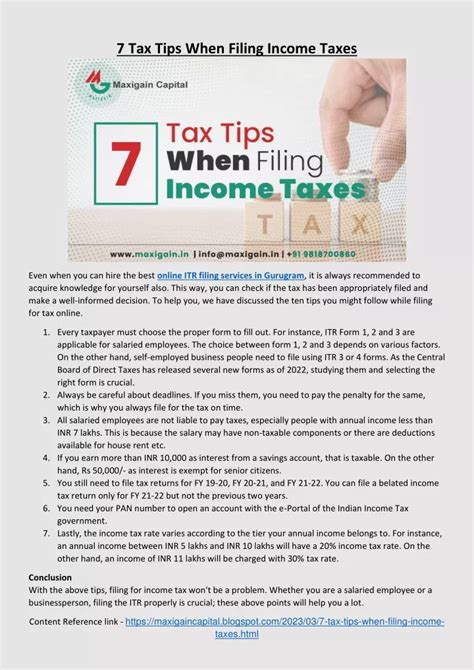

7 Tax Tips

Introduction to Tax Tips

When it comes to managing your finances, understanding tax laws and regulations can be a daunting task. With the ever-changing landscape of tax policies, it’s essential to stay informed to maximize your savings and minimize your liabilities. In this article, we’ll explore seven tax tips that can help you navigate the complex world of taxation. Whether you’re an individual or a business owner, these tips will provide you with valuable insights to make informed decisions about your financial situation.

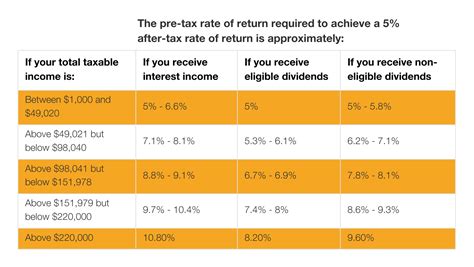

Understanding Tax Brackets

Before we dive into the tax tips, it’s crucial to understand how tax brackets work. Tax brackets are the ranges of income that are subject to different tax rates. The United States has a progressive tax system, which means that as your income increases, the tax rate also increases. However, it’s essential to note that you don’t pay the higher tax rate on your entire income, only on the amount that exceeds the threshold. For example, if you’re single and your taxable income is 50,000, you'll pay 12% on the amount between 9,875 and 40,125, and 22% on the amount between 40,126 and $50,000.

Tax Tip 1: Take Advantage of Tax Deductions

Tax deductions can significantly reduce your taxable income, which in turn reduces your tax liability. There are several tax deductions available, including: * Charitable donations: Donations to qualified charitable organizations can be deducted from your taxable income. * Medical expenses: Medical expenses that exceed 10% of your adjusted gross income (AGI) can be deducted. * Mortgage interest: Homeowners can deduct the interest paid on their mortgage from their taxable income. * State and local taxes: You can deduct state and local taxes, including sales taxes, from your taxable income.

Tax Tip 2: Utilize Tax Credits

Tax credits are even more valuable than tax deductions because they directly reduce your tax liability. Some common tax credits include: * Earned Income Tax Credit (EITC): A refundable tax credit for low-to-moderate-income working individuals and families. * Child Tax Credit: A tax credit of up to 2,000 per child for families with children under the age of 17. * <i>American Opportunity Tax Credit</i>: A tax credit of up to 2,500 per student for education expenses.

Tax Tip 3: Contribute to Retirement Accounts

Contributing to retirement accounts, such as 401(k) or IRA, can help reduce your taxable income. These contributions are tax-deductible, which means they can lower your tax liability. Additionally, the funds in these accounts grow tax-deferred, meaning you won’t pay taxes on the investment earnings until you withdraw the funds in retirement.

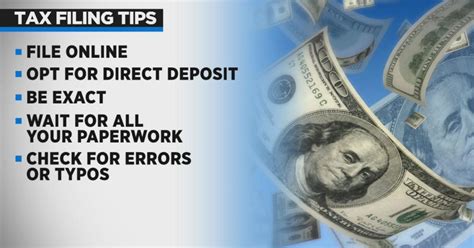

Tax Tip 4: Keep Accurate Records

Keeping accurate records of your income, expenses, and tax-related documents is essential for tax purposes. This includes: * W-2 forms: Forms from your employer showing your income and taxes withheld. * 1099 forms: Forms showing income from self-employment, freelance work, or investments. * Receipts and invoices: Documents supporting your business expenses or charitable donations.

Tax Tip 5: Consider Itemizing Deductions

Itemizing deductions can be beneficial if you have significant expenses that exceed the standard deduction. Some common itemized deductions include: * Medical expenses * Mortgage interest * State and local taxes * Charitable donations * Business expenses

Tax Tip 6: Take Advantage of Tax-Advantaged Savings Vehicles

Tax-advantaged savings vehicles, such as 529 plans or Health Savings Accounts (HSAs), can help you save for specific expenses while reducing your tax liability. These accounts offer tax benefits, such as tax-free growth or tax-deductible contributions.

Tax Tip 7: Consult a Tax Professional

Finally, consulting a tax professional can be incredibly beneficial in navigating the complex tax landscape. A tax professional can help you: * Understand tax laws and regulations * Identify tax savings opportunities * Prepare and file your tax return * Represent you in case of an audit

📝 Note: It's essential to stay up-to-date with tax laws and regulations, as they can change frequently. Consult a tax professional or the IRS website for the most recent information.

In summary, understanding tax laws and regulations can help you make informed decisions about your financial situation. By taking advantage of tax deductions, utilizing tax credits, contributing to retirement accounts, keeping accurate records, considering itemizing deductions, taking advantage of tax-advantaged savings vehicles, and consulting a tax professional, you can minimize your tax liability and maximize your savings.

What is the difference between a tax deduction and a tax credit?

+

A tax deduction reduces your taxable income, while a tax credit directly reduces your tax liability. Tax credits are generally more valuable than tax deductions because they provide a dollar-for-dollar reduction in your tax liability.

How do I know if I should itemize deductions or take the standard deduction?

+

You should itemize deductions if your total itemized deductions exceed the standard deduction. It’s essential to calculate both options and choose the one that results in the lowest tax liability.

What is the deadline for filing my tax return?

+

The deadline for filing your tax return is typically April 15th of each year. However, if you need an extension, you can file Form 4868 to request an automatic six-month extension.