IRS Tax Paperwork Pending Time

Understanding IRS Tax Paperwork Pending Time

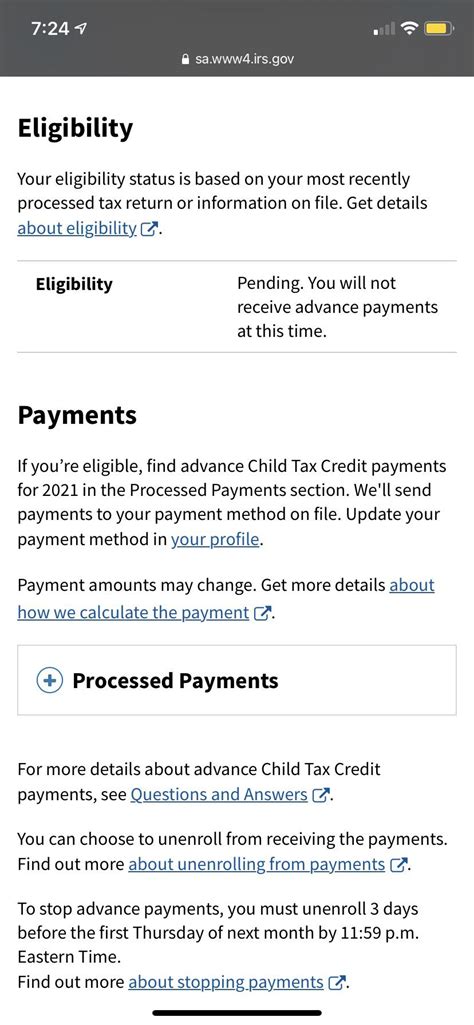

The Internal Revenue Service (IRS) is responsible for collecting taxes and administering tax laws in the United States. When taxpayers submit their tax returns, they often wonder how long it will take for the IRS to process their paperwork. The IRS tax paperwork pending time can vary depending on several factors, including the complexity of the return, the time of year, and the workload of the IRS.

The IRS receives millions of tax returns every year, and processing them can take some time. In general, the IRS aims to process tax returns within 6-8 weeks after they are received. However, this timeframe can be longer or shorter depending on the specific circumstances. For example, if a taxpayer files their return electronically, it may be processed faster than a paper return.

Factors Affecting IRS Tax Paperwork Pending Time

Several factors can influence the time it takes for the IRS to process tax paperwork. Some of the key factors include: * Time of year: The IRS is busiest during tax season, which typically runs from January to April. Taxpayers who file their returns during this period may experience longer processing times. * Complexity of the return: Tax returns with complex schedules, such as those with business income or investments, may take longer to process than simpler returns. * Workload of the IRS: The IRS has a limited number of staff and resources, which can impact its ability to process tax returns quickly. * Errors or missing information: If a tax return contains errors or missing information, it may be delayed while the IRS requests additional information or corrections.

How to Check the Status of Your Tax Return

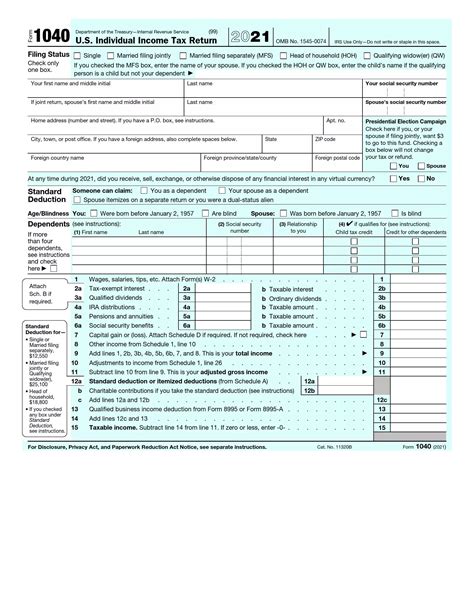

Taxpayers can check the status of their tax return using the IRS Where’s My Refund tool. This tool is available on the IRS website and allows taxpayers to track the status of their refund. To use the tool, taxpayers will need to provide their: * Social Security number or Individual Taxpayer Identification Number (ITIN) * Filing status (single, married, head of household, etc.) * Exact refund amount

Taxpayers can also contact the IRS directly to inquire about the status of their tax return. The IRS phone number is 1-800-829-1040, and representatives are available to assist taxpayers Monday through Friday from 7:00 a.m. to 7:00 p.m. local time.

What to Do If Your Tax Return Is Delayed

If a taxpayer’s tax return is delayed, there are several steps they can take: * Check the IRS website: The IRS website provides updates on tax return processing times and any issues that may be causing delays. * Contact the IRS: Taxpayers can contact the IRS to inquire about the status of their tax return and to request an update on the processing time. * Review the tax return: Taxpayers should review their tax return to ensure it is complete and accurate. If errors or missing information are found, taxpayers should correct the issues and resubmit their return.

| Return Type | Average Processing Time |

|---|---|

| E-filed return | 2-4 weeks |

| Paper return | 6-8 weeks |

| Complex return (business income, investments, etc.) | 8-12 weeks |

📝 Note: The processing times listed in the table are approximate and may vary depending on the specific circumstances of the tax return.

Conclusion and Next Steps

In conclusion, the IRS tax paperwork pending time can vary depending on several factors, including the complexity of the return, the time of year, and the workload of the IRS. Taxpayers can check the status of their tax return using the IRS Where’s My Refund tool or by contacting the IRS directly. If a tax return is delayed, taxpayers should review their return for errors or missing information and correct any issues before resubmitting. By understanding the factors that affect IRS tax paperwork pending time, taxpayers can better plan and prepare for the tax filing process.

How long does it take for the IRS to process a tax return?

+

The IRS aims to process tax returns within 6-8 weeks after they are received. However, this timeframe can be longer or shorter depending on the specific circumstances.

What can cause delays in processing my tax return?

+

Delays can be caused by errors or missing information on the tax return, complex schedules or business income, and a high workload for the IRS during tax season.

How can I check the status of my tax return?

+

Taxpayers can check the status of their tax return using the IRS Where’s My Refund tool or by contacting the IRS directly at 1-800-829-1040.