Audit Paperwork Retention Period

Introduction to Audit Paperwork Retention

When it comes to managing audit paperwork, one of the most critical aspects to consider is the retention period. The retention period refers to the length of time that audit documents and records should be kept on file. This is essential for maintaining compliance with regulatory requirements, supporting audit findings, and providing a clear audit trail. In this article, we will delve into the world of audit paperwork retention, exploring the key considerations, best practices, and guidelines for determining the appropriate retention period.

Importance of Audit Paperwork Retention

Audit paperwork retention is crucial for several reasons:

- Compliance: Regulatory bodies, such as the Securities and Exchange Commission (SEC), require companies to maintain audit records for a specified period.

- Audit Support: Retaining audit paperwork provides a clear audit trail, supporting audit findings and facilitating future audits.

- Risk Management: Maintaining accurate and complete audit records helps to mitigate risks associated with non-compliance, financial errors, and other potential issues.

Factors Influencing Retention Periods

Several factors influence the determination of audit paperwork retention periods, including:

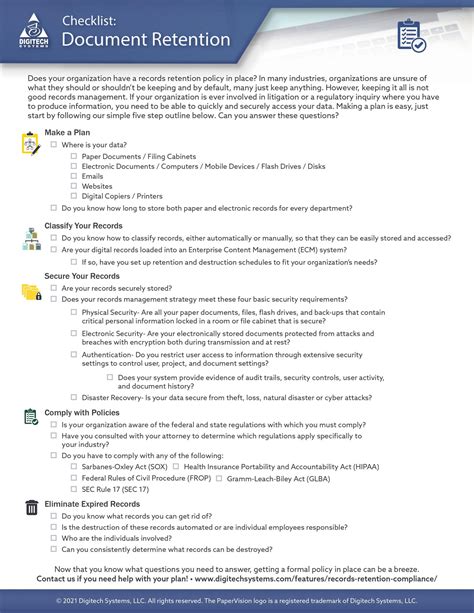

- Regulatory Requirements: Companies must comply with relevant laws, regulations, and standards, such as the Sarbanes-Oxley Act (SOX) or the Generally Accepted Auditing Standards (GAAS).

- Industry Standards: Certain industries, such as healthcare or finance, may have specific guidelines or regulations governing audit paperwork retention.

- Company Policies: Organizations may establish their own retention policies, which should be aligned with regulatory requirements and industry standards.

- Audit Type: The type of audit, such as an external or internal audit, may impact the retention period.

