Keep Bankruptcy Discharge Papers Forever

Understanding the Importance of Bankruptcy Discharge Papers

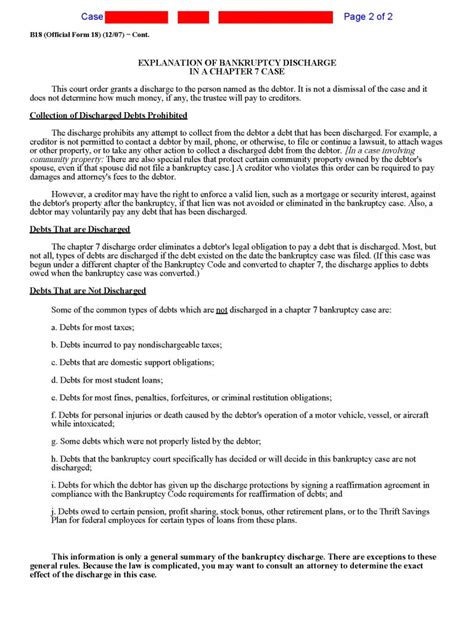

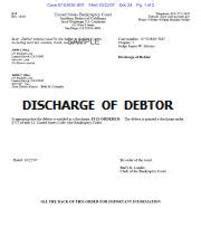

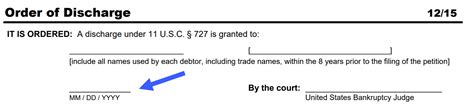

When individuals or businesses file for bankruptcy, the ultimate goal is to receive a discharge, which releases them from their debt obligations. The bankruptcy discharge papers are official documents issued by the court, confirming that the debtor’s debts have been discharged. It is crucial to keep these papers forever, as they serve as proof of the bankruptcy discharge and can be beneficial in various situations.

Why Keep Bankruptcy Discharge Papers?

There are several reasons why it is essential to retain bankruptcy discharge papers indefinitely. Some of the key reasons include: * Proof of discharge: The discharge papers provide official proof that the debtor’s debts have been discharged, which can be useful when dealing with creditors or applying for new credit. * Credit report disputes: If a discharged debt appears on a credit report, the discharge papers can be used to dispute the error and have it removed. * Future credit applications: When applying for new credit, such as a mortgage or car loan, the discharge papers may be required to verify the debtor’s bankruptcy status. * Tax purposes: In some cases, the discharge papers may be necessary for tax purposes, such as when claiming a loss or deduction related to the discharged debt.

What to Do with Bankruptcy Discharge Papers

To ensure the safekeeping of bankruptcy discharge papers, consider the following: * Make multiple copies: Create multiple copies of the discharge papers and store them in separate, secure locations, such as a safe deposit box or a fireproof safe. * Organize with other important documents: Store the discharge papers with other important documents, such as tax returns, property deeds, and insurance policies. * Inform relevant parties: Provide copies of the discharge papers to relevant parties, such as creditors, credit reporting agencies, and financial institutions.

Potential Consequences of Losing Bankruptcy Discharge Papers

Losing bankruptcy discharge papers can lead to several issues, including: * Difficulty proving discharge: Without the discharge papers, it may be challenging to prove that the debts have been discharged, which can lead to disputes with creditors or credit reporting agencies. * Delayed or denied credit applications: The inability to provide proof of discharge may delay or deny credit applications, such as mortgages or car loans. * Unnecessary stress and expense: Losing the discharge papers can lead to unnecessary stress and expense, as the debtor may need to obtain replacement documents or engage in disputes with creditors.

💡 Note: If the bankruptcy discharge papers are lost or destroyed, it may be possible to obtain replacement documents from the court or the debtor's attorney.

Best Practices for Storing Bankruptcy Discharge Papers

To ensure the safekeeping of bankruptcy discharge papers, follow these best practices: * Use a secure storage method: Store the discharge papers in a secure location, such as a safe deposit box or a fireproof safe. * Make digital copies: Create digital copies of the discharge papers and store them in a secure online storage service, such as a cloud storage provider. * Inform a trusted individual: Inform a trusted individual, such as a spouse or family member, about the location and contents of the discharge papers.

| Document | Location | Copy |

|---|---|---|

| Bankruptcy discharge papers | Safe deposit box | Digital copy |

| Bankruptcy discharge papers | Fireproof safe | Paper copy |

As the years pass, it is easy to forget about the importance of keeping bankruptcy discharge papers. However, these documents remain crucial for various aspects of life, from credit applications to tax purposes. By understanding the significance of these papers and taking steps to ensure their safekeeping, individuals can avoid potential issues and ensure a smoother financial future.

In the end, keeping bankruptcy discharge papers forever is a simple yet essential step in maintaining a healthy financial life. By following the tips and best practices outlined above, individuals can ensure that their discharge papers are safe and easily accessible, providing peace of mind and protection against potential financial issues.

What happens if I lose my bankruptcy discharge papers?

+

If you lose your bankruptcy discharge papers, you may be able to obtain replacement documents from the court or your attorney. However, this can be a time-consuming and costly process.

How long should I keep my bankruptcy discharge papers?

+

Can I store my bankruptcy discharge papers digitally?

+

Yes, you can store your bankruptcy discharge papers digitally, but make sure to use a secure online storage service and keep a backup of the documents in a separate location.