Cobra Paperwork Deadline for Employers

Introduction to Cobra Paperwork Deadline

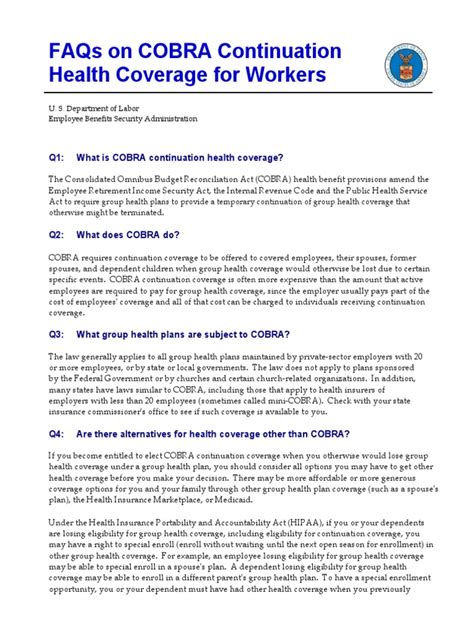

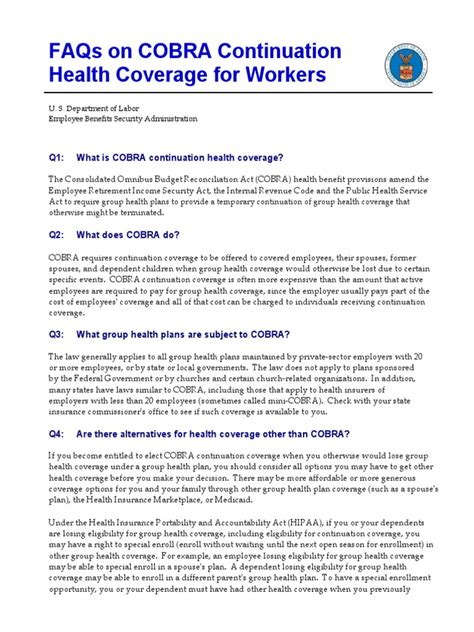

The Consolidated Omnibus Budget Reconciliation Act (COBRA) is a federal law that requires employers to offer continued health coverage to employees and their families after a qualifying event, such as job loss or reduction in work hours. As an employer, it is essential to understand the COBRA paperwork deadline to ensure compliance with the law and avoid potential penalties. In this article, we will discuss the importance of meeting the COBRA paperwork deadline, the consequences of non-compliance, and provide a step-by-step guide on how to complete the necessary paperwork.

What is the COBRA Paperwork Deadline?

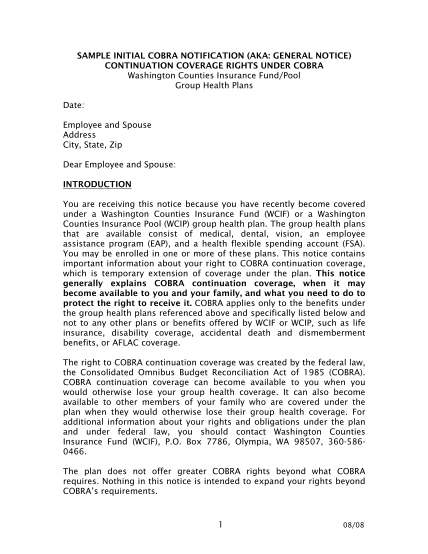

The COBRA paperwork deadline varies depending on the type of qualifying event and the plan administrator. Generally, the employer must notify the plan administrator within 30 days of a qualifying event, such as an employee’s termination or reduction in work hours. The plan administrator then has 14 days to notify the qualified beneficiary (the employee or their family member) of their COBRA rights.

Consequences of Missing the COBRA Paperwork Deadline

Failing to meet the COBRA paperwork deadline can result in severe consequences, including:

- Penalties: The employer may be subject to penalties of up to $110 per day for non-compliance.

- Lawsuits: The qualified beneficiary may file a lawsuit against the employer for failure to provide COBRA coverage.

- Loss of Tax Benefits: The employer may lose tax benefits associated with the health plan if they fail to comply with COBRA regulations.

Step-by-Step Guide to Completing COBRA Paperwork

To ensure compliance with COBRA regulations, follow these steps:

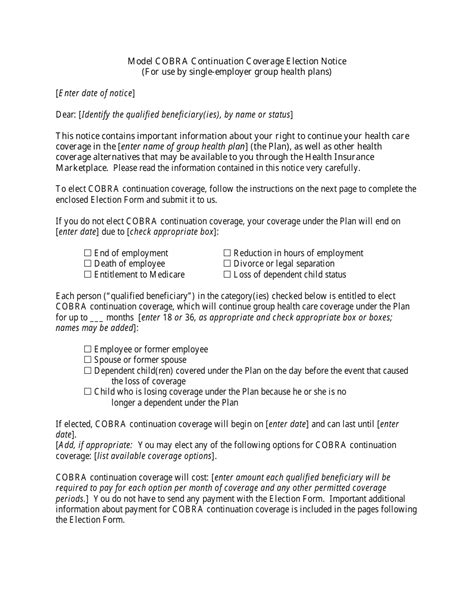

- Identify Qualifying Events: Determine which events trigger COBRA coverage, such as termination, reduction in work hours, divorce, or death of the employee.

- Notify the Plan Administrator: Inform the plan administrator within 30 days of a qualifying event.

- Provide COBRA Notice: The plan administrator must provide the qualified beneficiary with a COBRA notice within 14 days of receiving notification from the employer.

