5 Tips Autozone Approval

Introduction to Autozone Approval

Getting approved for an Autozone credit card can be a great way to finance your car repairs, maintenance, and accessories. Autozone is a leading retailer of automotive parts and accessories, and their credit card offers numerous benefits, including special financing options and rewards programs. However, the approval process can be challenging, especially for those with less-than-perfect credit. In this article, we will provide you with 5 tips to increase your chances of getting approved for an Autozone credit card.

Understanding the Autozone Credit Card

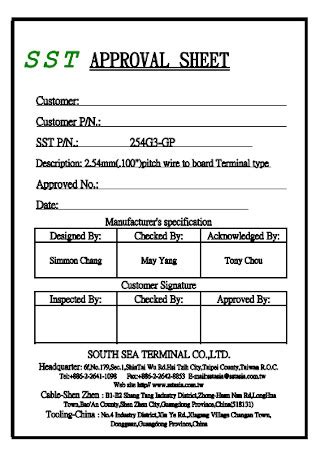

Before we dive into the tips, it’s essential to understand the Autozone credit card and its benefits. The card is issued by Synchrony Bank and offers special financing options for purchases made at Autozone stores. Cardholders can enjoy 6-month special financing on purchases of 199 or more, and <b>12-month special financing</b> on purchases of 499 or more. Additionally, the card offers a rewards program that allows cardholders to earn points for every dollar spent at Autozone.

Tips for Autozone Approval

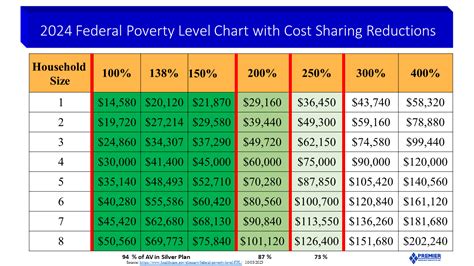

Here are 5 tips to help you get approved for an Autozone credit card: * Check your credit score: Your credit score plays a significant role in determining your approval. Autozone typically requires a fair to good credit score for approval. You can check your credit score for free on various websites, such as Credit Karma or Experian. * Meet the income requirements: Autozone requires applicants to have a stable income to ensure they can make payments on time. Make sure you meet the income requirements, which may vary depending on your location and other factors. * Verify your identity: Autozone requires applicants to provide valid identification to verify their identity. Make sure you have a valid government-issued ID, such as a driver’s license or passport. * Apply for the right card: Autozone offers different credit cards, each with its own set of benefits and requirements. Make sure you apply for the card that best suits your needs and credit profile. * Monitor your credit report: Errors on your credit report can negatively impact your credit score and reduce your chances of approval. Monitor your credit report regularly and dispute any errors you find.

Benefits of Autozone Approval

Getting approved for an Autozone credit card can offer numerous benefits, including: * Special financing options: Enjoy 6-month or 12-month special financing on purchases made at Autozone stores. * Rewards program: Earn points for every dollar spent at Autozone and redeem them for rewards, such as gift cards or discounts. * Convenient payment options: Make payments online, by phone, or by mail. * No annual fee: The Autozone credit card has no annual fee, making it a great option for those who want to avoid extra charges.

📝 Note: Make sure to read and understand the terms and conditions of the Autozone credit card before applying.

Common Mistakes to Avoid

When applying for an Autozone credit card, it’s essential to avoid common mistakes that can reduce your chances of approval. These include: * Applying for multiple cards: Applying for multiple credit cards in a short period can negatively impact your credit score. * Not meeting the income requirements: Make sure you meet the income requirements to increase your chances of approval. * Not verifying your identity: Autozone requires valid identification to verify your identity. * Not monitoring your credit report: Errors on your credit report can negatively impact your credit score and reduce your chances of approval.

| Card Benefits | Description |

|---|---|

| Special Financing Options | 6-month or 12-month special financing on purchases made at Autozone stores |

| Rewards Program | Earn points for every dollar spent at Autozone and redeem them for rewards |

| Convenient Payment Options | Make payments online, by phone, or by mail |

| No Annual Fee | The Autozone credit card has no annual fee |

To summarize, getting approved for an Autozone credit card requires a good credit score, stable income, and valid identification. By following the 5 tips outlined in this article, you can increase your chances of approval and enjoy the numerous benefits of the Autozone credit card. Remember to avoid common mistakes and monitor your credit report regularly to maintain a good credit score.

What is the minimum credit score required for Autozone approval?

+

The minimum credit score required for Autozone approval is not publicly disclosed. However, it’s recommended to have a fair to good credit score to increase your chances of approval.

How long does it take to get approved for an Autozone credit card?

+

The approval process for an Autozone credit card typically takes a few minutes to a few hours. You may receive instant approval or be required to provide additional documentation to support your application.

Can I use my Autozone credit card at other stores?

+

No, the Autozone credit card can only be used at Autozone stores or on their website. It’s a closed-loop credit card, meaning it’s not accepted at other stores or online retailers.