7 Years Delinquency

Understanding the Impact of 7 Years Delinquency on Credit Scores

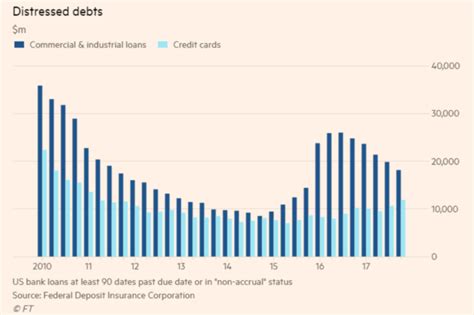

When it comes to maintaining a healthy credit score, one of the most critical factors to consider is the presence of delinquencies on your credit report. A delinquency occurs when you fail to make a payment on a debt as agreed upon with the lender. One common question that arises in the context of credit scores and delinquencies is how long these delinquencies remain on your credit report and affect your score. Specifically, the concept of a 7-year delinquency is crucial to understand, as it pertains to how long negative information, such as late payments or accounts sent to collections, can stay on your credit report.

What Happens After 7 Years?

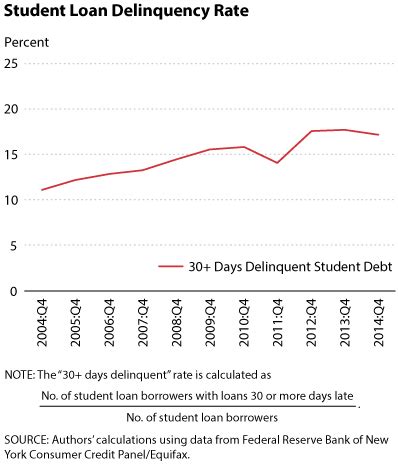

According to the Fair Credit Reporting Act (FCRA), most negative information on your credit report, including late payments, accounts sent to collections, and even bankruptcies, can remain there for up to 7 years from the date of the first delinquency. This means that if you missed a payment or had an account go to collections, the negative impact of this event on your credit score will diminish over time and completely disappear from your credit report after 7 years. However, the impact of this delinquency on your credit score is most significant in the first two years and gradually lessens as time progresses.

Factors Influencing Credit Score Recovery

The rate at which your credit score recovers from a delinquency depends on several factors, including: - The severity of the delinquency: A single missed payment may have less of an impact compared to multiple missed payments or more severe actions like foreclosure. - The age of the delinquency: Newer delinquencies affect your score more than older ones. - The presence of positive credit information: Maintaining a good payment history after the delinquency, keeping credit utilization low, and having a long credit history can all contribute to faster recovery. - The overall credit mix and inquiries: A diverse mix of credit types (e.g., credit cards, loans) and minimal inquiries can also support recovery.

Rebuilding Credit After Delinquency

Rebuilding your credit after a delinquency requires a strategic approach: - Make on-time payments: The most critical step is to ensure that all payments are made on time going forward. - Keep credit utilization low: Aim to use less than 30% of your available credit to show lenders you can manage your debt responsibly. - Monitor your credit report: Regularly check your credit report for errors or the delinquency in question to ensure it is accurately reported and removed after the 7-year period. - Consider a secured credit card or becoming an authorized user: For those with severely damaged credit, a secured credit card or becoming an authorized user on someone else’s credit account can be a pathway to rebuilding credit.

| Type of Negative Information | Duration on Credit Report |

|---|---|

| Late Payments | 7 years from the original delinquency date |

| Accounts Sent to Collections | 7 years from the original delinquency date |

| Bankruptcies | 7 years for Chapter 13, 10 years for Chapter 7 |

💡 Note: Understanding the timeline for how long delinquencies stay on your credit report is crucial for planning your financial recovery and ensuring that your credit score reflects your current financial situation accurately.

Long-Term Financial Planning

While the 7-year rule provides a clear timeline for the removal of negative information from your credit report, long-term financial planning is key to maintaining a healthy credit score. This involves not just recovering from past delinquencies but also avoiding future ones. By adopting responsible credit habits and staying informed about your credit report, you can navigate the complexities of credit scoring and work towards a stronger financial future.

In the end, recovering from a 7-year delinquency is about patience, consistent effort, and a deep understanding of how credit works. By focusing on rebuilding your credit history with positive information and waiting out the statutory period for negative marks to be removed, you can overcome past financial setbacks and achieve a better financial standing. This journey towards financial recovery and stability is marked by gradual improvements in your credit score, reflecting your growing creditworthiness over time. As you move forward, keeping a keen eye on your credit report and maintaining good credit practices will be essential in ensuring that your financial health continues to flourish.