Guidelines for Audit Paperwork Retention

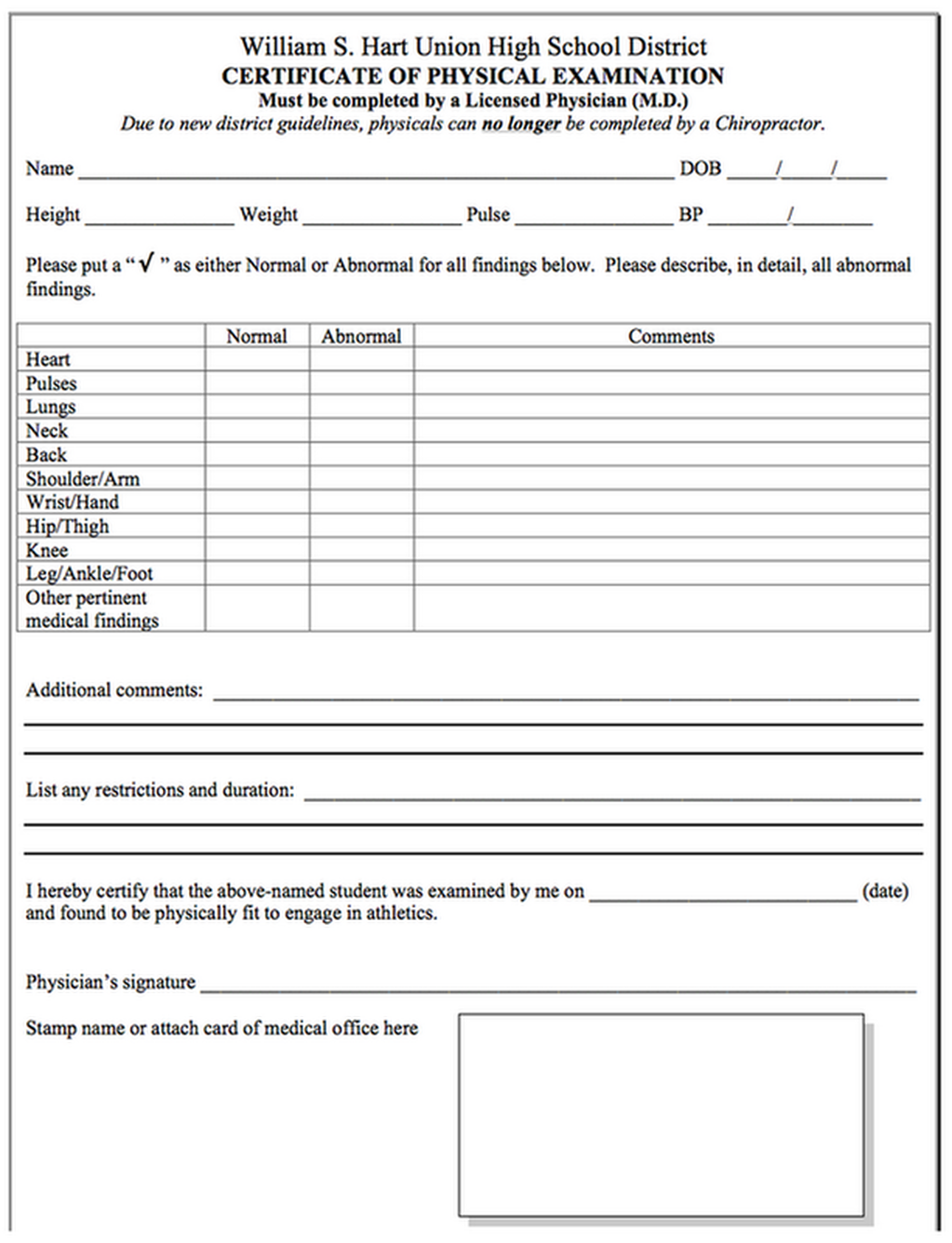

The following guidelines provide a general framework for audit paperwork retention:

