5 Investment Paper Tips

Understanding Investment Papers

Investment papers, such as stocks, bonds, and mutual funds, are essential components of a diversified investment portfolio. They offer a way to grow your wealth over time, providing a potentially higher return on investment compared to traditional savings accounts. However, navigating the world of investment papers can be daunting, especially for those new to investing. In this article, we will explore five key tips to help you make informed decisions when dealing with investment papers.

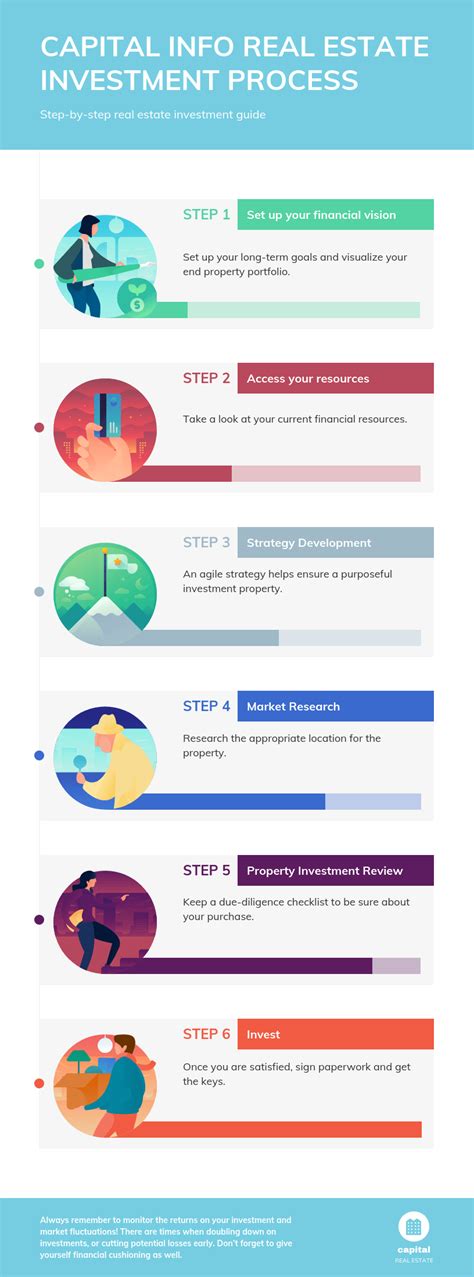

Tip 1: Set Clear Financial Goals

Before investing in any investment paper, it’s crucial to define your financial goals. Are you saving for retirement, a down payment on a house, or your children’s education? Different goals require different investment strategies. For instance, if you’re saving for a short-term goal, you may want to consider more conservative investments, such as bonds or money market funds, which offer lower returns but are generally less risky. On the other hand, if you’re investing for a long-term goal, you may be able to take on more risk and potentially earn higher returns with stocks or mutual funds.

Tip 2: Assess Your Risk Tolerance

Your risk tolerance is another critical factor to consider when investing in investment papers. It refers to your ability to withstand market fluctuations and potential losses. If you’re risk-averse, you may want to focus on more conservative investments, such as bonds or dividend-paying stocks. However, if you’re willing to take on more risk, you may be able to earn higher returns with growth stocks or international investments. It’s essential to find a balance between risk and potential return that aligns with your financial goals and personal comfort level.

Tip 3: Diversify Your Portfolio

Diversification is a key principle of investing in investment papers. By spreading your investments across different asset classes, such as stocks, bonds, and real estate, you can reduce your risk and increase potential returns. A diversified portfolio can help you weather market downturns and take advantage of growth opportunities in different sectors. Consider the following benefits of diversification: * Reduced risk: By investing in a variety of assets, you can minimize your exposure to any one particular market or sector. * Increased potential returns: Diversification can help you capture growth opportunities in different areas, potentially leading to higher returns over the long term. * Improved stability: A diversified portfolio can provide a more stable source of returns, as different assets may perform well at different times.

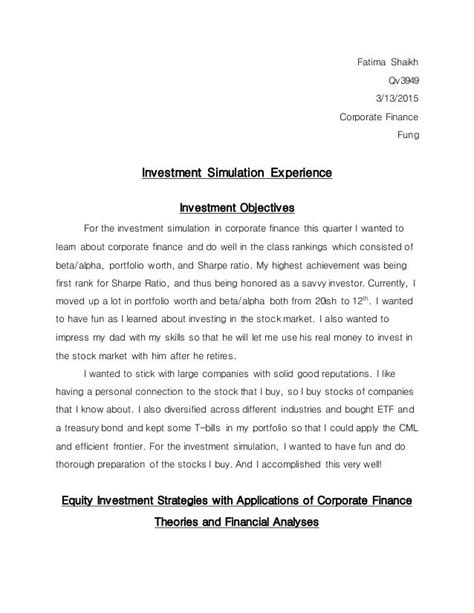

Tip 4: Conduct Thorough Research

Before investing in any investment paper, it’s essential to conduct thorough research. This includes: * Evaluating the company’s financial health and performance * Assessing the competitive landscape and market trends * Reviewing the investment’s fees and expenses * Considering the tax implications of your investment By doing your homework, you can make informed decisions and avoid costly mistakes. Consider the following research tools: * Financial statements: Review a company’s income statement, balance sheet, and cash flow statement to understand its financial health. * Industry reports: Stay up-to-date on market trends and competitive analysis to identify potential growth opportunities. * Investment websites: Utilize online resources, such as Morningstar or Yahoo Finance, to research investment papers and track their performance.

Tip 5: Monitor and Adjust Your Portfolio

Finally, it’s crucial to monitor and adjust your portfolio regularly. This includes: * Tracking your investments’ performance and adjusting your asset allocation as needed * Rebalancing your portfolio to maintain an optimal mix of assets * Tax-loss harvesting: Selling losing investments to offset gains from other investments By regularly reviewing and adjusting your portfolio, you can ensure that it remains aligned with your financial goals and risk tolerance. Consider the following table to illustrate the importance of portfolio rebalancing:

| Asset Class | Initial Allocation | Current Allocation | Rebalanced Allocation |

|---|---|---|---|

| Stocks | 60% | 65% | 60% |

| Bonds | 30% | 25% | 30% |

| Real Estate | 10% | 10% | 10% |

📝 Note: Regular portfolio rebalancing can help you maintain an optimal asset allocation, reducing risk and increasing potential returns.

In summary, investing in investment papers requires careful consideration of your financial goals, risk tolerance, and diversification strategy. By conducting thorough research, monitoring and adjusting your portfolio, and maintaining a long-term perspective, you can make informed decisions and achieve your investment objectives. Ultimately, a well-crafted investment strategy can help you build wealth over time, providing a secure financial future for yourself and your loved ones.

What is the best way to diversify my investment portfolio?

+

The best way to diversify your investment portfolio is to spread your investments across different asset classes, such as stocks, bonds, and real estate. This can help reduce risk and increase potential returns.

How often should I review and adjust my investment portfolio?

+

What are the benefits of conducting thorough research before investing in investment papers?

+

Conducting thorough research before investing in investment papers can help you make informed decisions, avoid costly mistakes, and increase potential returns. It allows you to evaluate the company’s financial health, assess the competitive landscape, and review the investment’s fees and expenses.