Cobra Paperwork Arrival Timeframe

Introduction to Cobra Paperwork Arrival Timeframe

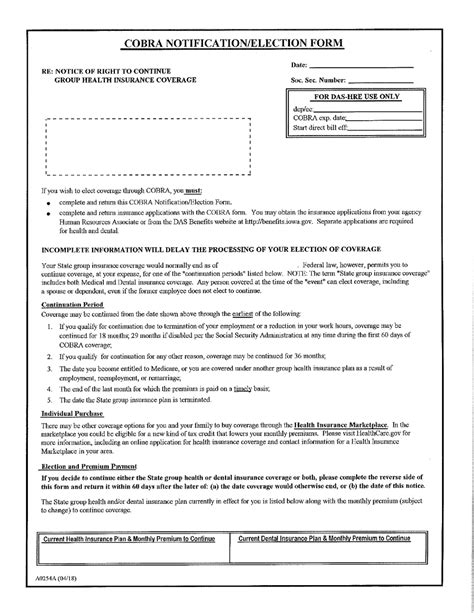

When dealing with the Cobra paperwork arrival timeframe, it’s essential to understand the significance of the Consolidated Omnibus Budget Reconciliation Act (COBRA) in the context of health insurance continuation. COBRA is a federal law that allows eligible employees and their dependents to continue their group health coverage temporarily when they experience a qualifying event, such as job loss, divorce, or death of the covered employee. The timeframe for receiving COBRA paperwork is crucial for individuals to make informed decisions about their health insurance coverage.

