Paperwork

Financial Advisor PaperworkRetention Period

Introduction to Financial Advisor Paperwork Retention

As a financial advisor, maintaining accurate and detailed records of client interactions, transactions, and other business activities is crucial for compliance, risk management, and client service. The paperwork retention period refers to the length of time that financial advisors must keep these records, which can vary depending on the type of document, regulatory requirements, and industry best practices. In this article, we will delve into the world of financial advisor paperwork retention, exploring the key considerations, regulatory requirements, and best practices for managing these critical documents.

Understanding Regulatory Requirements

Financial advisors are subject to various regulatory requirements that dictate the retention period for different types of documents. These regulations are designed to protect clients, maintain market integrity, and prevent fraudulent activities. Some of the key regulatory requirements for financial advisor paperwork retention include: * SEC Rule 17a-4: Requires broker-dealers to retain certain records, such as trade confirmations and account statements, for a minimum of six years. * FINRA Rule 4511: Mandates that member firms retain all electronic communications, including emails and instant messages, for a minimum of three years. * Dodd-Frank Act: Requires financial institutions to maintain records of certain transactions, such as swaps and security-based swaps, for a minimum of five years.

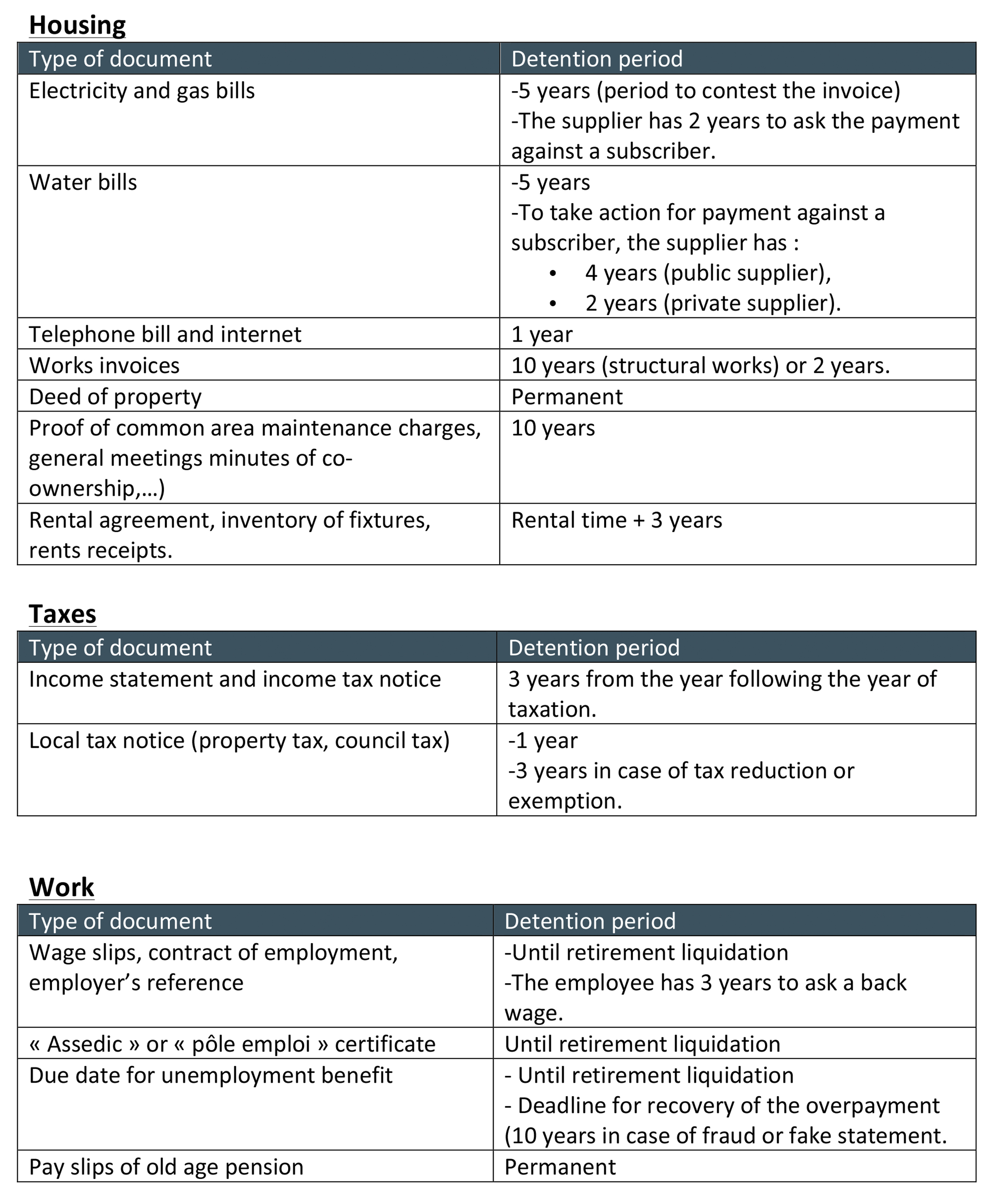

Key Considerations for Paperwork Retention

When determining the retention period for financial advisor paperwork, several factors must be considered, including: * Type of document: Different types of documents have varying retention periods. For example, tax returns and supporting documentation may need to be retained for seven years, while brokerage account statements may only require a three-year retention period. * Client relationships: Financial advisors may need to retain records of client interactions, such as meeting notes and correspondence, for an extended period to demonstrate compliance with regulatory requirements and industry standards. * Business operations: Financial advisors must also consider the retention period for business records, such as employee personnel files, accounting records, and marketing materials.

Best Practices for Managing Financial Advisor Paperwork

