7 Tax Paper Tips

Introduction to Tax Paper Tips

When it comes to handling tax papers, whether for personal or business purposes, organization and accuracy are key. Tax season can be a stressful time, but with the right strategies, you can navigate through it more efficiently. In this article, we will explore seven valuable tips to help you manage your tax papers effectively, ensuring you take advantage of all the deductions you’re eligible for and avoid any potential penalties.

Tip 1: Keep All Documents Organized

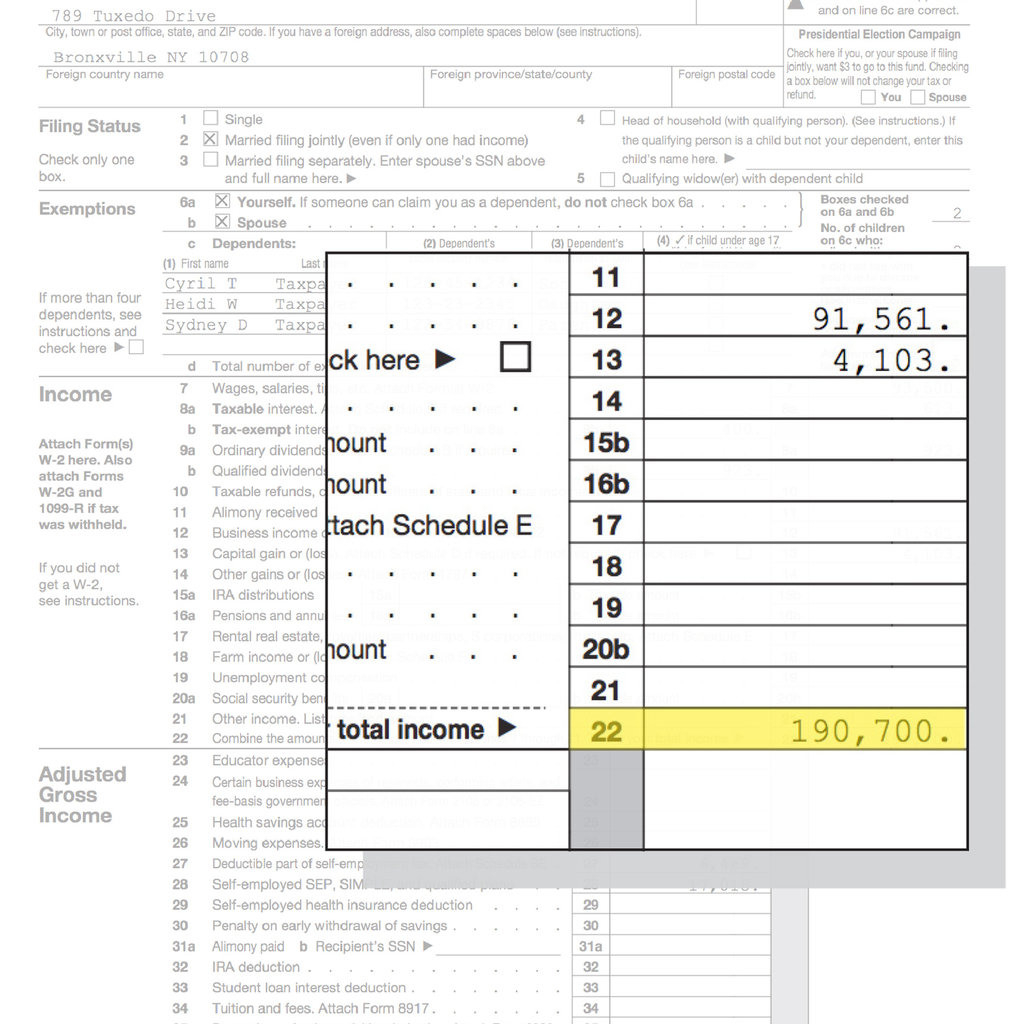

One of the most critical steps in managing tax papers is keeping all relevant documents organized. This includes W-2 forms, 1099 forms for freelance or contract work, receipts for deductions, and any other documents related to your income or expenses. Using a filing system, either physical or digital, can help ensure that all necessary documents are easily accessible when you need them.

