Paperwork

5 FSBO Loan Tips

Introduction to FSBO Loans

When it comes to selling a property, many homeowners consider the For Sale By Owner (FSBO) route to avoid paying real estate agent commissions. However, securing a loan for an FSBO property can be challenging. In this article, we will explore the world of FSBO loans and provide valuable tips for navigating this complex process. Understanding the nuances of FSBO loans is crucial for a successful transaction.

What are FSBO Loans?

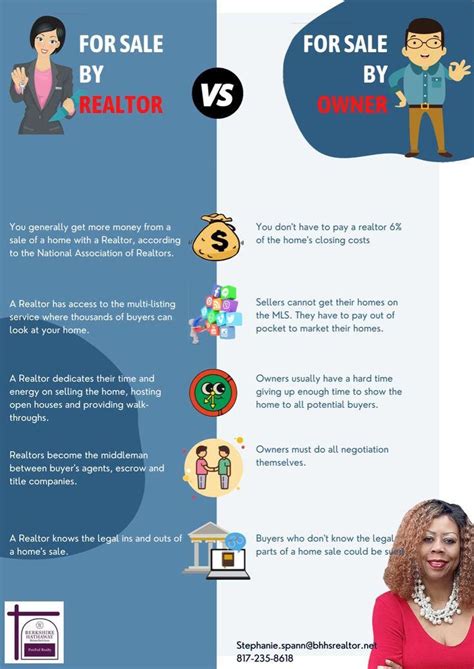

FSBO loans are mortgages or financing options specifically designed for properties being sold by their owners without the involvement of a real estate agent. These loans can be more complicated than traditional mortgages due to the lack of professional representation. Homeowners must be prepared to handle all aspects of the sale, including marketing, negotiations, and paperwork.

Benefits of FSBO Loans

There are several benefits to considering FSBO loans: * Cost savings: Avoiding real estate agent commissions can result in significant cost savings for the seller. * Increased control: FSBO sellers have more control over the sales process, allowing them to make decisions and negotiations directly with potential buyers. * Faster transaction: Without the need for agent involvement, FSBO transactions can potentially move faster, as there are fewer parties involved in the process.

5 FSBO Loan Tips

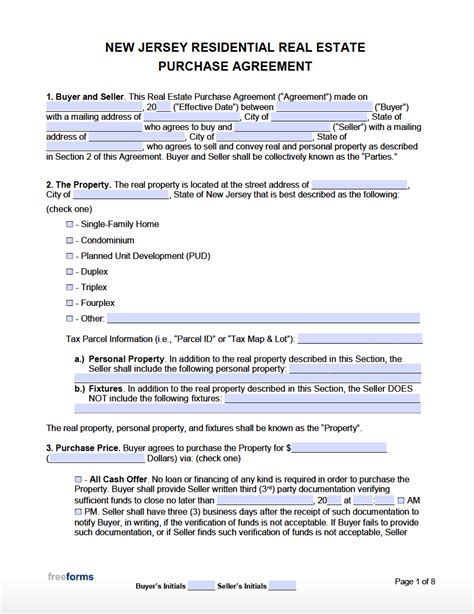

To ensure a smooth and successful FSBO loan process, follow these tips: * Tip 1: Prepare Your Finances: Before applying for an FSBO loan, ensure your financial situation is in order. This includes checking your credit score, gathering financial documents, and having a clear understanding of your income and expenses. * Tip 2: Research Lenders: Not all lenders offer FSBO loans, so research and compare different lenders to find the best option for your situation. Consider factors such as interest rates, fees, and repayment terms. * Tip 3: Understand the Loan Options: FSBO loans can come in various forms, including fixed-rate and adjustable-rate mortgages. Choose a loan option that aligns with your financial goals and situation. * Tip 4: Be Prepared for Inspections and Appraisals: As part of the loan process, inspections and appraisals may be required to determine the property’s value. Be prepared to provide access to the property and address any issues that may arise during these processes. * Tip 5: Seek Professional Advice: While the goal of FSBO is to avoid agent commissions, seeking professional advice from a lawyer, accountant, or financial advisor can be beneficial in navigating the complex loan process.

📝 Note: It's essential to carefully review and understand the terms and conditions of your FSBO loan before signing any agreements.

Common FSBO Loan Mistakes to Avoid

When navigating the FSBO loan process, it’s essential to avoid common mistakes that can lead to delays or even loan rejection. Some of these mistakes include: * Inaccurate property valuation * Insufficient documentation * Poor credit history * Failure to disclose information

| FSBO Loan Option | Interest Rate | Fees |

|---|---|---|

| Fixed-Rate Mortgage | 4.5% | 2% of loan amount |

| Adjustable-Rate Mortgage | 3.5% | 1.5% of loan amount |

Conclusion and Final Thoughts

In conclusion, navigating the world of FSBO loans requires careful consideration and planning. By understanding the benefits and challenges of FSBO loans and following the tips outlined in this article, homeowners can increase their chances of a successful transaction. Remember to stay organized, seek professional advice when needed, and carefully review all loan agreements before signing.

What is the main advantage of FSBO loans?

+

The main advantage of FSBO loans is the potential cost savings from avoiding real estate agent commissions.

How do I qualify for an FSBO loan?

+

To qualify for an FSBO loan, you will typically need to meet the lender’s credit score, income, and debt-to-income ratio requirements, as well as provide documentation such as pay stubs, bank statements, and tax returns.

Can I use an FSBO loan to purchase a property?

+

Yes, FSBO loans can be used to purchase a property, but the process and requirements may differ from those for selling a property.