7 Tax Paperwork Tips

Introduction to Tax Paperwork

Tax season can be a daunting time for many individuals and businesses, especially when it comes to navigating the complex world of tax paperwork. With so many forms, deadlines, and regulations to keep track of, it’s easy to feel overwhelmed. However, with the right approach and a bit of planning, you can make the process much more manageable. In this article, we’ll provide you with 7 tax paperwork tips to help you stay on top of your tax obligations and avoid any potential pitfalls.

Understanding Your Tax Obligations

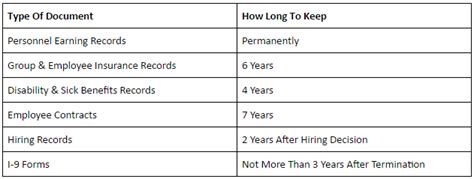

Before we dive into the tips, it’s essential to understand your tax obligations. This includes knowing which forms you need to file, what deadlines you need to meet, and what records you need to keep. Failure to comply with tax regulations can result in penalties and fines, so it’s crucial to get it right. Take some time to familiarize yourself with the tax laws and regulations that apply to your situation, and don’t hesitate to seek professional advice if you’re unsure about anything.

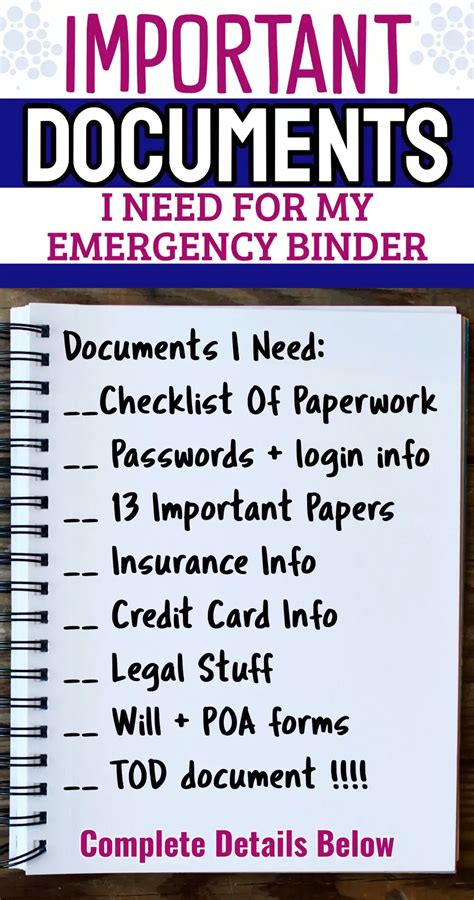

Tax Paperwork Tips

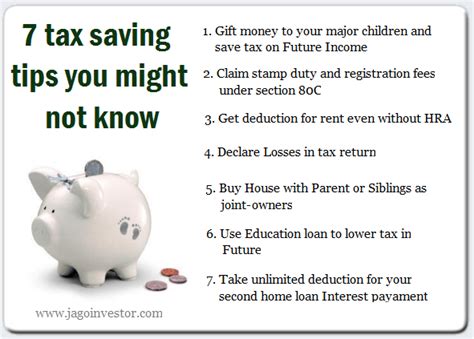

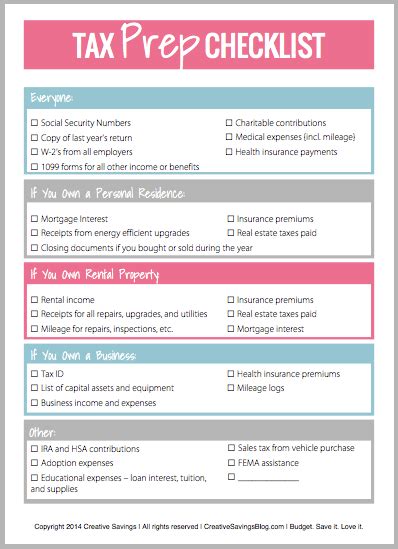

Here are 7 tax paperwork tips to help you navigate the tax season with ease: * Keep accurate records: This is the foundation of good tax paperwork management. Make sure you keep all your financial records, including receipts, invoices, and bank statements, in a safe and organized manner. * Use tax software: Tax software can help you prepare and file your tax return quickly and accurately. There are many options available, so choose one that suits your needs and budget. * Stay on top of deadlines: Missing deadlines can result in penalties and fines, so make sure you stay on top of all the important dates. Set reminders and calendar events to ensure you never miss a deadline. * Seek professional advice: If you’re unsure about any aspect of your tax paperwork, don’t hesitate to seek professional advice. A tax professional can help you navigate the complex world of tax and ensure you’re taking advantage of all the deductions and credits you’re eligible for. * Keep your paperwork organized: Use a folder or binder to keep all your tax paperwork in one place. This will make it easier to find the documents you need when you need them. * Take advantage of tax deductions: Tax deductions can help reduce your tax liability, so make sure you take advantage of all the deductions you’re eligible for. This may include deductions for charitable donations, home office expenses, and more. * Review your return carefully: Before you submit your tax return, review it carefully to ensure everything is accurate and complete. This will help you avoid any potential errors or omissions that could delay your refund or result in penalties.

Common Tax Paperwork Mistakes

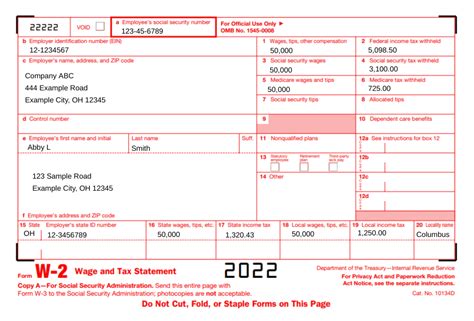

Here are some common tax paperwork mistakes to avoid: * Incorrect Social Security number * Incomplete or missing forms * Math errors * Mismatched names and addresses * Failure to sign and date the return

📝 Note: It's essential to review your tax return carefully before submitting it to avoid any potential errors or omissions.

