Paperwork

House Sale Paperwork Retention Period

Introduction to House Sale Paperwork

When selling a house, there are numerous documents involved in the process, from the initial agreement to the final transfer of ownership. Understanding the importance of these documents and how long to retain them is crucial for both sellers and buyers. Proper documentation and record-keeping can help prevent disputes, ensure compliance with legal requirements, and provide a smooth transaction process. In this article, we will delve into the world of house sale paperwork, focusing on the retention period for these critical documents.

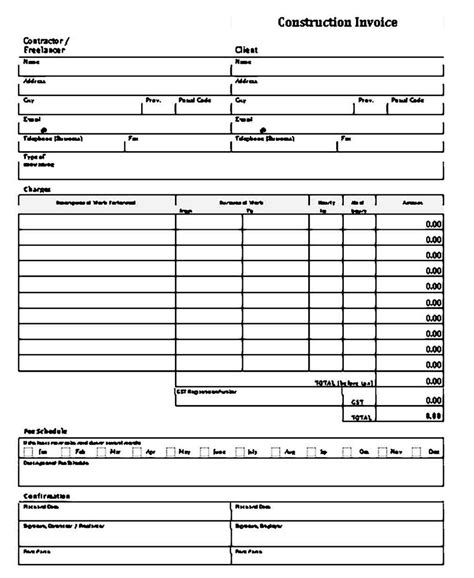

Understanding House Sale Documents

The process of selling a house involves a plethora of documents, each serving a specific purpose. These include: - Purchase Agreement: The contract between the buyer and seller that outlines the terms of the sale. - Title Deeds: Documents that prove ownership of the property. - Mortgage Documents: If the property is being sold with an existing mortgage, these documents are essential for the transfer process. - Inspection Reports: Reports from home inspections that can affect the sale price or terms. - Appraisal Reports: Documents that assess the value of the property. - Transfer Documents: Papers required for the legal transfer of the property from the seller to the buyer.

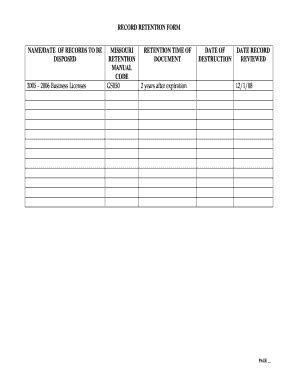

Retention Period for House Sale Documents

The retention period for house sale documents can vary based on the type of document, local laws, and potential future needs. Here are some general guidelines: - Tax-Related Documents: It’s recommended to keep tax-related documents, such as the sale contract and any receipts for taxes paid on the sale, for at least 3 to 6 years in case of an audit. - Title and Deed Documents: These should be kept indefinitely, as they prove ownership and are crucial for any future transactions. - Mortgage and Financing Documents: If a mortgage is involved, it’s a good idea to retain these documents until the mortgage is fully paid off, which could be 15 to 30 years. - Inspection and Appraisal Reports: While not as critical for legal purposes, these can be useful for up to 5 years for potential future sales or renovations. - Correspondence and Communication: Keeping records of all correspondence with the buyer, seller, real estate agents, and attorneys can be helpful for up to 2 years in case of any disputes.

Importance of Digital Storage

In today’s digital age, storing documents electronically can be incredibly beneficial. Cloud storage services offer a secure, accessible way to keep your documents organized and safe from physical damage or loss. When choosing a digital storage method, consider the following: - Security: Look for services that offer strong encryption and two-factor authentication. - Accessibility: Ensure that you can easily access your documents from anywhere. - Space: Choose a service that provides enough storage space for all your documents.

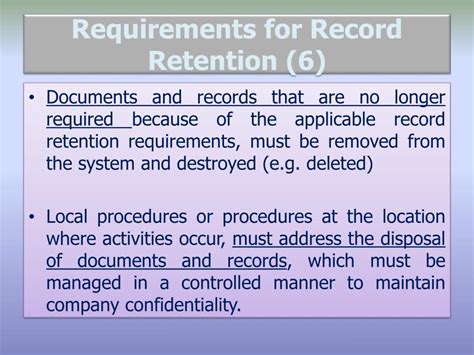

Best Practices for Document Retention

To ensure that you are properly retaining your house sale documents, follow these best practices: - Create a Filing System: Whether physical or digital, have a well-organized system for your documents. - Scan Documents: Digitize your paperwork to save space and improve accessibility. - Regularly Backup: If storing digitally, regularly backup your files to prevent loss. - Secure Physical Documents: If keeping physical copies, store them in a secure, fireproof location.

📝 Note: Always consult with a legal professional to ensure you are meeting all legal requirements for document retention in your area.

Conclusion and Future Considerations

In conclusion, the process of selling a house involves a significant amount of paperwork, each with its own recommended retention period. Understanding these periods and implementing a secure storage system, whether physical or digital, can protect you from potential legal issues and ensure a smooth transaction process. As you navigate the complex world of real estate, remember that proper documentation and retention are key to a successful and stress-free house sale experience.

What is the most important document to retain after a house sale?

+

The title deed, as it proves ownership of the property.

How long should tax-related documents be kept?

+

At least 3 to 6 years in case of an audit.

Is digital storage a secure way to keep house sale documents?

+

Yes, if you use a reputable service with strong security measures such as encryption and two-factor authentication.