Understanding COBRA Qualifying Events

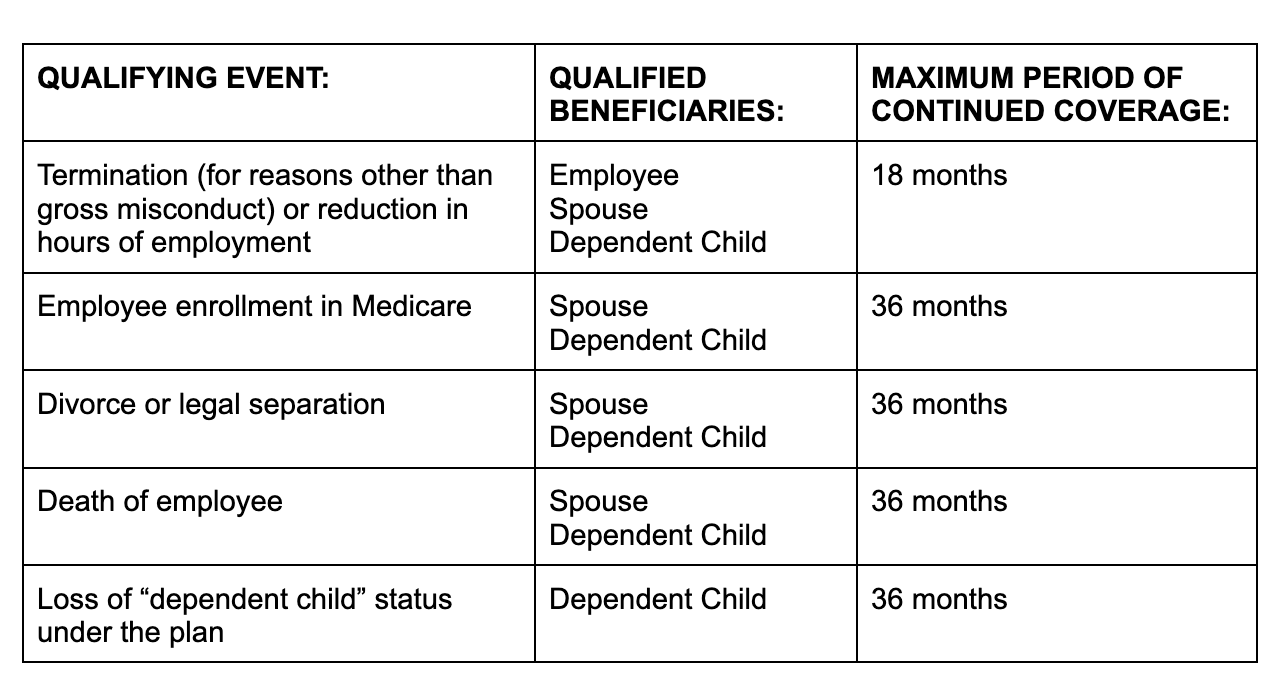

Before diving into the specifics of the COBRA paperwork arrival timeframe, it’s vital to recognize the qualifying events that trigger COBRA eligibility. These events include: - Termination of employment: When an employee’s employment is terminated, either voluntarily or involuntarily, they may be eligible for COBRA. - Divorce or legal separation: If the covered employee gets divorced or legally separated, their spouse and dependents may qualify for COBRA. - Death of the covered employee: The dependents of a covered employee who passes away may be eligible for COBRA. - Dependent child ceasing to be a dependent: When a child is no longer considered a dependent under the plan, they may qualify for COBRA. - Employer bankruptcy: In some cases, if the employer goes bankrupt, employees and their dependents may be eligible for COBRA.

COBRA Paperwork Arrival Timeframe

The timeframe for receiving COBRA paperwork is regulated by law. Generally, the plan administrator must provide the COBRA election notice to eligible individuals within 44 days after the qualifying event or the date the employer notifies the plan administrator of the qualifying event, whichever is later. This notice includes crucial information, such as: - The qualifying event that triggered COBRA eligibility - The names of the individuals eligible for COBRA - The date of the qualifying event - The deadline for electing COBRA coverage - The cost of COBRA coverage - The duration of COBRA coverage

Electing COBRA Coverage

Once the COBRA paperwork is received, eligible individuals have 60 days from the date they receive the election notice or the date coverage would end, whichever is later, to decide whether to elect COBRA coverage. This decision should be made carefully, considering the cost of COBRA premiums, which can be up to 102% of the cost of coverage (including both the employee and employer portions of the premium, plus a 2% administrative fee).

Key Considerations

When navigating the COBRA paperwork arrival timeframe, several key points should be considered: - Qualifying event notification: The employer must notify the plan administrator of the qualifying event within 30 days. - COBRA premium payments: Initial premium payments are due 45 days after the COBRA coverage is elected. - Duration of COBRA coverage: COBRA coverage typically lasts for 18 months but can be extended in certain circumstances, such as disability or a second qualifying event.

📝 Note: It's essential to review the COBRA paperwork carefully and understand the deadlines and requirements to avoid losing eligibility for COBRA coverage.

Alternatives to COBRA

While COBRA provides a vital safety net for health insurance coverage, it may not be the most affordable or suitable option for everyone. Alternative health insurance options should be explored, including: - Spouse’s employer plan: If a spouse has access to an employer-sponsored health plan, this might be a more cost-effective option. - Individual and family plans: Plans purchased directly from insurance companies or through the Affordable Care Act (ACA) marketplace might offer better coverage at a lower cost. - Short-term limited-duration insurance (STLDI): Although these plans are not comprehensive and do not meet the minimum essential coverage requirements under the ACA, they can provide temporary coverage.

Importance of Timely Decision-Making

The timeframe for receiving and acting on COBRA paperwork is limited, making timely decision-making critical. Eligible individuals must ensure they understand their options, the costs involved, and the deadlines for making decisions about COBRA coverage. Failure to act within the specified timeframes can result in the loss of COBRA eligibility and potential gaps in health insurance coverage.

In wrapping up the discussion on the COBRA paperwork arrival timeframe, it’s clear that understanding the intricacies of COBRA and its associated deadlines is vital for making informed decisions about health insurance coverage. By being aware of the qualifying events, the timeframe for receiving COBRA paperwork, and the process for electing coverage, individuals can better navigate the complexities of health insurance continuation under COBRA.

What is the typical timeframe for receiving COBRA paperwork after a qualifying event?

+

The plan administrator must provide the COBRA election notice within 44 days after the qualifying event or the date the employer notifies the plan administrator of the qualifying event, whichever is later.

How long do eligible individuals have to decide whether to elect COBRA coverage?

+

Eligible individuals have 60 days from the date they receive the election notice or the date coverage would end, whichever is later, to decide whether to elect COBRA coverage.

What are some alternatives to COBRA coverage that individuals should consider?

+

Alternatives include a spouse’s employer plan, individual and family plans purchased directly from insurance companies or through the Affordable Care Act (ACA) marketplace, and short-term limited-duration insurance (STLDI).

Related Terms:

- COBRA notice requirements after termination

- COBRA letter template

- COBRA notification requirements

- Does COBRA coverage begin immediately

- COBRA election period

- COBRA loophole 60 days