5 Ways Lease Own

Introduction to Lease Ownership

Lease ownership, often considered a middle ground between renting and buying, has gained popularity in various sectors, including real estate, vehicles, and equipment. This arrangement allows individuals or businesses to use an asset for a specified period in exchange for regular payments, without the need for a significant upfront purchase price. The concept of leasing is particularly appealing in today’s economic climate, where flexibility and cost management are crucial. In this article, we will delve into the concept of lease ownership, its benefits, and explore five ways lease ownership can be applied across different industries.

Understanding Lease Ownership

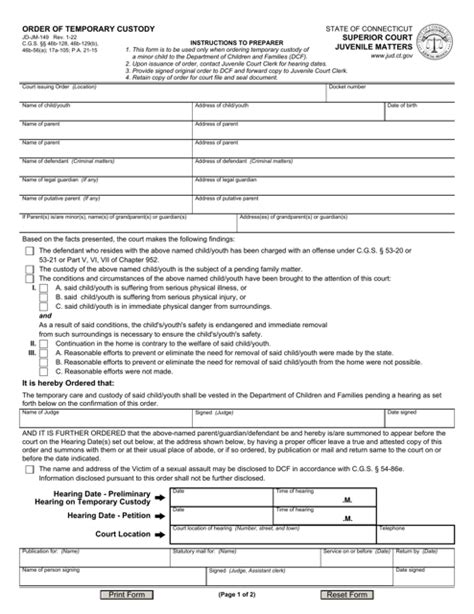

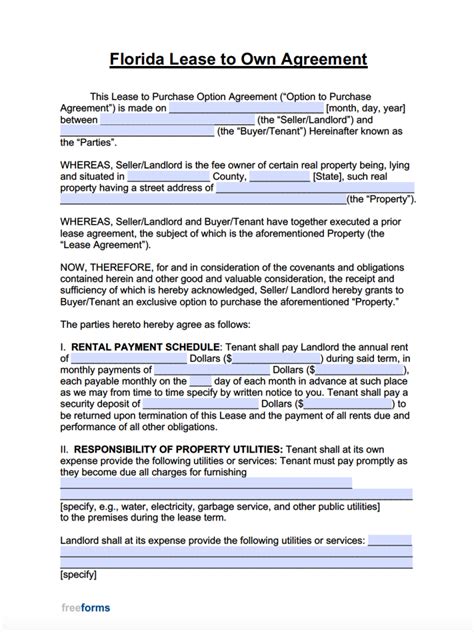

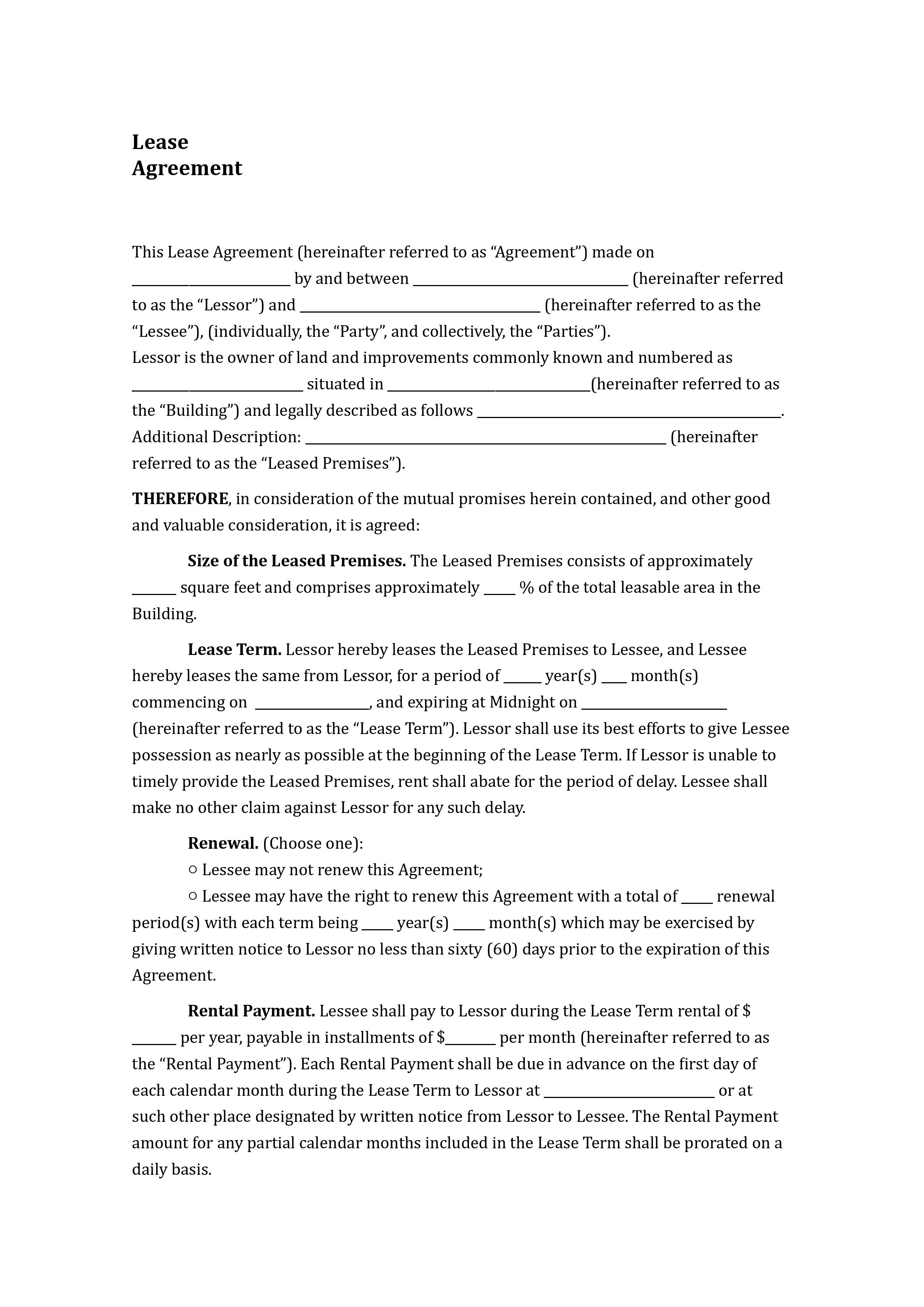

Lease ownership, or leasing, is a contractual agreement where the lessor (the owner of the asset) grants the lessee (the user) the right to use the asset for a specified period. This period can range from a few months to several years, depending on the type of lease and the asset involved. The lessee makes periodic payments, usually monthly, to the lessor in exchange for the use of the asset. At the end of the lease, the lessee typically has the option to return the asset, extend the lease, or purchase the asset at a predetermined price.

Benefits of Lease Ownership

The benefits of lease ownership are multifaceted and can be particularly advantageous for individuals and businesses looking to manage their expenses and maintain flexibility. Some key benefits include: - Lower Upfront Costs: Leasing often requires little to no down payment, making it more accessible than purchasing. - Flexibility: Lease terms can be negotiated to fit the user’s needs, and the option to upgrade or change assets at the end of the lease is a significant advantage. - Tax Benefits: Lease payments can be deductible as operating expenses, which can help reduce taxable income. - Reduced Risk: The lessor typically handles maintenance and repairs, reducing the lessee’s risk and financial burden.

Five Ways Lease Own

Given the versatility and advantages of lease ownership, it can be applied in various ways across different sectors:

- Real Estate: Lease-to-own options for homes are becoming increasingly popular, especially among those who cannot secure a mortgage or prefer the flexibility of renting with the option to buy.

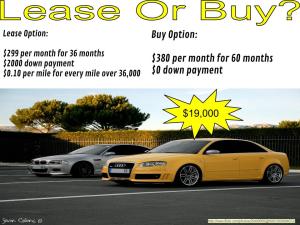

