Paperwork

Keep Paperwork For How Long

Introduction to Record Keeping

When it comes to keeping paperwork, one of the most common questions people ask is, “How long should I keep my records?” The answer to this question varies depending on the type of document, its purpose, and the potential need for future reference. In this article, we will explore the different types of paperwork, their recommended retention periods, and provide guidance on how to manage your records effectively.

Understanding Record Types

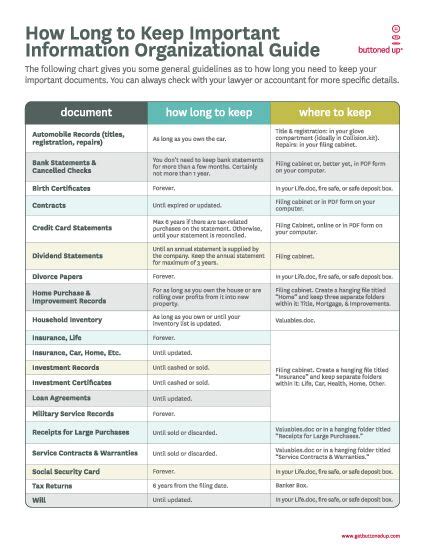

There are several categories of records, each with its own set of guidelines for retention. These include: * Financial records: Bank statements, receipts, invoices, and tax returns * Personal documents: Identification papers, birth and marriage certificates, and insurance policies * Employment records: Pay stubs, W-2 forms, and employee contracts * Medical records: Health insurance claims, medical bills, and doctor’s notes * Business records: Corporate documents, contracts, and financial statements

Retention Periods for Common Records

Here are some general guidelines for how long to keep different types of paperwork: * Financial records: + Bank statements: 1-2 years + Receipts: 1 year + Invoices: 3-5 years + Tax returns: 3-7 years * Personal documents: + Identification papers: permanently + Birth and marriage certificates: permanently + Insurance policies: 1-5 years * Employment records: + Pay stubs: 1-3 years + W-2 forms: 3-7 years + Employee contracts: 3-5 years * Medical records: + Health insurance claims: 1-3 years + Medical bills: 1-3 years + Doctor’s notes: 5-10 years * Business records: + Corporate documents: permanently + Contracts: 3-10 years + Financial statements: 3-7 years

Managing Your Records Effectively

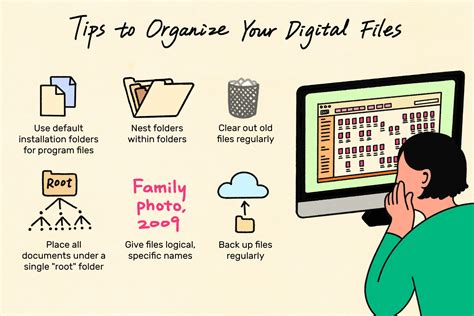

To keep your paperwork organized and ensure you can find what you need when you need it, consider the following tips: * Create a filing system: Use a consistent method for categorizing and storing your records, such as alphabetical or chronological order. * Use digital storage: Consider scanning and saving your documents electronically to free up physical storage space and make it easier to search for specific records. * Set reminders: Schedule regular reviews of your records to determine what can be safely discarded and what needs to be updated. * Shred unnecessary documents: Protect your personal and financial information by securely disposing of paperwork that is no longer needed.

📝 Note: Always check with your accountant, attorney, or other relevant professionals for specific guidance on record-keeping requirements, as laws and regulations may vary depending on your location and industry.

Best Practices for Record Keeping

To ensure you are keeping your paperwork for the right amount of time, follow these best practices: * Be consistent: Apply the same retention rules to similar types of records. * Review regularly: Regularly review your records to determine what can be discarded and what needs to be updated. * Keep it organized: Use a consistent filing system and consider digital storage to make it easier to find what you need. * Consider the purpose: Think about why you are keeping a particular record and whether it is still relevant.

Conclusion and Final Thoughts

Keeping paperwork for the right amount of time is crucial for maintaining accurate records, ensuring compliance with laws and regulations, and protecting your personal and financial information. By understanding the different types of records, their recommended retention periods, and following best practices for record-keeping, you can create a system that works for you and your unique needs. Remember to regularly review your records, shred unnecessary documents, and consider digital storage to free up physical space and make it easier to search for specific records.

What is the recommended retention period for tax returns?

+

The recommended retention period for tax returns is 3-7 years, depending on the type of return and the potential for audit.

How long should I keep bank statements?

+

You should keep bank statements for 1-2 years, depending on your personal financial situation and the potential need for future reference.

What is the best way to organize my paperwork?

+

The best way to organize your paperwork is to create a consistent filing system, use digital storage, and set reminders to regularly review your records.