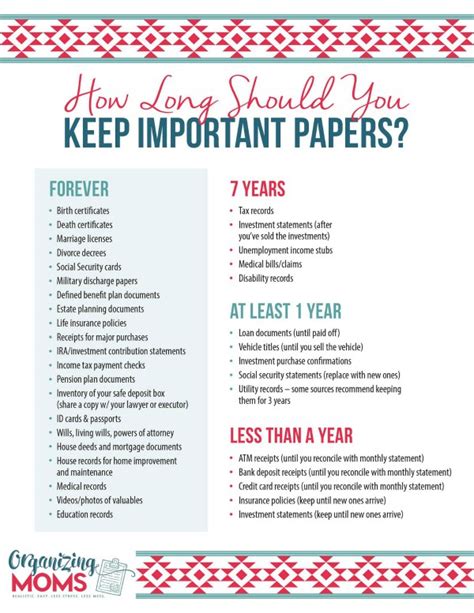

General Guidelines for Keeping Tax Paperwork

The general rule of thumb is to keep tax paperwork for at least three to seven years. This allows you to have a record of your income, expenses, and tax payments in case of an audit or if you need to file an amended return. However, the exact length of time you should keep your tax paperwork may vary depending on your specific situation. For example, if you have a complex tax return with multiple deductions and credits, you may want to keep your paperwork for a longer period.

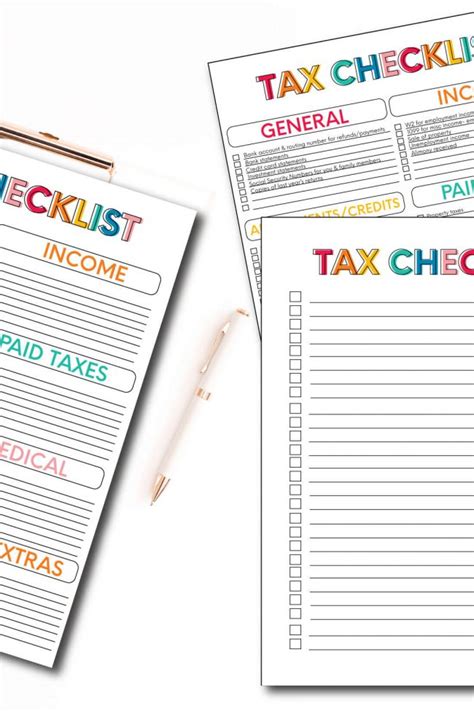

Types of Tax Paperwork to Keep

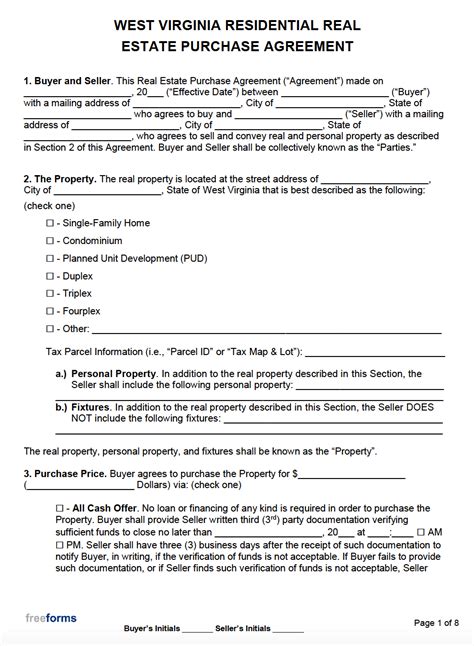

There are several types of tax paperwork that you should keep, including: * Tax returns (personal and business) * W-2 forms and 1099 forms * Receipts and invoices for deductions and credits * Bank statements and cancelled checks * Records of charitable donations and medical expenses * Records of home improvements and investments

Why Keep Tax Paperwork for an Extended Period?

Keeping tax paperwork for an extended period can help you in several ways: * Audit protection: In case of an audit, having a complete record of your tax paperwork can help you prove your income, expenses, and tax payments. * Amended returns: If you need to file an amended return, having a record of your original tax paperwork can help you identify any errors or discrepancies. * Tax planning: Keeping a record of your tax paperwork can help you identify areas where you can reduce your tax liability and plan for future tax savings.

📝 Note: It's essential to keep your tax paperwork organized and easily accessible in case you need to retrieve it quickly.

How to Store Tax Paperwork

There are several ways to store tax paperwork, including: * Physical storage: Keep your tax paperwork in a secure, fireproof safe or a locked file cabinet. * Digital storage: Scan your tax paperwork and store it electronically using a secure cloud storage service or an external hard drive. * Shredding: Shred any sensitive documents that you no longer need to keep, such as receipts and invoices.

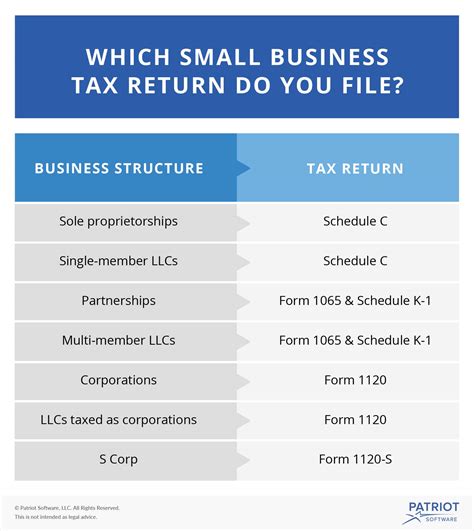

Table: Tax Paperwork Retention Guidelines

| Type of Tax Paperwork | Retention Period |

|---|---|

| Personal tax returns | 3-7 years |

| Business tax returns | 7-10 years |

| W-2 forms and 1099 forms | 3-7 years |

| Receipts and invoices | 3-7 years |

Conclusion Summary

In summary, keeping tax paperwork for an extended period can help you protect yourself in case of an audit, file amended returns, and plan for future tax savings. It’s essential to keep your tax paperwork organized, easily accessible, and stored securely. By following the guidelines outlined in this article, you can ensure that you have a complete record of your tax paperwork and can manage your documents effectively.

How long should I keep my tax returns?

+

You should keep your tax returns for at least 3-7 years, depending on the type of tax return and any potential audits or disputes.

What types of tax paperwork should I keep?

+

You should keep tax returns, W-2 forms and 1099 forms, receipts and invoices, bank statements and cancelled checks, records of charitable donations and medical expenses, and records of home improvements and investments.

How should I store my tax paperwork?

+

You can store your tax paperwork physically in a secure, fireproof safe or a locked file cabinet, or digitally using a secure cloud storage service or an external hard drive.