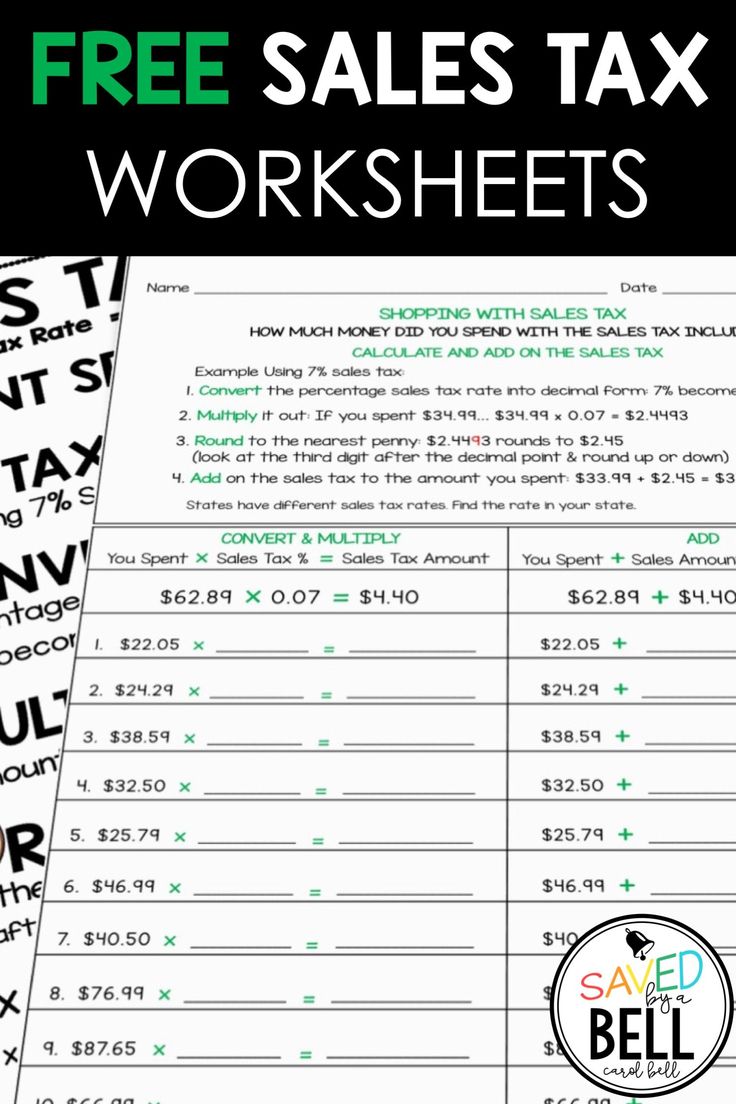

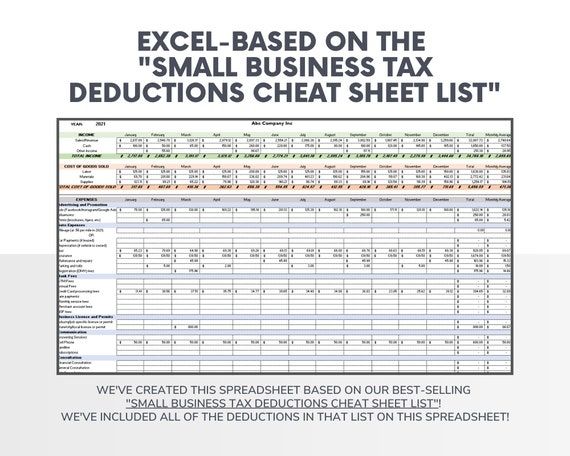

Tip 2: Understand What You Can Deduct

Knowing what expenses you can deduct is crucial for minimizing your tax liability. This can include business expenses if you’re self-employed, charitable donations, medical expenses, and mortgage interest. It’s essential to keep detailed records of these expenses throughout the year, as you’ll need to provide proof of them when filing your taxes.

