7 Bankruptcy Paper Tips

Understanding the Bankruptcy Process

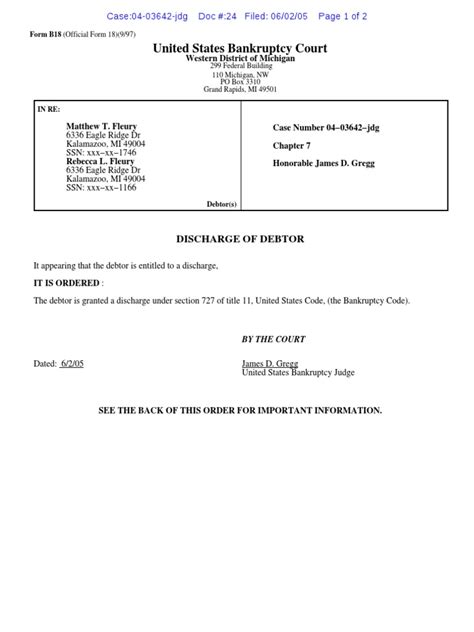

Filing for bankruptcy can be a daunting and complex process, involving numerous legal and financial considerations. At its core, bankruptcy is a legal proceeding that allows individuals or businesses to restructure or eliminate debts under the protection of the federal bankruptcy court. The process begins with the filing of a petition with the bankruptcy court, which triggers an automatic stay that temporarily halts most collection activities by creditors. Understanding the different types of bankruptcy, such as Chapter 7 (liquidation) and Chapter 13 (reorganization), is crucial for determining the best course of action for debt relief.

Preparing for Bankruptcy

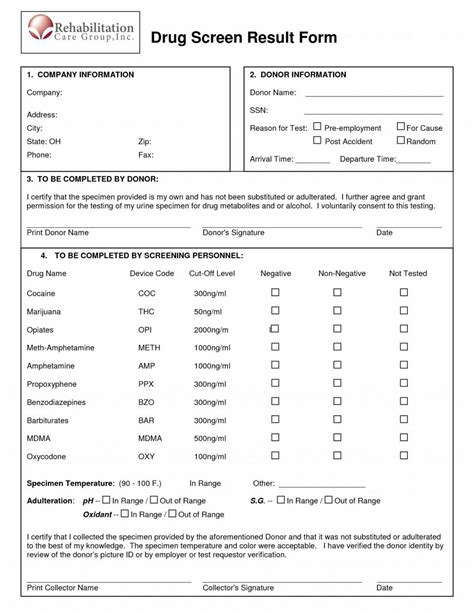

Before diving into the specifics of bankruptcy paperwork, it’s essential to prepare by gathering all necessary financial documents. This includes:

- Income statements: Pay stubs, tax returns, and any other proof of income.

- Expense records: Bills, receipts, and bank statements to outline monthly expenses.

- Debt lists: Comprehensive lists of all creditors, including the nature of the debt and the amount owed.

- Asset valuations: Assessments of the value of all assets, such as real estate, vehicles, and personal property.

Bankruptcy Paper Tips

Here are seven key tips for handling bankruptcy paperwork effectively: 1. Accuracy is Key: Ensuring that all information provided in the bankruptcy papers is accurate and complete is vital. Inaccurate or incomplete filings can lead to delays or even dismissal of the bankruptcy case. 2. Understand the Forms: The bankruptcy process involves filling out numerous forms, each with its specific requirements. Taking the time to understand what each form requires can help in avoiding mistakes. 3. List All Creditors: Failing to list a creditor can result in that debt not being discharged. It’s crucial to ensure all creditors are included in the bankruptcy paperwork. 4. Disclose All Assets: While the thought of losing assets can be daunting, failing to disclose them can lead to severe legal consequences, including fraud charges. All assets, no matter how small they may seem, must be disclosed. 5. Seek Professional Help: Given the complexity of bankruptcy law, seeking the assistance of a bankruptcy attorney can be highly beneficial. They can guide you through the process, ensure all paperwork is correctly filled out, and represent you in court. 6. Stay Organized: Keeping all bankruptcy-related documents organized and easily accessible can make a significant difference in the efficiency of the process. This includes not only the initial filing but also any subsequent documentation or communication with the court or creditors. 7. Follow Up: After filing, it’s essential to follow up on the status of your case. This includes attending the meeting of creditors (also known as the 341 meeting), responding to any requests from the trustee, and completing any required financial management courses.

Common Challenges in Bankruptcy Filings

Despite the best preparations, several challenges can arise during the bankruptcy filing process. These can include:

- Creditor Objections: Creditors may object to the discharge of certain debts, requiring additional legal proceedings to resolve.

- Asset Disputes: Disagreements over the value or exemption status of assets can complicate the process.

- Procedure Errors: Mistakes in the filing process, such as missing deadlines or failing to file required documents, can lead to delays or dismissal.

📝 Note: The complexity of bankruptcy law means that individual circumstances can significantly affect the outcome of a case. Seeking professional advice is crucial for navigating these complexities effectively.

Conclusion and Next Steps

In conclusion, while the bankruptcy process can seem overwhelming, understanding the requirements and potential challenges can make it more manageable. By carefully preparing, seeking professional help when needed, and staying organized, individuals can navigate the bankruptcy process more effectively. Remember, bankruptcy is a legal tool designed to provide relief to those overwhelmed by debt, offering a chance for a financial fresh start.

What is the main difference between Chapter 7 and Chapter 13 bankruptcy?

+

Chapter 7 bankruptcy involves the liquidation of assets to pay off debts, while Chapter 13 involves creating a repayment plan to pay off debts over time, allowing individuals to keep more of their assets.

How long does a bankruptcy stay on my credit report?

+

A Chapter 7 bankruptcy can remain on a credit report for up to 10 years from the filing date, while a Chapter 13 bankruptcy can remain for up to 7 years from the filing date, provided the repayment plan is completed successfully.

Can I file for bankruptcy more than once?

+

Yes, but there are time limits between filings. For example, if you received a discharge in a previous Chapter 7 case, you must wait at least 8 years before filing another Chapter 7 case. The time limits vary depending on the type of bankruptcy and the outcome of the previous case.