Paperwork

Loan Paperwork Processing Time

Understanding Loan Paperwork Processing Time

The process of obtaining a loan involves several steps, including application, approval, and finally, the disbursement of funds. One of the critical components of this process is the loan paperwork processing time. This refers to the duration it takes for the lender to review and process the loan application, verify the borrower’s information, and prepare the necessary documents for signing. The loan paperwork processing time can significantly impact the overall loan experience, affecting both the borrower’s and the lender’s efficiency and satisfaction.

Factors Influencing Loan Paperwork Processing Time

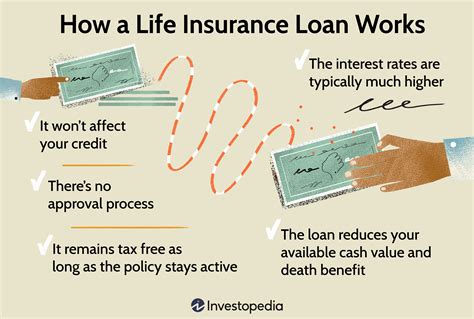

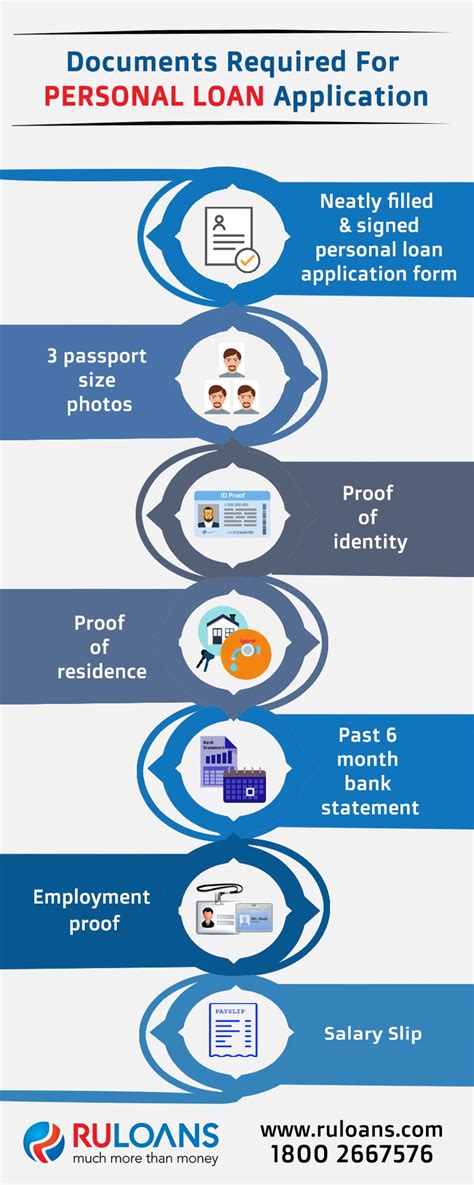

Several factors can influence the loan paperwork processing time, including: * Type of loan: Different types of loans, such as mortgages, personal loans, or business loans, have varying complexities and requirements, which can affect the processing time. * Lender’s efficiency: The lender’s internal processes, technology, and staffing can significantly impact the speed of loan paperwork processing. * Borrower’s preparedness: The borrower’s ability to provide complete and accurate information can expedite the processing time. * Regulatory requirements: Compliance with regulatory requirements can sometimes slow down the loan paperwork processing time.

