5 Refinance Paperwork Tips

Understanding the Refinance Process

The decision to refinance a mortgage can be a significant financial move, offering the potential to save money, tap into home equity, or adjust the terms of a loan to better suit current needs. However, the process of refinancing involves a considerable amount of paperwork and documentation. It’s essential for homeowners to approach this process with a clear understanding of what to expect and how to navigate the various requirements efficiently. This guide provides valuable insights and tips on managing refinance paperwork, ensuring a smoother and less stressful experience.

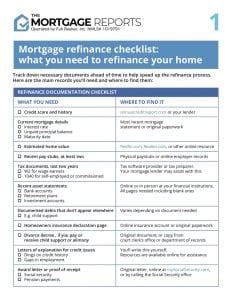

Preparation is Key

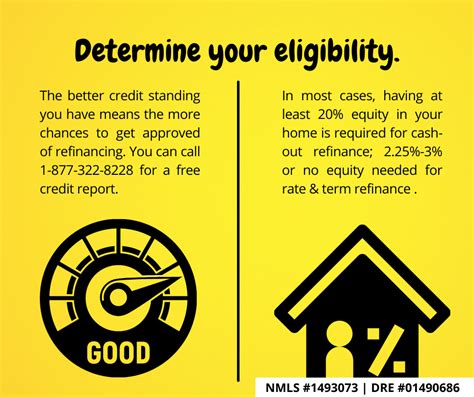

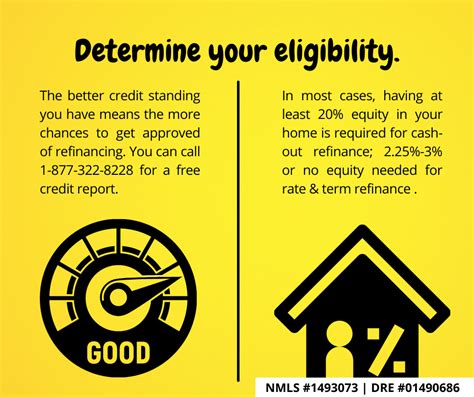

Before diving into the refinance paperwork, it’s crucial to be prepared. This involves gathering all necessary documents, understanding the lender’s requirements, and having a clear picture of one’s financial situation. Organizing financial documents, such as income statements, bank records, and tax returns, is a vital first step. Lenders typically require a comprehensive overview of a borrower’s financial health to assess the risk and potential for loan repayment. Being prepared also means improving credit scores if necessary, as a good credit score can significantly impact the interest rates offered by lenders.

Tips for Managing Refinance Paperwork

Here are several key tips for managing the paperwork involved in refinancing a mortgage: - Stay Organized: Keep all documents in a dedicated folder, both physically and digitally, to ensure easy access and reduce the likelihood of losing important papers. - Understand the Requirements: Each lender may have slightly different requirements, so it’s essential to understand what is needed from the outset to avoid delays. - Review Documents Carefully: Before signing any documents, review them carefully to ensure all information is accurate and complete. - Ask Questions: Don’t hesitate to ask the lender or a financial advisor about any aspects of the process that are unclear. - Consider Digital Options: Many lenders now offer digital platforms for refinancing, which can streamline the process and reduce paperwork.

