Buy House Paperwork Time

Introduction to Buying a House

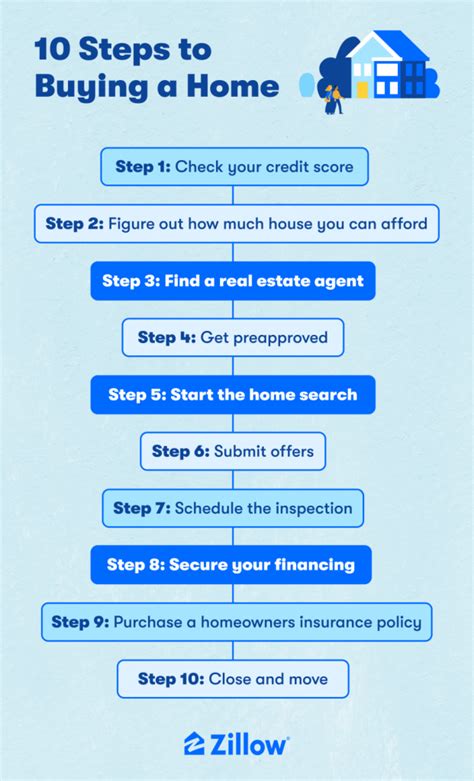

When it comes to buying a house, the process can be lengthy and involves a significant amount of paperwork. The time it takes to complete the paperwork can vary depending on several factors, including the complexity of the transaction, the efficiency of the parties involved, and the jurisdiction in which the property is located. In this article, we will delve into the world of buying a house and explore the various types of paperwork involved, as well as the timeframe for completion.

