5 IRS LLC Tips

Introduction to IRS LLC Tips

When forming a Limited Liability Company (LLC), it’s essential to understand the tax implications and requirements set by the Internal Revenue Service (IRS). An LLC offers flexibility in taxation, allowing owners to choose how they want to be taxed. This flexibility, combined with the personal liability protection it provides, makes an LLC a popular choice for many businesses. However, navigating the IRS guidelines can be complex. Here are some key IRS LLC tips to consider when setting up and operating your business.

Choosing the Right Tax Classification

One of the most important decisions you’ll make as an LLC is how you want to be taxed. By default, the IRS treats a single-member LLC as a disregarded entity for tax purposes, meaning the business income is reported on the owner’s personal tax return. Multi-member LLCs are considered partnerships by default, with each member reporting their share of the business income on their personal tax return. However, an LLC can elect to be taxed as a corporation (either a C corporation or an S corporation) by filing Form 8832 with the IRS. - C Corporation: The LLC will be taxed on its profits, and then the owners will be taxed again on the dividends they receive, resulting in double taxation. - S Corporation: The LLC will not be taxed on its profits; instead, the income will pass through to the owners, who report it on their personal tax returns, avoiding double taxation.

📝 Note: The decision on tax classification should be made carefully, considering factors such as the number of owners, the nature of the business, and the potential tax implications.

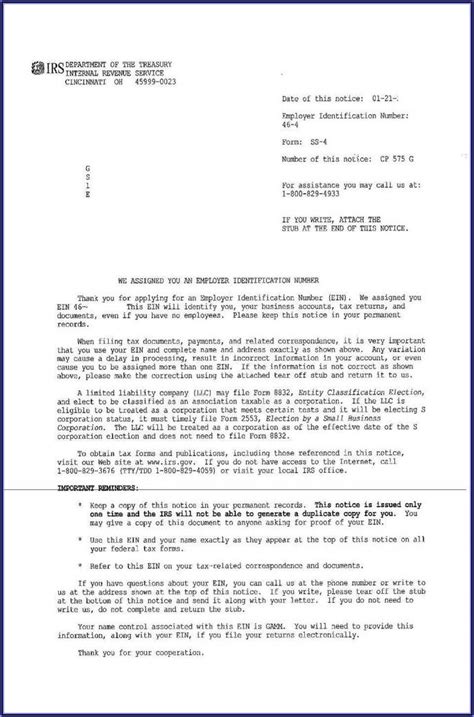

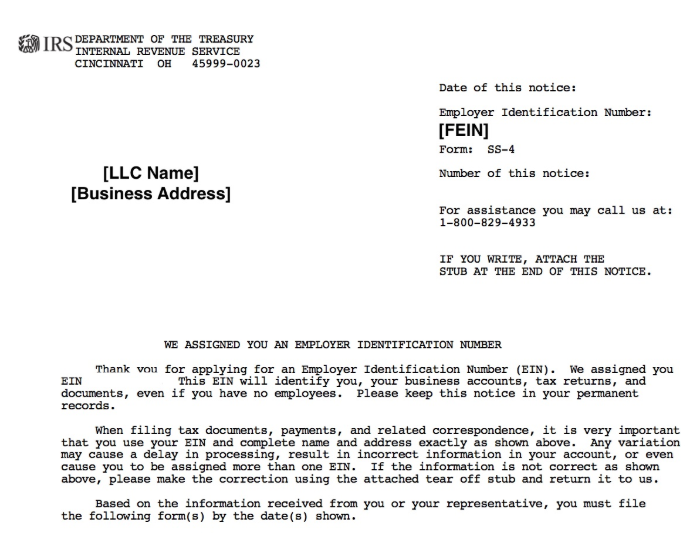

Understanding Employer Identification Numbers (EINs)

An Employer Identification Number (EIN) is a unique nine-digit number assigned by the IRS to identify your business for tax purposes. It’s required for: - Opening a business bank account - Hiring employees - Filing tax returns - Applying for credit Even if you’re a single-member LLC with no employees, having an EIN can help you maintain a separation between personal and business finances and is often required for other business purposes.

