7 Years To Keep Taxes

Understanding the Importance of Keeping Tax Records

When it comes to taxes, it’s essential to keep accurate and detailed records. The Internal Revenue Service (IRS) recommends keeping tax-related documents for at least 7 years in case of an audit or other issues. This may seem like a long time, but it’s crucial to ensure you have the necessary documentation to support your tax returns and avoid any potential penalties.

Why 7 Years?

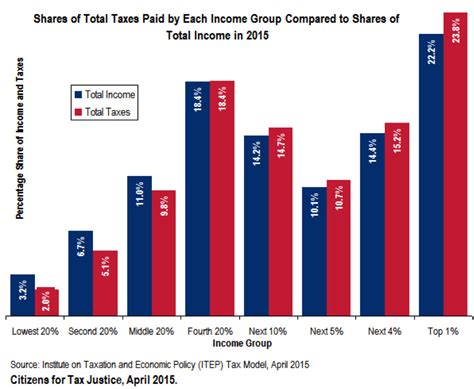

The 7-year rule is based on the IRS’s statute of limitations for auditing tax returns. Generally, the IRS has 3 years to initiate an audit after the tax return filing date. However, in cases of fraud or substantial underreporting of income, the statute of limitations can be extended to 6 years. In extreme cases, such as willful failure to file or gross negligence, there is no statute of limitations. To be on the safe side, it’s best to keep tax records for at least 7 years to cover all possible scenarios.

What Records Should You Keep?

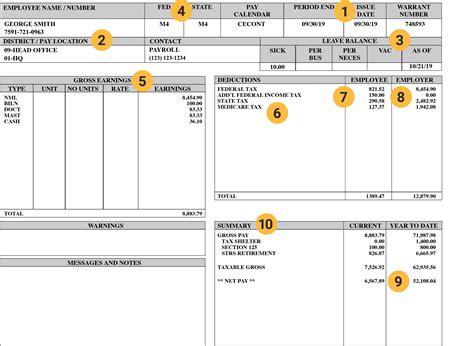

It’s essential to keep a wide range of tax-related documents, including: * Tax returns: Keep copies of your tax returns, including W-2s, 1099s, and any other supporting documentation. * Receipts and invoices: Keep receipts and invoices for business expenses, charitable donations, and medical expenses. * Bank statements: Keep bank statements and cancelled checks to support income and expense claims. * Investment records: Keep records of investment transactions, including stock purchases and sales. * Real estate documents: Keep records of real estate transactions, including property purchases and sales.

How to Store Your Records

With the advancement of technology, it’s easier than ever to store your tax records digitally. Consider using a cloud storage service or a secure online storage platform to keep your records safe and organized. You can also use password-protected folders or encrypted files to add an extra layer of security. If you prefer to keep physical records, consider using a fireproof safe or a secure storage unit.

What Happens If You Don’t Keep Records?

Failing to keep accurate and detailed tax records can lead to penalties and interest on any taxes owed. In severe cases, it can even lead to audits and criminal charges. If you’re audited and don’t have the necessary records to support your tax returns, you may be required to reconstruct your income and expenses, which can be a time-consuming and costly process.

📝 Note: Keeping accurate and detailed tax records is crucial to avoid any potential penalties and ensure you're in compliance with tax laws and regulations.

Additional Tips

* Keep records organized: Use a systematic approach to organize your tax records, making it easy to locate specific documents when needed. * Back up your records: Consider keeping a backup of your tax records in a separate location, such as an external hard drive or a secure online storage platform. * Seek professional help: If you’re unsure about what records to keep or how to store them, consider consulting a tax professional or accountant.

In the end, keeping tax records for at least 7 years is essential to ensure you’re in compliance with tax laws and regulations. By keeping accurate and detailed records, you can avoid potential penalties and ensure you’re prepared in case of an audit. Remember to store your records safely and securely, and consider seeking professional help if you’re unsure about any aspect of tax record-keeping.

What is the statute of limitations for auditing tax returns?

+

The statute of limitations for auditing tax returns is generally 3 years, but can be extended to 6 years in cases of fraud or substantial underreporting of income.

What records should I keep for tax purposes?

+

You should keep a wide range of tax-related documents, including tax returns, receipts and invoices, bank statements, investment records, and real estate documents.

How long should I keep tax records?

+

It’s recommended to keep tax records for at least 7 years to cover all possible scenarios, including audits and other issues.