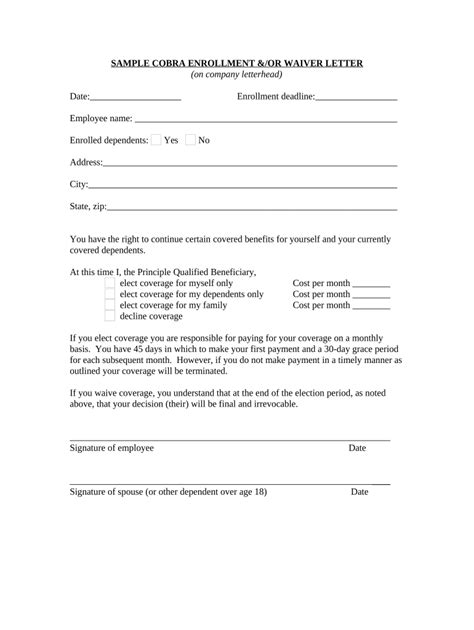

- Elect COBRA Coverage: The qualified beneficiary has 60 days to elect COBRA coverage after receiving the notice.

- Pay COBRA Premiums: The qualified beneficiary must pay the COBRA premiums within 45 days of electing coverage.

COBRA Paperwork Requirements

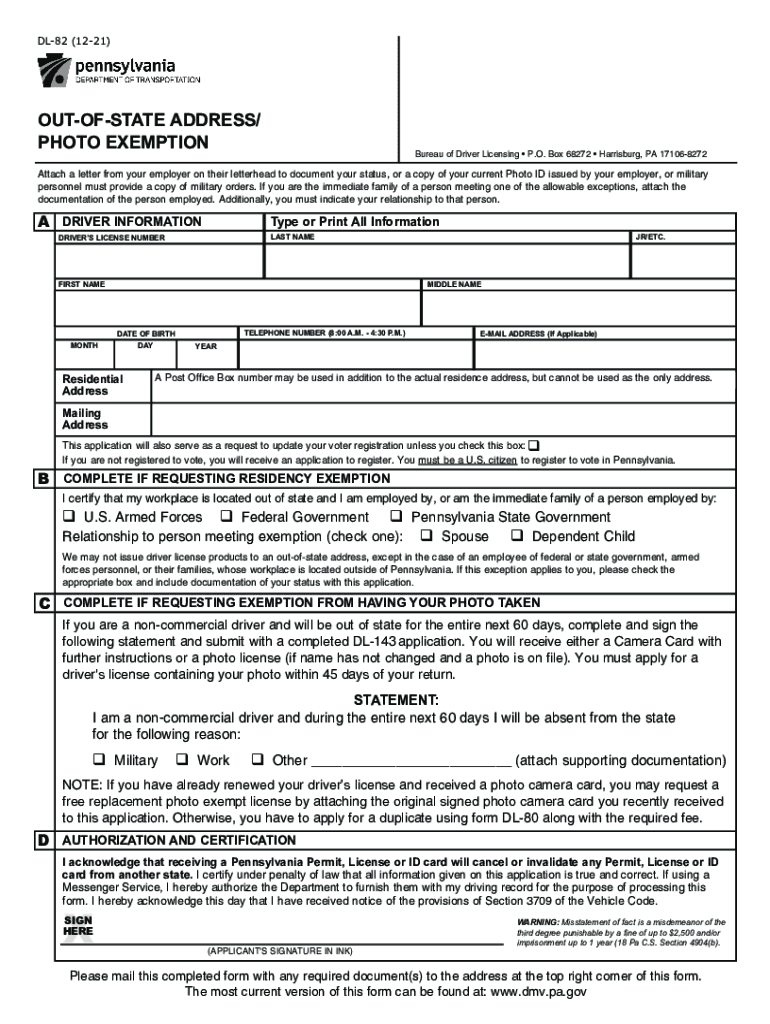

The following documents are required to complete the COBRA paperwork process:

| Document | Description |

|---|---|

| COBRA Notice | Notifies the qualified beneficiary of their COBRA rights |

| Election Form | Allows the qualified beneficiary to elect COBRA coverage |

| Payment Coupon | Used to pay COBRA premiums |

💡 Note: Employers must maintain accurate records of COBRA paperwork, including notices, election forms, and payment coupons, to ensure compliance with COBRA regulations.

Best Practices for Managing COBRA Paperwork

To ensure a smooth COBRA paperwork process, follow these best practices:

- Designate a COBRA Administrator: Appoint a person to manage COBRA paperwork and ensure compliance with regulations.

- Use COBRA Software: Utilize software to track COBRA events, generate notices, and manage paperwork.

- Establish a COBRA Policy: Develop a policy outlining the COBRA process, including procedures for notifying the plan administrator and providing COBRA notices.

In summary, meeting the COBRA paperwork deadline is crucial for employers to avoid penalties and ensure compliance with federal regulations. By following the step-by-step guide and best practices outlined in this article, employers can ensure a smooth COBRA paperwork process and maintain a positive relationship with their employees and former employees.

What is the purpose of COBRA?

+

The purpose of COBRA is to provide continued health coverage to employees and their families after a qualifying event, such as job loss or reduction in work hours.

Who is eligible for COBRA coverage?

+

Eligible individuals include employees, spouses, and dependent children who lose health coverage due to a qualifying event.

How long does COBRA coverage last?

+

COBRA coverage typically lasts for 18 months, but may be extended to 36 months in certain circumstances.