Everify Paperwork Retention Period

Understanding E-Verify Paperwork Retention Period

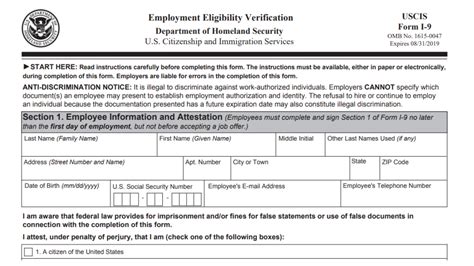

The E-Verify program is a web-based system that allows employers to electronically verify the employment eligibility of their newly hired employees. It is a voluntary program, but it is mandatory for some federal contractors and subcontractors. One of the key aspects of the E-Verify program is the retention of paperwork related to the verification process. In this blog post, we will delve into the details of the E-Verify paperwork retention period and its importance for employers.

Why is E-Verify Paperwork Retention Important?

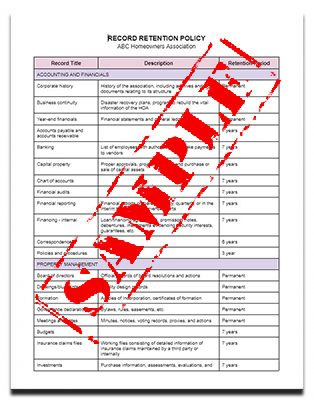

The retention of E-Verify paperwork is crucial for employers as it provides a record of the employment eligibility verification process. This paperwork includes documents such as the Form I-9, E-Verify case numbers, and Tentative Nonconfirmation (TNC) notices. These documents serve as evidence that the employer has complied with the E-Verify program requirements and has taken the necessary steps to verify the employment eligibility of their employees. In the event of an audit or investigation, these documents can help employers demonstrate their compliance with the program.

E-Verify Paperwork Retention Period

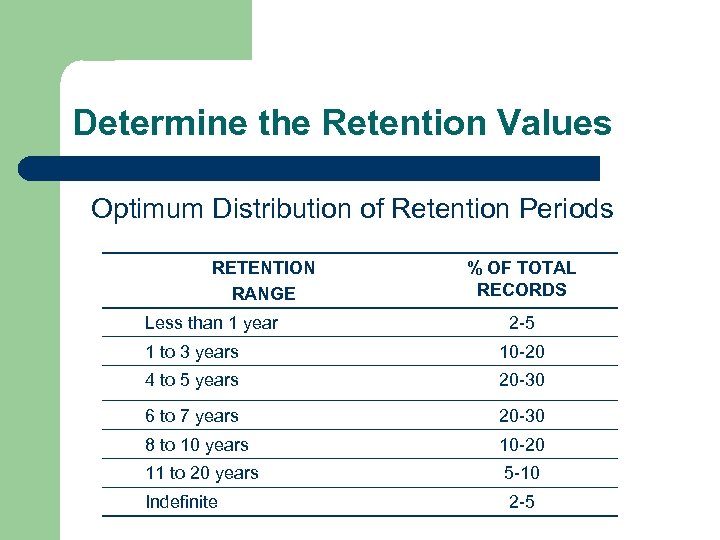

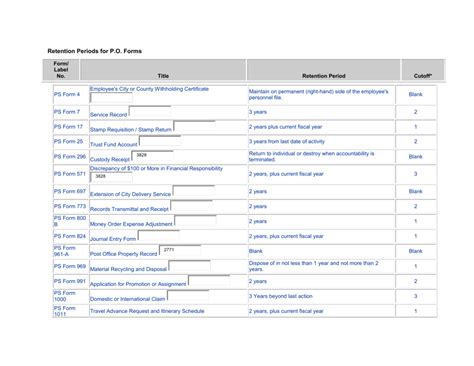

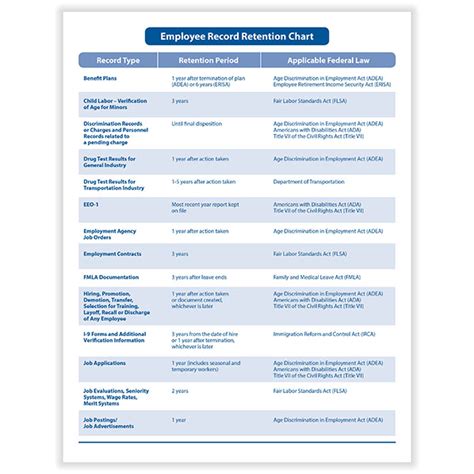

The retention period for E-Verify paperwork varies depending on the type of document. The following are the general guidelines for the retention period of E-Verify paperwork:

- Form I-9: The Form I-9 must be retained for at least three years after the date of hire or one year after the date of termination, whichever is later.