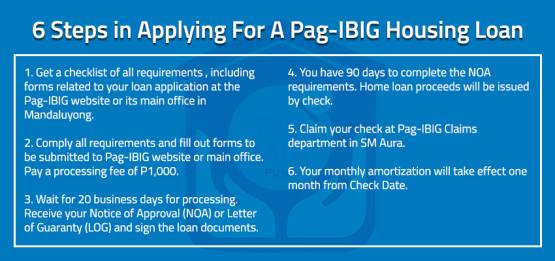

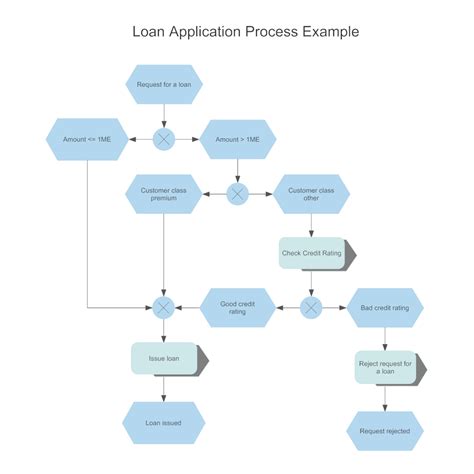

Steps Involved in Loan Paperwork Processing

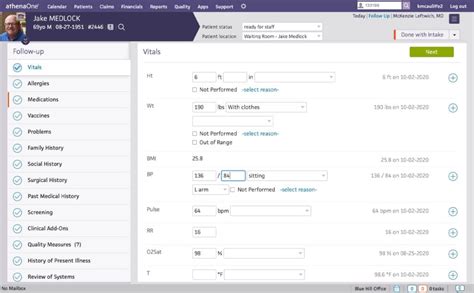

The loan paperwork processing involves several steps, including: * Application submission: The borrower submits the loan application, which includes providing personal and financial information. * Initial review: The lender reviews the application to ensure it is complete and meets the minimum requirements. * Credit check: The lender conducts a credit check to assess the borrower’s creditworthiness. * Verification: The lender verifies the borrower’s information, including income, employment, and identity. * Approval: The lender approves or rejects the loan application based on the verification and credit check results. * Document preparation: The lender prepares the loan agreement and other necessary documents for signing. * Signing and disbursement: The borrower signs the loan agreement, and the lender disburses the funds.

Technologies Improving Loan Paperwork Processing Time

Advances in technology have significantly improved the loan paperwork processing time. Some of these technologies include: * Automated underwriting systems: These systems use algorithms to quickly evaluate loan applications and make decisions. * Digital signature platforms: These platforms enable borrowers to sign loan documents electronically, reducing the need for physical paperwork. * Online application portals: These portals allow borrowers to submit loan applications and upload required documents online, streamlining the process. * Machine learning algorithms: These algorithms can help lenders quickly verify borrower information and detect potential fraud.

Benefits of Efficient Loan Paperwork Processing

Efficient loan paperwork processing can have several benefits, including: * Faster access to funds for borrowers * Improved borrower satisfaction * Increased lender efficiency and productivity * Reduced costs associated with manual processing * Enhanced security and compliance with regulatory requirements

Best Practices for Lenders to Improve Loan Paperwork Processing Time

Lenders can improve loan paperwork processing time by: * Implementing efficient internal processes and workflows * Investing in technology, such as automated underwriting systems and digital signature platforms * Providing clear and concise communication to borrowers throughout the process * Ensuring staff are trained and knowledgeable about the loan process * Continuously monitoring and evaluating the loan paperwork processing time to identify areas for improvement

📝 Note: Lenders should prioritize transparency and communication with borrowers throughout the loan paperwork processing time to ensure a smooth and efficient experience.

Conclusion and Future Outlook

In conclusion, the loan paperwork processing time is a critical component of the loan process, and lenders should strive to improve efficiency and speed while maintaining compliance with regulatory requirements. As technology continues to evolve, we can expect to see further innovations in loan paperwork processing, such as the use of artificial intelligence and blockchain. By embracing these technologies and implementing best practices, lenders can enhance the borrower experience, reduce costs, and increase productivity.

What is the average loan paperwork processing time?

+

The average loan paperwork processing time varies depending on the type of loan and lender, but it can range from a few days to several weeks.

How can borrowers speed up the loan paperwork processing time?

+

Borrowers can speed up the loan paperwork processing time by providing complete and accurate information, responding promptly to lender requests, and using online application portals and digital signature platforms.

What technologies are improving loan paperwork processing time?

+

Technologies such as automated underwriting systems, digital signature platforms, online application portals, and machine learning algorithms are improving loan paperwork processing time.