To ensure compliance with regulatory requirements and maintain efficient business operations, financial advisors should adopt the following best practices for managing paperwork: * Implement a centralized document management system: A centralized system allows for easy storage, retrieval, and tracking of documents, reducing the risk of lost or misplaced records. * Establish a retention schedule: Develop a retention schedule that outlines the types of documents, retention periods, and disposal procedures to ensure consistency and compliance. * Train personnel: Educate employees on the importance of paperwork retention, regulatory requirements, and company policies to ensure that all staff members understand their roles and responsibilities.

Common Types of Financial Advisor Paperwork

The following table highlights common types of financial advisor paperwork, their retention periods, and relevant regulatory requirements:

| Document Type | Retention Period | Regulatory Requirement |

|---|---|---|

| Trade confirmations | 6 years | SEC Rule 17a-4 |

| Account statements | 6 years | SEC Rule 17a-4 |

| Tax returns and supporting documentation | 7 years | IRS regulations |

| Electronic communications | 3 years | FINRA Rule 4511 |

📝 Note: Financial advisors should consult with regulatory agencies and industry experts to ensure compliance with applicable laws and regulations.

Conclusion and Future Outlook

In conclusion, financial advisor paperwork retention is a critical aspect of regulatory compliance, risk management, and client service. By understanding regulatory requirements, considering key factors, and implementing best practices, financial advisors can ensure that they are meeting their obligations and maintaining the trust of their clients. As the financial services industry continues to evolve, it is essential for financial advisors to stay informed about changes in regulatory requirements and industry standards to ensure that their paperwork retention practices remain effective and compliant.

What is the minimum retention period for trade confirmations?

+

The minimum retention period for trade confirmations is 6 years, as required by SEC Rule 17a-4.

How long must financial advisors retain electronic communications?

+

Financial advisors must retain electronic communications, such as emails and instant messages, for a minimum of 3 years, as required by FINRA Rule 4511.

What is the purpose of implementing a centralized document management system?

+

The purpose of implementing a centralized document management system is to ensure easy storage, retrieval, and tracking of documents, reducing the risk of lost or misplaced records and improving compliance with regulatory requirements.