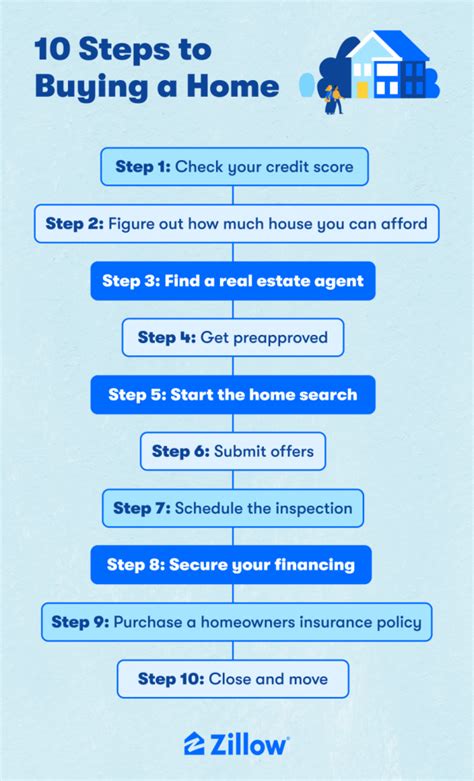

5 Steps to Buy Property

Introduction to Buying Property

Buying a property can be a daunting task, especially for first-time buyers. The process involves several steps, from finding the right property to completing the purchase. It’s essential to understand the steps involved to ensure a smooth and successful transaction. In this article, we will guide you through the 5 steps to buy a property, providing you with the necessary information to make informed decisions.

Step 1: Determine Your Budget

Before starting your property search, it’s crucial to determine your budget. You need to consider your income, savings, and expenses to decide how much you can afford to spend on a property. Lenders will also assess your creditworthiness to determine the amount they are willing to lend you. Consider the following factors when determining your budget: * Your income and savings * Your credit score and history * The amount of debt you have * The interest rates and loan terms * The additional costs associated with buying a property, such as stamp duty, solicitor fees, and survey costs

Step 2: Research and Find the Right Property

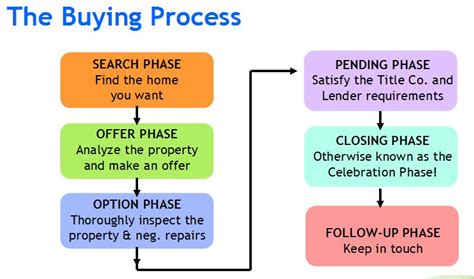

Once you have determined your budget, you can start researching and finding the right property. Consider the following factors when searching for a property: * Location: proximity to work, schools, public transport, and amenities * Type of property: house, apartment, or townhouse * Size and layout: number of bedrooms, bathrooms, and living areas * Condition: new, old, or renovated * Amenities: pool, gym, parking, and security You can search for properties online, visit open houses, or contact a real estate agent to find the right property for you.

Step 3: Inspect and Evaluate the Property

When you find a property that meets your criteria, it’s essential to inspect and evaluate it carefully. Consider the following: * The property’s condition: look for any signs of damage or needed repairs * The neighborhood: research the local crime rate, schools, and amenities * The property’s potential: consider its resale value and potential for renovation or expansion * The property’s flaws: consider any issues that may affect its value or livability You can also hire a professional to inspect the property and provide a report on its condition.

Step 4: Make an Offer and Negotiate the Price

When you find a property that you want to purchase, you need to make an offer and negotiate the price. Consider the following: * The property’s market value: research the prices of similar properties in the area * The seller’s asking price: consider the seller’s motivation and flexibility * Your budget: ensure that you don’t exceed your budget * The terms of the sale: consider the inclusions, exclusions, and conditions of the sale You can work with a real estate agent to make an offer and negotiate the price.

Step 5: Complete the Purchase

Once your offer is accepted, you need to complete the purchase. This involves: * Signing the contract: ensure that you understand the terms and conditions * Conducting due diligence: research the property’s title, survey, and any outstanding debts * Obtaining finance: finalize your loan and ensure that you have enough funds * Settling the purchase: pay the balance of the purchase price and transfer the ownership You can work with a solicitor or conveyancer to ensure that the purchase is completed smoothly and efficiently.

📝 Note: It's essential to work with professionals, such as real estate agents, solicitors, and conveyancers, to ensure that the purchase is completed smoothly and efficiently.

The process of buying a property can be complex and time-consuming. However, by following these 5 steps, you can ensure that you find the right property and complete the purchase successfully. Remember to stay informed, work with professionals, and prioritize your needs and budget throughout the process.

In the end, buying a property is a significant investment, and it’s crucial to approach it with caution and careful planning. By understanding the steps involved and taking the time to research and evaluate your options, you can make an informed decision and achieve your goal of owning a property.

What is the first step in buying a property?

+

The first step in buying a property is to determine your budget. This involves considering your income, savings, and expenses to decide how much you can afford to spend on a property.

How do I find the right property?

+

You can find the right property by researching online, visiting open houses, or contacting a real estate agent. Consider factors such as location, type of property, size, and condition when searching for a property.

What is the importance of inspecting and evaluating a property?

+

Inspecting and evaluating a property is crucial to ensure that you are aware of its condition and potential flaws. This can help you make an informed decision and avoid costly surprises in the future.