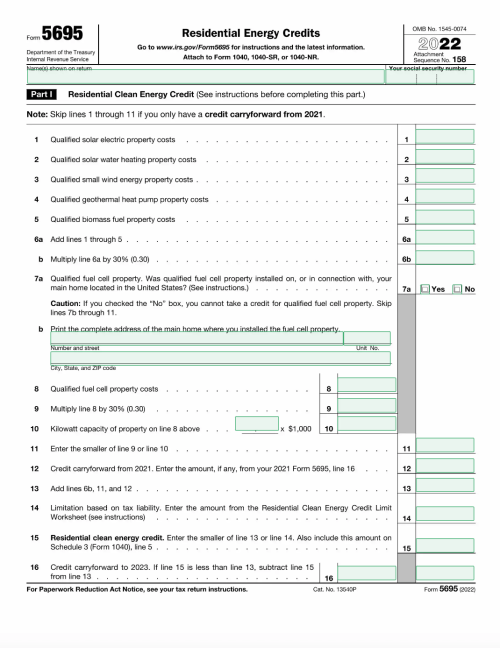

Tip 3: Take Advantage of Tax Credits

Unlike deductions, which reduce your taxable income, tax credits directly reduce the amount of tax you owe. There are various tax credits available, such as the Earned Income Tax Credit (EITC) for low-to-moderate-income workers, child tax credits, and credits for education expenses. Understanding which credits you’re eligible for can significantly impact your tax refund or the amount you owe.

Tip 4: File Electronically

Filing your taxes electronically, or e-filing, offers several advantages over traditional paper filing. It’s generally faster, with refunds being issued sooner, and it reduces the risk of errors, which can delay processing. Additionally, e-filing can help you avoid penalties associated with late or incorrect filings.

Tip 5: Consider Professional Help

While many people choose to file their taxes themselves, using tax preparation software or doing it manually, others may find it beneficial to seek the help of a tax professional. This can be especially useful if you have a complex tax situation, are self-employed, or have experienced significant life changes that could impact your taxes, such as buying a home or having a child.

Tip 6: Plan Ahead

Tax planning shouldn’t just happen during tax season. Throughout the year, you can take steps to reduce your tax liability. This might include contributing to a retirement account, such as a 401(k) or IRA, which can reduce your taxable income, or setting aside funds for estimated tax payments if you’re self-employed.

Tip 7: Review and Adjust

After filing your taxes, it’s a good idea to review your return to ensure everything is accurate and complete. If you find any errors or realize you’ve missed deductions or credits, you can amend your return. Additionally, use this time to adjust your tax strategy for the upcoming year, making any necessary changes to maximize your refund or minimize the amount you owe.

📝 Note: Keeping detailed records and staying organized are key to a successful tax filing experience. Make sure to regularly review and update your tax strategy to ensure you're taking full advantage of all available deductions and credits.

In summary, managing tax papers effectively is about being organized, informed, and proactive. By following these seven tips, you can make the tax filing process less stressful and potentially more beneficial financially. Remember, tax laws and regulations can change, so staying informed about any updates or changes is crucial for ongoing tax planning and compliance.

What are the benefits of e-filing my taxes?

+

E-filing your taxes offers several benefits, including faster processing times, reduced risk of errors, and the potential for a quicker refund. It’s also more secure than traditional paper filing, reducing the risk of identity theft and other fraud.

How can I ensure I’m taking all the deductions I’m eligible for?

+

To ensure you’re taking all eligible deductions, keep detailed records of your expenses throughout the year. This includes receipts for business expenses, charitable donations, and medical expenses. Consulting with a tax professional can also help you identify deductions you might otherwise miss.

What is the difference between a tax deduction and a tax credit?

+

A tax deduction reduces your taxable income, while a tax credit directly reduces the amount of tax you owe. For example, if you have a 1,000 tax deduction, it reduces your taxable income by 1,000, potentially lowering your tax liability. In contrast, a 1,000 tax credit would directly reduce the amount of tax you owe by 1,000.