Types of Paperwork Involved

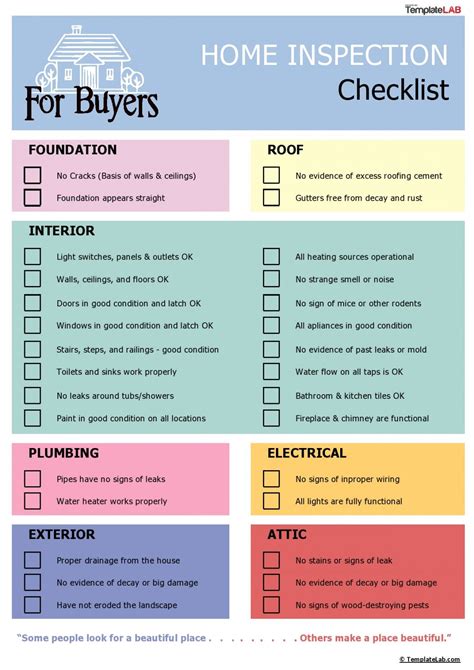

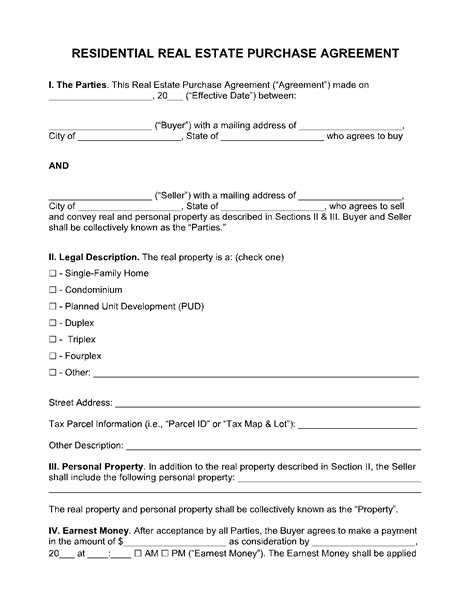

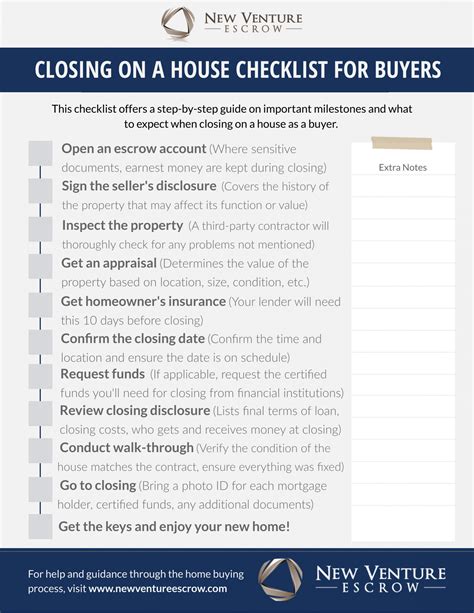

There are several types of paperwork involved in buying a house, including: * Offer to Purchase: This is the initial document that outlines the terms of the sale, including the price, contingencies, and closing date. * Purchase Agreement: This document is signed by both the buyer and seller and outlines the final terms of the sale. * Loan Application: If the buyer is financing the purchase, they will need to complete a loan application and provide financial documentation to the lender. * Appraisal Report: The lender may require an appraisal of the property to ensure its value is sufficient to secure the loan. * Inspection Report: The buyer may hire a home inspector to identify any potential issues with the property. * Title Search: A title search is conducted to ensure the seller has clear ownership of the property and to identify any potential liens or encumbrances. * Closing Documents: These documents are signed at the closing meeting and transfer ownership of the property from the seller to the buyer.

Timeframe for Completion

The timeframe for completing the paperwork involved in buying a house can vary significantly depending on the complexity of the transaction and the efficiency of the parties involved. On average, it can take anywhere from 30 to 60 days to complete the paperwork, but it’s not uncommon for the process to take longer. The following is a general outline of the timeframe for each stage of the process: * Offer to Purchase: 1-3 days * Purchase Agreement: 1-3 days * Loan Application: 1-2 weeks * Appraisal Report: 1-2 weeks * Inspection Report: 1-2 weeks * Title Search: 1-2 weeks * Closing Documents: 1-3 days

Factors That Can Affect the Timeframe

There are several factors that can affect the timeframe for completing the paperwork involved in buying a house, including: * Complexity of the transaction: If the transaction is complex, such as a short sale or foreclosure, it can take longer to complete the paperwork. * Efficiency of the parties involved: The efficiency of the parties involved, including the buyer, seller, lender, and title company, can significantly impact the timeframe for completion. * Jurisdiction: The jurisdiction in which the property is located can impact the timeframe for completion, as different states and localities have different regulations and requirements. * Financing: If the buyer is financing the purchase, the lender’s requirements and processing time can impact the timeframe for completion.

📝 Note: It's essential to work with experienced professionals, including a real estate agent, lender, and title company, to ensure the process is completed efficiently and effectively.

Table of Paperwork Involved

The following table outlines the various types of paperwork involved in buying a house:

| Type of Paperwork | Description | Timeframe for Completion |

|---|---|---|

| Offer to Purchase | Initial document outlining terms of sale | 1-3 days |

| Purchase Agreement | Final document outlining terms of sale | 1-3 days |

| Loan Application | Application for financing | 1-2 weeks |

| Appraisal Report | Report on property value | 1-2 weeks |

| Inspection Report | Report on property condition | 1-2 weeks |

| Title Search | Search for clear ownership and liens | 1-2 weeks |

| Closing Documents | Documents transferring ownership | 1-3 days |

In summary, buying a house involves a significant amount of paperwork, and the timeframe for completion can vary depending on several factors. It’s essential to work with experienced professionals to ensure the process is completed efficiently and effectively. By understanding the various types of paperwork involved and the timeframe for completion, buyers can better navigate the process and achieve their goal of homeownership.

What is the average timeframe for completing the paperwork involved in buying a house?

+

The average timeframe for completing the paperwork involved in buying a house is 30 to 60 days, but it can take longer depending on the complexity of the transaction and the efficiency of the parties involved.

What are the most common types of paperwork involved in buying a house?

+

The most common types of paperwork involved in buying a house include the offer to purchase, purchase agreement, loan application, appraisal report, inspection report, title search, and closing documents.

How can I ensure the paperwork process is completed efficiently and effectively?

+

To ensure the paperwork process is completed efficiently and effectively, it’s essential to work with experienced professionals, including a real estate agent, lender, and title company.