Keep Income Tax Paperwork

Introduction to Income Tax Paperwork

Keeping track of income tax paperwork is a crucial aspect of managing one’s finances, regardless of whether you are an individual or a business owner. The process involves gathering, organizing, and maintaining various documents that are essential for filing tax returns. In this article, we will delve into the importance of keeping income tax paperwork, the types of documents you need to keep, and how to organize them efficiently.

Why Keep Income Tax Paperwork?

Keeping income tax paperwork is vital for several reasons: * It helps you stay organized and ensures that you have all the necessary documents when filing your tax return. * It provides a paper trail in case of an audit, helping you to prove your income, deductions, and credits. * It enables you to claim deductions and credits that you are eligible for, which can help reduce your tax liability. * It helps you to keep track of your tax payments and ensure that you are meeting your tax obligations.

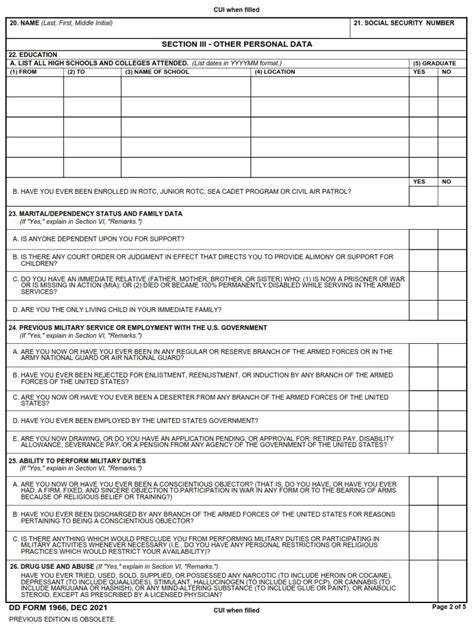

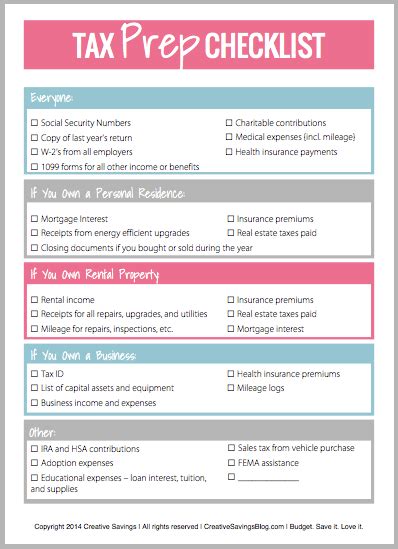

Types of Income Tax Paperwork

There are several types of income tax paperwork that you need to keep, including: * W-2 forms: These forms show your income and taxes withheld from your employer. * 1099 forms: These forms show income from freelance work, consulting, or other sources. * Receipts and invoices: These documents support business expenses, charitable donations, and medical expenses. * Bank statements: These statements show your income, expenses, and tax payments. * Tax returns: Keep copies of your previous tax returns, including federal and state returns.

Organizing Income Tax Paperwork

Organizing your income tax paperwork is crucial to ensure that you can easily access the documents you need when filing your tax return. Here are some tips to help you get started: * Create a filing system: Set up a filing system that includes folders or categories for different types of documents, such as income, expenses, and tax returns. * Use a scanner: Consider scanning your documents and saving them electronically to free up physical storage space and reduce the risk of losing important papers. * Keep digital copies: Make sure to keep digital copies of your documents, such as PDFs or scanned images, in case the physical copies are lost or damaged. * Set reminders: Set reminders to review and update your paperwork regularly, such as at the end of each tax year or when you receive new documents.

| Document Type | Retention Period |

|---|---|

| W-2 forms | At least 3 years |

| 1099 forms | At least 3 years |

| Receipts and invoices | At least 3 years |

| Bank statements | At least 1 year |

| Tax returns | Permanently |

📝 Note: The retention period for income tax paperwork may vary depending on your location and specific circumstances. It's essential to check with your local tax authority or a tax professional to determine the required retention period for your documents.

In order to stay on top of your income tax paperwork, consider implementing a routine check of your documents on a regular basis. This will help ensure that you are meeting the necessary requirements and that you have all the documents you need when filing your tax return.

When it comes to storing your documents, make sure to keep them in a secure location, such as a fireproof safe or a locked cabinet. This will help protect your documents from damage or theft.

Best Practices for Keeping Income Tax Paperwork

Here are some best practices to keep in mind when keeping income tax paperwork: * Be consistent: Develop a consistent system for organizing and storing your documents. * Keep it up to date: Regularly review and update your paperwork to ensure that it is accurate and complete. * Use secure storage: Store your documents in a secure location, such as a fireproof safe or a locked cabinet. * Make digital copies: Consider making digital copies of your documents to reduce the risk of loss or damage.

In summary, keeping income tax paperwork is an essential part of managing your finances and ensuring that you are meeting your tax obligations. By understanding the types of documents you need to keep, organizing them efficiently, and following best practices, you can stay on top of your income tax paperwork and reduce the stress and complexity of tax season.

Overall, the key to successfully keeping income tax paperwork is to stay organized, keep accurate records, and seek professional help when needed. By following these tips and best practices, you can ensure that you are meeting your tax obligations and taking advantage of the deductions and credits that you are eligible for.

What types of income tax paperwork should I keep?

+

You should keep documents such as W-2 forms, 1099 forms, receipts and invoices, bank statements, and tax returns.

How long should I keep my income tax paperwork?

+

The retention period for income tax paperwork may vary depending on your location and specific circumstances. It’s essential to check with your local tax authority or a tax professional to determine the required retention period for your documents.

What are some best practices for keeping income tax paperwork?

+

Some best practices include being consistent, keeping your paperwork up to date, using secure storage, and making digital copies of your documents.