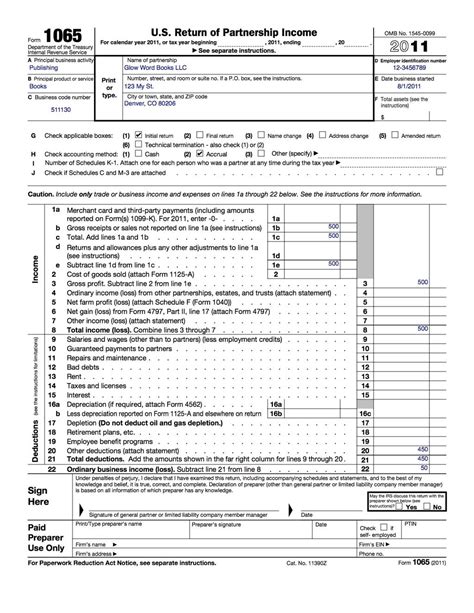

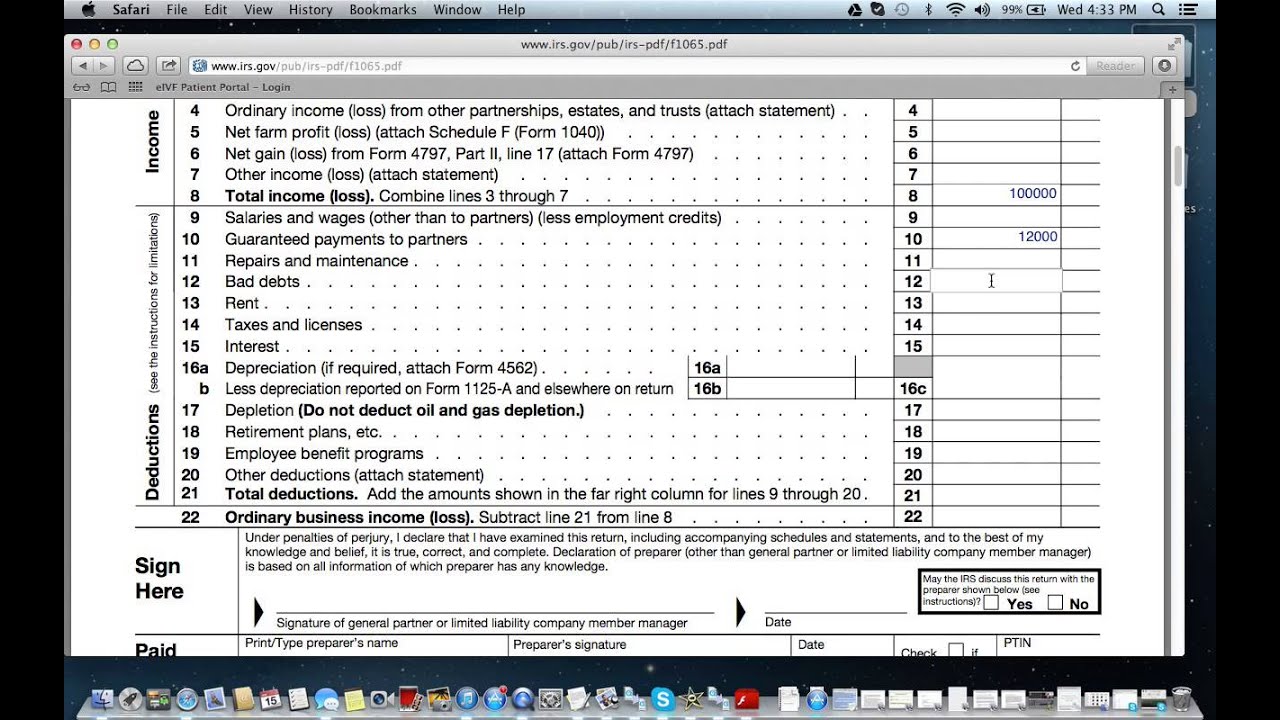

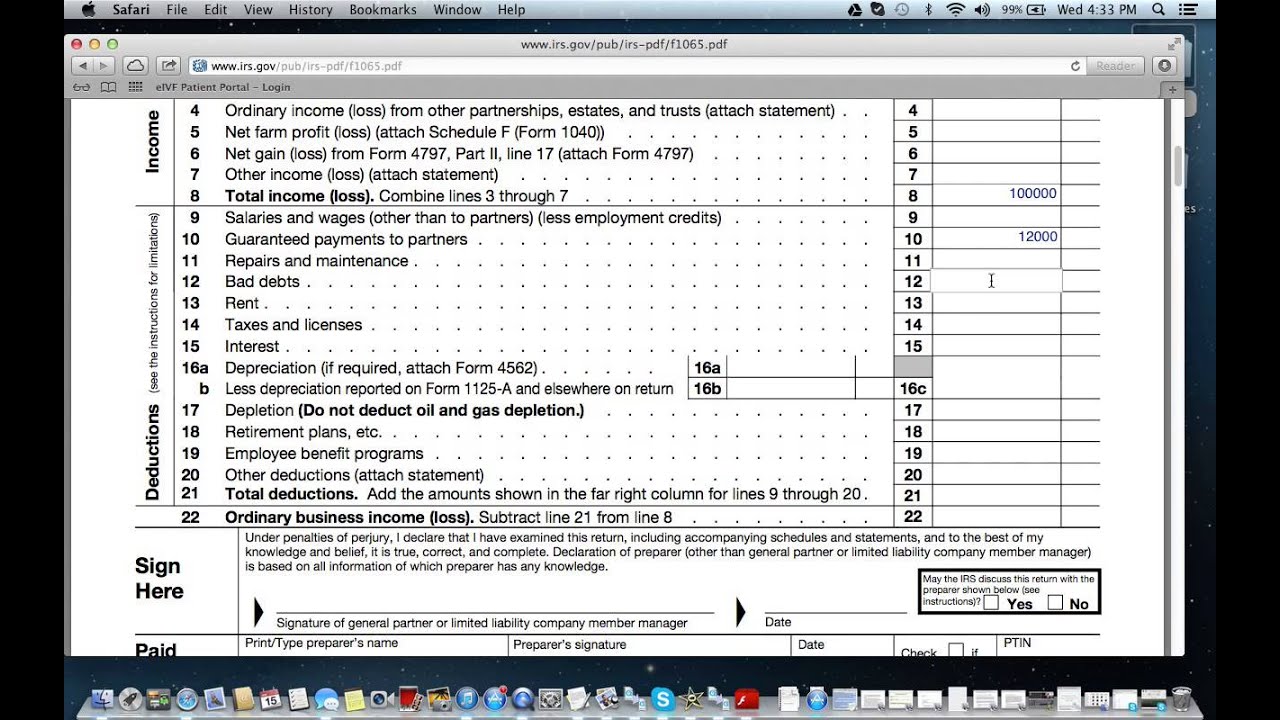

Filing Taxes as an LLC

The tax filing requirements for an LLC depend on its tax classification: - Single-member LLC (disregarded entity): Reports income and expenses on Schedule C (Form 1040). - Multi-member LLC (partnership): Files Form 1065, with each member receiving a Schedule K-1 to report their share of income and expenses on their personal tax return. - LLC taxed as a corporation: Files either Form 1120 (for C corporations) or Form 1120S (for S corporations), with owners reporting dividends or pass-through income on their personal tax returns.

Annual Reports and Compliance

While tax compliance is crucial, LLCs also have other ongoing compliance requirements, such as filing annual reports with the state where the LLC is registered. These reports typically require updating the LLC’s information, such as its address, members, and managers. Failure to file these reports can result in fines, penalties, and even the dissolution of the LLC.