Tax Paperwork Tools and Resources

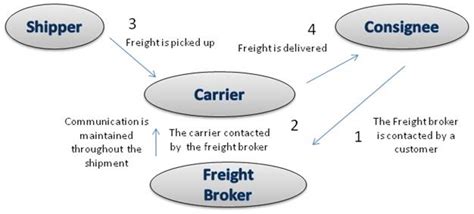

There are many tools and resources available to help you with your tax paperwork. Here are a few: * Tax software: Tax software can help you prepare and file your tax return quickly and accurately. * Tax professionals: Tax professionals can provide expert advice and guidance to help you navigate the complex world of tax. * IRS website: The IRS website is a wealth of information on tax laws, regulations, and forms. * Tax calculators: Tax calculators can help you estimate your tax liability and plan your tax strategy.

| Tool/Resource | Description |

|---|---|

| Tax software | Helps you prepare and file your tax return quickly and accurately |

| Tax professionals | Provides expert advice and guidance to help you navigate the complex world of tax |

| IRS website | A wealth of information on tax laws, regulations, and forms |

| Tax calculators | Helps you estimate your tax liability and plan your tax strategy |

In summary, tax paperwork can be a complex and time-consuming process, but with the right approach and tools, you can make it much more manageable. By following these 7 tax paperwork tips and avoiding common mistakes, you can ensure you’re taking advantage of all the deductions and credits you’re eligible for and minimizing your tax liability. Remember to stay organized, seek professional advice when needed, and take advantage of tax software and other tools to make the process as smooth as possible.

What is the deadline for filing my tax return?

+

The deadline for filing your tax return is typically April 15th, but it may vary depending on your location and individual circumstances. Be sure to check with the IRS or a tax professional to confirm the deadline for your specific situation.

What are the most common tax deductions?

+

The most common tax deductions include charitable donations, home office expenses, and mortgage interest. However, the specific deductions you’re eligible for will depend on your individual circumstances, so be sure to consult with a tax professional to determine the best course of action for your situation.

How do I know if I need to file a tax return?

+

You’ll need to file a tax return if you have income that’s subject to taxation, such as employment income, self-employment income, or investment income. You may also need to file a tax return if you have tax deductions or credits you want to claim. If you’re unsure whether you need to file a tax return, consult with a tax professional or contact the IRS for guidance.

What happens if I miss the deadline for filing my tax return?

+

If you miss the deadline for filing your tax return, you may be subject to penalties and fines. The IRS may also delay or deny your refund. To avoid these consequences, it’s essential to file your tax return on time or request an extension if you need more time to complete your return.

How do I get help with my tax paperwork?

+

You can get help with your tax paperwork by consulting with a tax professional, contacting the IRS, or using tax software. Many tax professionals offer free consultations or discounted services for first-time clients, so be sure to shop around and find the best fit for your needs and budget.