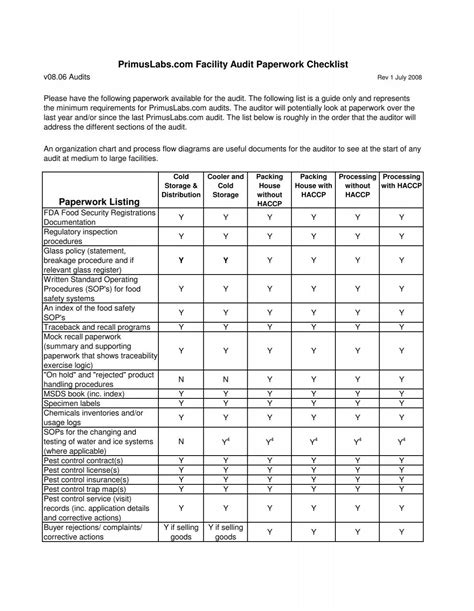

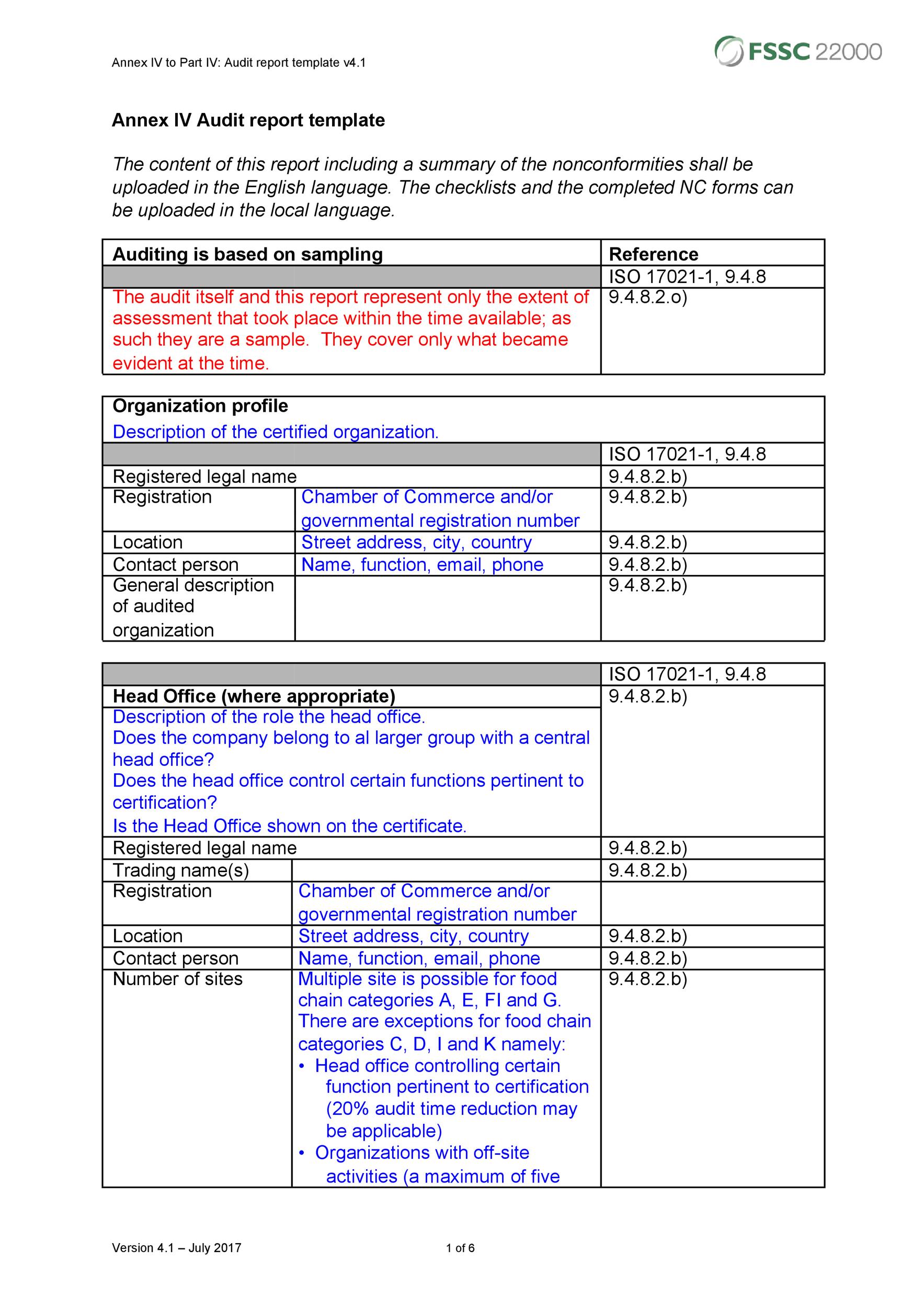

| Document Type | Retention Period |

|---|---|

| Audit reports | 7-10 years |

| Audit working papers | 3-7 years |

| Financial statements | 7-10 years |

| Supporting documentation | 3-7 years |

Please note that these guidelines are general and may vary depending on the specific regulatory requirements, industry standards, and company policies.

📝 Note: It is essential to consult with regulatory bodies, industry experts, and company policies to determine the specific retention periods for your organization.

Best Practices for Audit Paperwork Retention

To ensure effective audit paperwork retention, consider the following best practices:

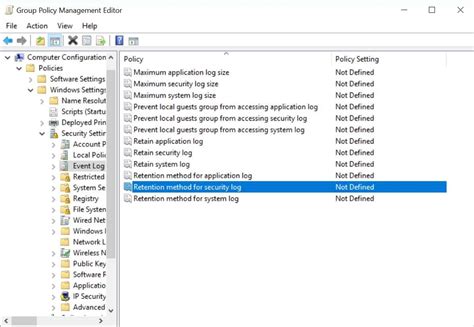

- Centralized Storage: Store audit documents in a centralized location, such as a secure online repository or a designated filing area.

- Clear Labeling: Clearly label and categorize audit documents to facilitate easy retrieval and review.

- Access Controls: Implement access controls to ensure that only authorized personnel can access and modify audit documents.

- Regular Review: Regularly review and update audit paperwork retention policies to ensure compliance with changing regulatory requirements and industry standards.

As we move forward in the world of audit paperwork retention, it is essential to stay up-to-date with the latest regulatory requirements, industry standards, and best practices. By doing so, organizations can ensure they are maintaining compliance, supporting audit findings, and providing a clear audit trail.

To recap, the key points to consider when it comes to audit paperwork retention are the importance of compliance, the factors influencing retention periods, and the guidelines and best practices for maintaining effective audit paperwork retention. By understanding and implementing these concepts, organizations can ensure they are meeting regulatory requirements and maintaining a robust audit process.

What is the purpose of audit paperwork retention?

+

The purpose of audit paperwork retention is to maintain compliance with regulatory requirements, support audit findings, and provide a clear audit trail.

What factors influence the determination of audit paperwork retention periods?

+

Regulatory requirements, industry standards, company policies, and audit type are some of the factors that influence the determination of audit paperwork retention periods.

What are some best practices for audit paperwork retention?

+

Best practices for audit paperwork retention include centralized storage, clear labeling, access controls, and regular review and update of retention policies.