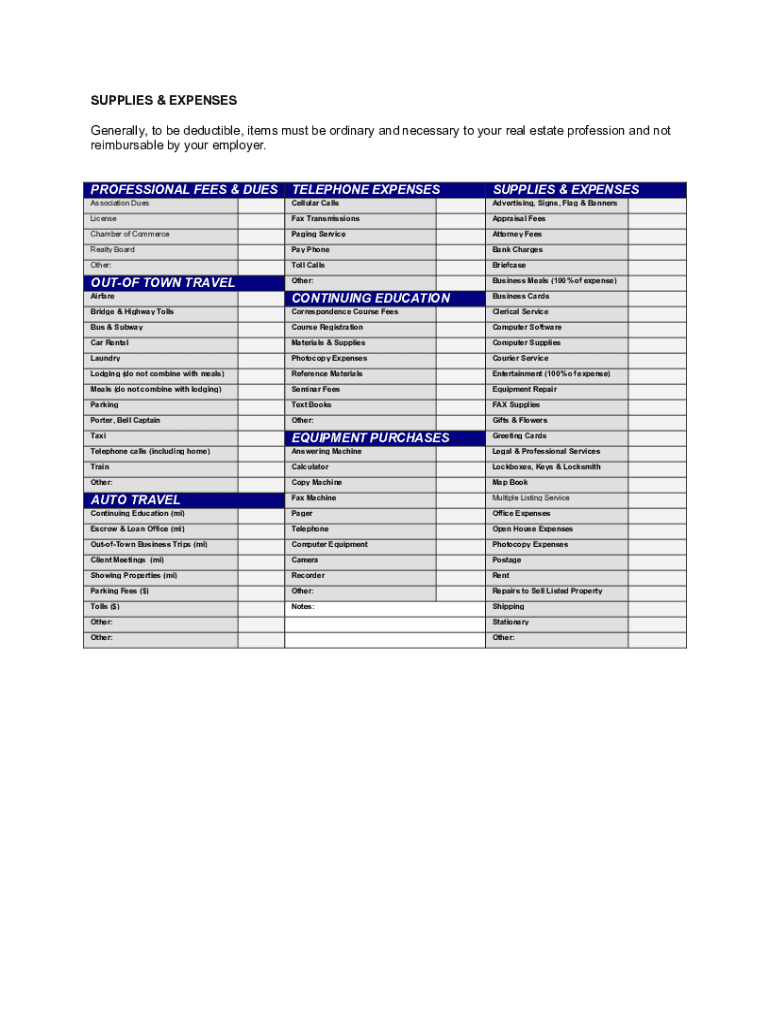

Record Keeping and Accounting

Maintaining accurate and detailed financial records is vital for any business, including LLCs. This includes: - Separating personal and business finances: Open a business bank account to keep personal and business transactions separate. - Recording expenses and income: Use accounting software to track all business expenses and income throughout the year. - Maintaining a profit and loss statement: Regularly update your profit and loss statement to understand your business’s financial health.

| Category | Importance | Description |

|---|---|---|

| Tax Classification | High | Choosing how the LLC will be taxed affects the owners' personal tax returns and the business's tax liability. |

| EIN | High | Required for opening a business bank account, hiring employees, and filing tax returns. |

| Tax Filing | High | Depends on the tax classification of the LLC; accurate and timely filing is crucial for avoiding penalties. |

| Annual Reports | Medium | Required by the state to update the LLC's information; failure to file can result in penalties. |

| Record Keeping | High | Essential for tax purposes, understanding the business's financial health, and making informed decisions. |

In conclusion, understanding and complying with IRS regulations is crucial for the successful operation of an LLC. By choosing the right tax classification, obtaining an EIN, filing taxes correctly, maintaining compliance with annual reports, and keeping accurate financial records, LLC owners can ensure their business remains in good standing with the IRS and positions itself for long-term success.

What is the default tax classification for a single-member LLC?

+

A single-member LLC is considered a disregarded entity by default, with the business income reported on the owner’s personal tax return.

Why is an Employer Identification Number (EIN) necessary for an LLC?

+

An EIN is required for opening a business bank account, hiring employees, filing tax returns, and applying for credit. It helps separate personal and business finances.

What are the consequences of not filing annual reports for an LLC?

+

Failure to file annual reports can result in fines, penalties, and potentially the dissolution of the LLC, depending on the state’s requirements and enforcement policies.