Retirement Fund Holding Period After Paperwork

Introduction to Retirement Fund Holding Period

When it comes to retirement planning, understanding the concepts and rules surrounding retirement funds is crucial for maximizing benefits and ensuring a secure financial future. One key aspect of retirement fund management is the holding period, which refers to the length of time an individual must hold onto their retirement fund assets before they can be accessed without penalty. In this article, we will delve into the specifics of the retirement fund holding period, exploring what it entails, how it works, and the implications for retirees.

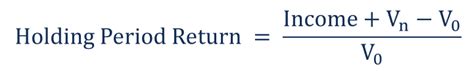

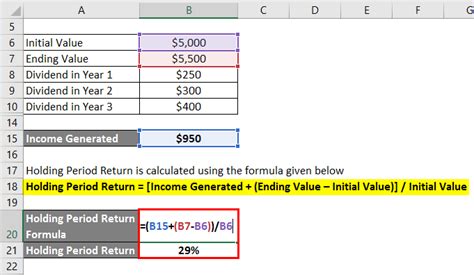

Understanding the Holding Period

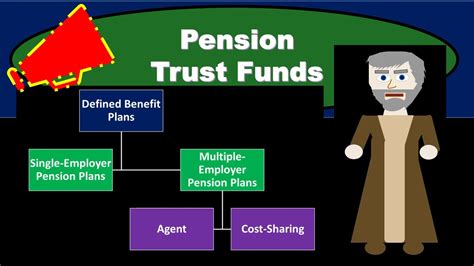

The holding period for retirement funds is a critical component of retirement planning, as it directly impacts when and how individuals can access their retirement savings. Generally, the holding period is designed to encourage long-term savings by imposing penalties on early withdrawals. This period can vary depending on the type of retirement account, such as a 401(k), IRA, or Roth IRA, each with its own set of rules and regulations regarding withdrawals and holding periods.

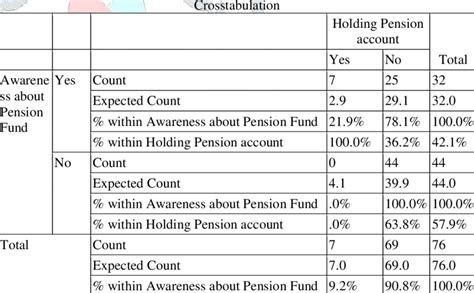

Types of Retirement Accounts and Holding Periods

Different types of retirement accounts have different rules regarding the holding period: - 401(k) and Traditional IRA: These accounts are subject to a 10% penalty for withdrawals made before the age of 59 1⁄2, unless specific exceptions apply. There is no minimum holding period in the sense of a fixed number of years after opening the account, but rather, it’s based on the age of the account holder. - Roth IRA: For Roth IRAs, the holding period is five years from the first contribution or conversion to a Roth IRA for tax-free and penalty-free withdrawals of earnings. Contributions can be withdrawn at any time tax-free and penalty-free, but the five-year rule applies to the earnings.

Importance of Holding Period

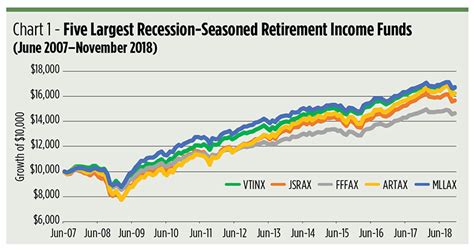

The holding period is essential for long-term financial planning. It helps in several ways: - Encourages Long-Term Savings: By imposing penalties on early withdrawals, the holding period encourages individuals to keep their savings intact for retirement. - Reduces Financial Stress: Knowing that a significant portion of one’s savings is secure and growing can reduce financial stress and anxiety about the future. - Optimizes Growth: The longer the holding period, the more time the money has to grow, potentially leading to a larger retirement nest egg.

Strategies for Managing the Holding Period

Managing the holding period effectively requires careful planning: - Diversification: Spread investments across different asset classes to minimize risk. - Regular Contributions: Consistently contribute to retirement accounts to build savings over time. - Understanding Withdrawal Rules: Be aware of the rules surrounding withdrawals from different types of retirement accounts to avoid penalties.

Table of Holding Periods for Common Retirement Accounts

| Account Type | Holding Period | Penalty for Early Withdrawal |

|---|---|---|

| 401(k) | Until 59 1⁄2 years old | 10% penalty |

| Traditional IRA | Until 59 1⁄2 years old | 10% penalty |

| Roth IRA | 5 years from first contribution | 10% penalty on earnings if before 59 1⁄2 or within 5 years |

📝 Note: The rules and penalties can change, so it's essential to consult with a financial advisor or check the latest regulations before making decisions about your retirement accounts.

As individuals approach retirement, understanding and navigating the holding period of their retirement funds becomes increasingly important. By grasping the concepts outlined above and planning accordingly, retirees can ensure they maximize their retirement savings and enjoy a more secure financial future.

In summarizing the key points, it’s clear that the holding period is a critical factor in retirement planning, influencing how and when retirement funds can be accessed. Different types of retirement accounts come with their own rules and penalties for early withdrawals, making it essential for individuals to understand these specifics to plan effectively. Whether through a 401(k), Traditional IRA, or Roth IRA, the goal remains the same: to build a substantial retirement nest egg that supports a comfortable post-work life. By encouraging long-term savings, reducing financial stress, and optimizing growth, the holding period plays a pivotal role in achieving this goal.

What is the holding period for a Roth IRA?

+

The holding period for a Roth IRA is five years from the first contribution or conversion to a Roth IRA for tax-free and penalty-free withdrawals of earnings.

Why is the holding period important for retirement planning?

+

The holding period is essential for encouraging long-term savings, reducing financial stress, and optimizing the growth of retirement funds.

Can I withdraw money from my 401(k) at any time?

+

No, withdrawals from a 401(k) before the age of 59 1⁄2 are subject to a 10% penalty, unless specific exceptions apply.