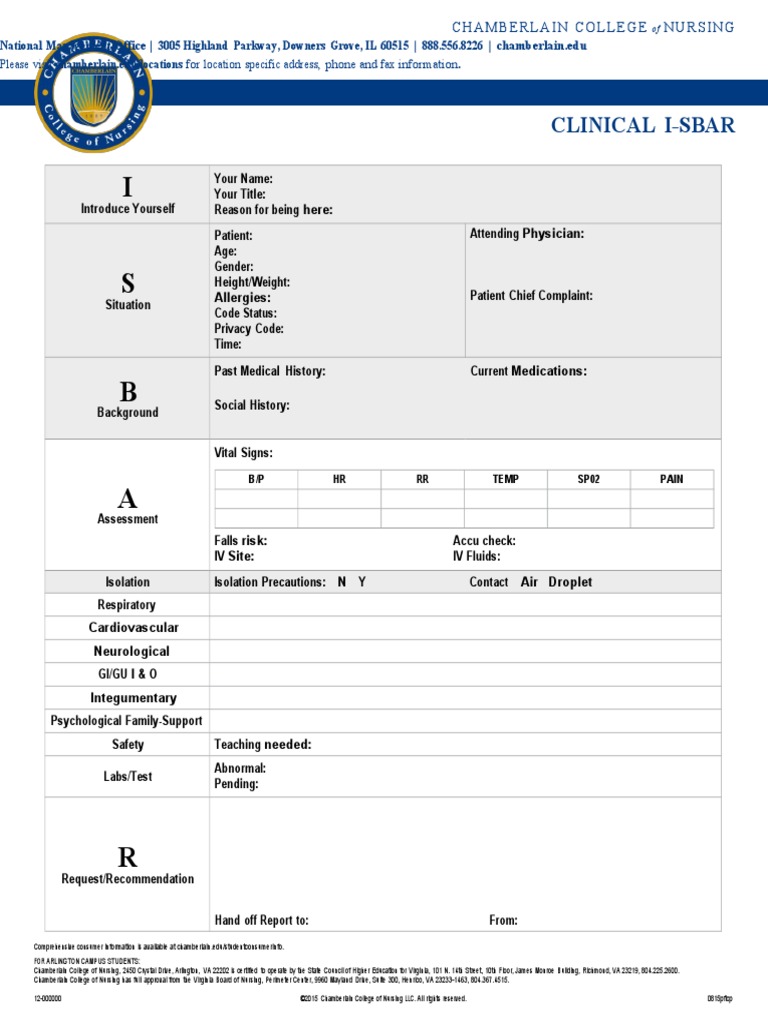

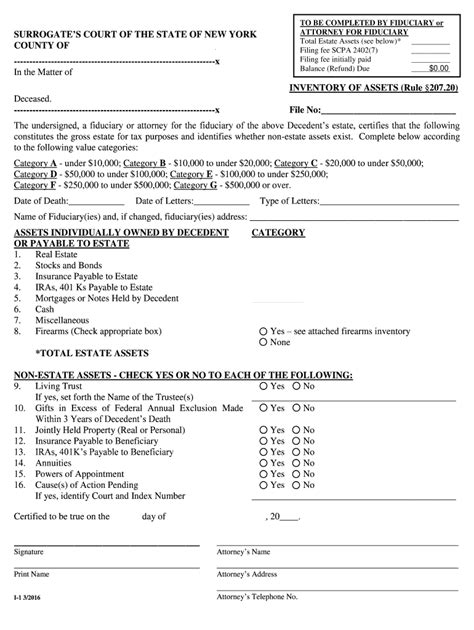

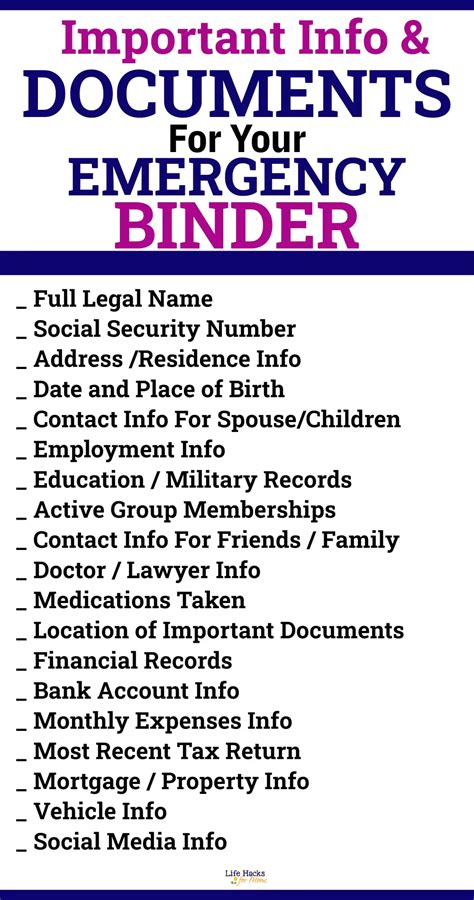

Common Documents Required

The refinance process typically requires a variety of documents to verify income, creditworthiness, and the value of the property. Some of the most common documents include: * Income statements and pay stubs * Bank statements and investment accounts * Tax returns for the past two to three years * Identification documents, such as a driver’s license or passport * Appraisal reports to determine the current value of the property * Insurance documents to ensure the property is adequately covered

| Document Type | Purpose |

|---|---|

| Income Statements | To verify income and employment status |

| Bank Statements | To assess financial stability and savings |

| Tax Returns | To evaluate overall financial health and compliance |

Finalizing the Refinance

Once all the paperwork is in order and the lender has approved the refinance, the final step is closing the loan. This involves signing the loan documents, which legally binds the borrower to the new loan terms. It’s a critical moment in the process, and borrowers should ensure they understand all the terms, including the interest rate, repayment period, and any associated fees. After the documents are signed, the refinance is considered complete, and the borrower begins making payments according to the new loan agreement.

📝 Note: It's essential to keep copies of all signed documents for personal records, as they may be needed for future financial transactions or audits.

As the refinance process comes to a close, it’s a good idea to review the experience, noting what worked well and what could be improved for future financial transactions. This reflective approach can help in making more informed decisions about financial management and planning. The key to a successful refinance lies in thorough preparation, understanding the process, and carefully managing the associated paperwork. By following these guidelines and staying informed, homeowners can navigate the refinance process with confidence, achieving their financial goals more effectively.

The journey through the refinance process, from initial preparation to finalizing the loan, is a significant undertaking that requires patience, diligence, and a keen understanding of financial principles. By embracing these challenges and leveraging the tips and insights provided, individuals can better position themselves for long-term financial stability and success. The culmination of this effort is not just the completion of the refinance but the attainment of a more secure and prosperous financial future.

What are the primary benefits of refinancing a mortgage?

+

The primary benefits include potentially lowering monthly payments, taking advantage of lower interest rates, and tapping into home equity for other financial needs.

How long does the refinance process typically take?

+

The duration of the refinance process can vary, but it typically ranges from 30 to 60 days, depending on the complexity of the loan and the efficiency of the lender.

What are the most common reasons for refinancing a mortgage?

+

The most common reasons include lowering the interest rate, switching from an adjustable-rate to a fixed-rate loan, and accessing cash from the home’s equity for renovations, debt consolidation, or other significant expenses.