- Vehicles: Car leasing is a common practice, allowing individuals to drive a new vehicle every few years without the long-term commitment of buying.

- Equipment and Machinery: Businesses often lease equipment and machinery to avoid the high upfront costs of purchasing and to ensure they have access to the latest technology without the burden of maintenance.

- Technology and Software: With the rapid evolution of technology, leasing software and hardware can provide companies with the latest solutions without the need for significant capital expenditures.

- Commercial Properties: Lease ownership models can also be applied to commercial properties, such as office spaces or retail locations, offering businesses the flexibility to expand or relocate as needed.

📝 Note: When considering lease ownership, it's essential to carefully review the lease agreement to understand all terms, including the length of the lease, payment amounts, and any penalties for early termination.

Conclusion and Future Outlook

In summary, lease ownership offers a flexible and cost-effective alternative to traditional buying and renting. Its applications span across various industries, from real estate and vehicles to equipment and technology. As the global economy continues to evolve, the demand for lease ownership options is likely to increase, driven by the need for flexibility, reduced upfront costs, and the ability to adapt quickly to changing market conditions. Whether for personal use or business operations, understanding the concept and benefits of lease ownership can help individuals and companies make informed decisions about their asset management strategies.

What are the primary benefits of lease ownership?

+

The primary benefits include lower upfront costs, flexibility in lease terms, potential tax benefits, and reduced risk concerning maintenance and repairs.

Can lease ownership be applied to any type of asset?

+

Lease ownership can be applied to a wide range of assets, including real estate, vehicles, equipment, technology, and commercial properties. However, the feasibility and terms of the lease can vary significantly depending on the type of asset and the parties involved.

How does lease ownership impact tax obligations?

+

Lease payments are often deductible as operating expenses, which can help reduce taxable income. However, the specific tax implications can vary depending on the jurisdiction and the terms of the lease agreement. It’s advisable to consult with a tax professional to understand the potential tax benefits and obligations.