- E-Verify case numbers: E-Verify case numbers must be retained for at least five years from the date of hire.

- Tentative Nonconfirmation (TNC) notices: TNC notices must be retained for at least five years from the date of the notice.

Best Practices for E-Verify Paperwork Retention

To ensure compliance with the E-Verify program requirements, employers should follow these best practices for E-Verify paperwork retention:

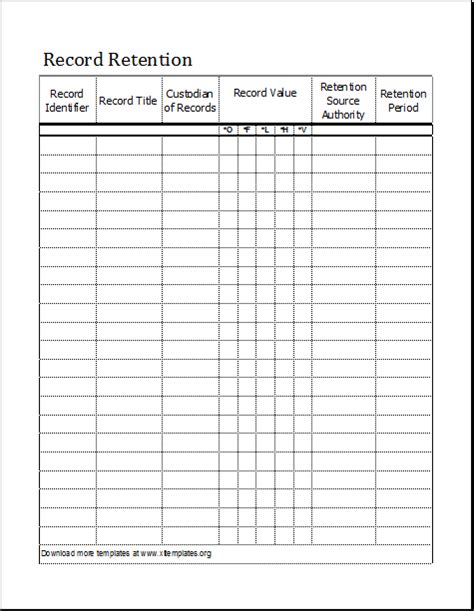

- Designate a responsible person: Employers should designate a responsible person to manage the E-Verify paperwork and ensure that all documents are retained for the required period.

- Use a secure storage system: Employers should use a secure storage system, such as a locked cabinet or a password-protected electronic folder, to store E-Verify paperwork.

- Maintain accurate and complete records: Employers should maintain accurate and complete records of all E-Verify paperwork, including the retention of all relevant documents for the required period.

- Conduct regular audits: Employers should conduct regular audits to ensure that their E-Verify paperwork retention practices are compliant with the program requirements.

Consequences of Non-Compliance

Failure to comply with the E-Verify paperwork retention requirements can result in severe consequences, including:

- Monetary fines: Employers who fail to comply with the E-Verify paperwork retention requirements may be subject to monetary fines.

- Reputation damage: Non-compliance with the E-Verify program requirements can damage an employer’s reputation and lead to a loss of public trust.

- Loss of business opportunities: Employers who fail to comply with the E-Verify program requirements may be ineligible for federal contracts and other business opportunities.

📝 Note: Employers should consult with their legal counsel or a qualified immigration attorney to ensure that they are complying with all applicable laws and regulations related to the E-Verify program.

In summary, the E-Verify paperwork retention period is a critical aspect of the E-Verify program, and employers must ensure that they are retaining all relevant documents for the required period. By following the best practices outlined in this blog post and maintaining accurate and complete records, employers can ensure that they are complying with the program requirements and avoiding potential consequences.

The key points to remember are that the E-Verify paperwork retention period varies depending on the type of document, and employers must retain documents such as the Form I-9, E-Verify case numbers, and TNC notices for the required period. Employers should also designate a responsible person to manage the E-Verify paperwork, use a secure storage system, maintain accurate and complete records, and conduct regular audits to ensure compliance with the program requirements.

What is the purpose of the E-Verify program?

+

The E-Verify program is a web-based system that allows employers to electronically verify the employment eligibility of their newly hired employees.

How long must employers retain E-Verify paperwork?

+

The retention period for E-Verify paperwork varies depending on the type of document, but generally, employers must retain documents such as the Form I-9, E-Verify case numbers, and TNC notices for at least three to five years.

What are the consequences of non-compliance with the E-Verify program requirements?

+

Failure to comply with the E-Verify program requirements can result in severe consequences, including monetary fines, reputation damage, and loss of business opportunities.