5 Tips to File Probate

Introduction to Probate

When a loved one passes away, it can be a challenging and emotional time for those left behind. In addition to dealing with grief, there are often many practical tasks that need to be taken care of, including managing the deceased person’s estate. One of the key steps in this process is filing probate, which can seem like a daunting task, especially for those who are not familiar with the legal system. In this article, we will provide 5 tips to help guide you through the probate process and make it as smooth and stress-free as possible.

What is Probate?

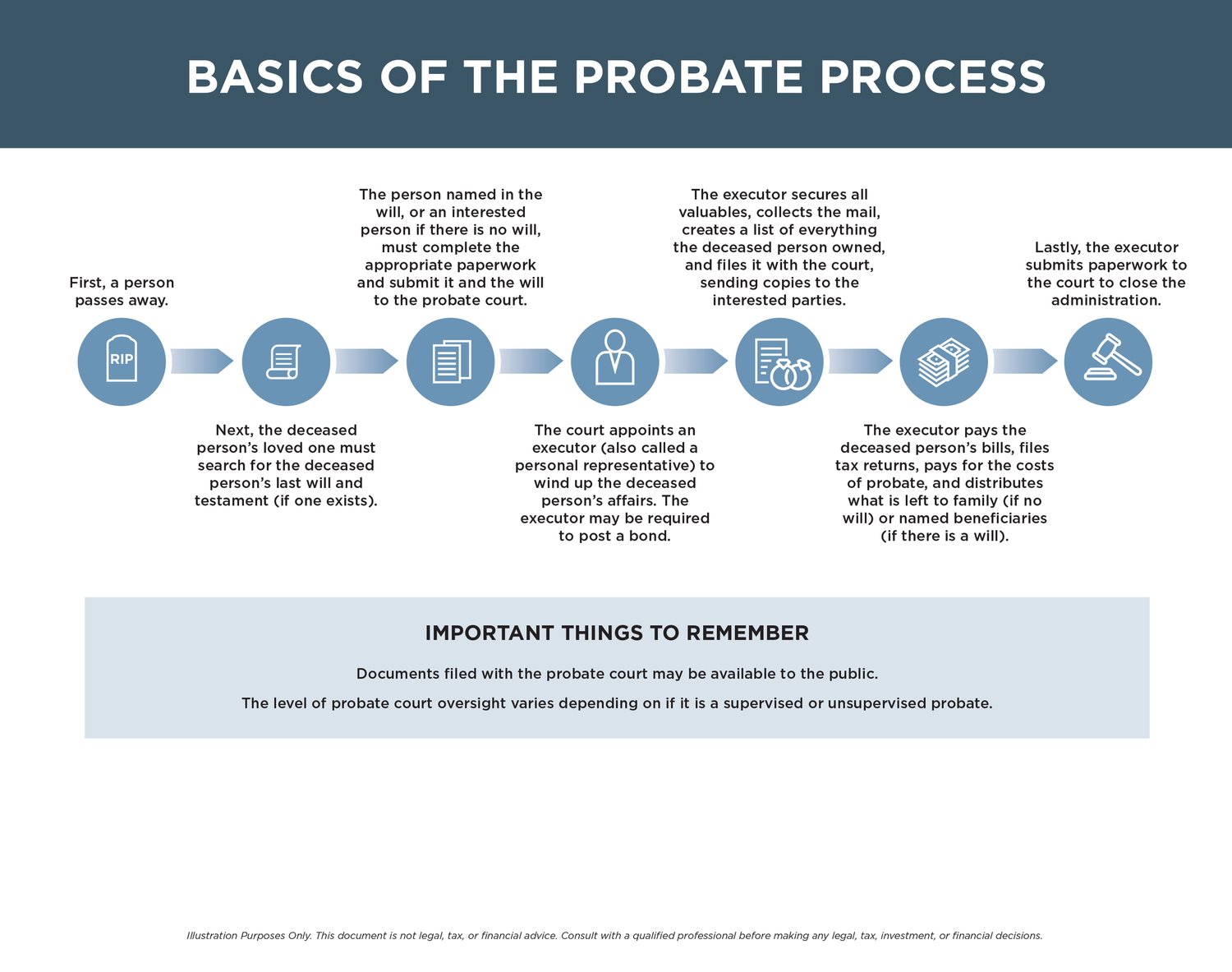

Before we dive into the tips, it’s essential to understand what probate is and why it’s necessary. Probate is the legal process of validating a deceased person’s will and distributing their assets according to their wishes. This process typically involves the court system and can be complex, which is why it’s crucial to have a good understanding of what’s involved. The probate process usually includes:

- Authenticating the will: Verifying that the will is genuine and was signed by the deceased person.

- Appointing an executor: Naming the person responsible for managing the estate and carrying out the wishes outlined in the will.

- Notifying beneficiaries and creditors: Informing those who will inherit assets from the estate, as well as any creditors who may have a claim against the estate.

- Settling debts and taxes: Paying any outstanding debts or taxes owed by the estate.

- Distributing assets: Transferring ownership of assets to the beneficiaries named in the will.

Tips for Filing Probate

Now that we have a better understanding of what probate is, let’s move on to the 5 tips for filing probate:

- Seek professional advice: Filing probate can be a complex and time-consuming process, especially if you’re not familiar with the legal system. Consider hiring a probate attorney or seeking guidance from a trustee company to help you navigate the process.

- Gather all necessary documents: To file probate, you’ll need to gather a range of documents, including:

- The original will

- Death certificate

- Proof of identity (e.g., passport, driver’s license)

- Asset documentation (e.g., property deeds, bank statements)

- Tax returns and other financial records

- Understand the costs involved: Filing probate can be expensive, with costs including:

- Court fees: Paid to the court for the probate process

- Attorney fees: Paid to the probate attorney for their services

- Appraisal fees: Paid to appraisers for valuing assets

- Other expenses: Such as taxes, debts, and other costs associated with managing the estate

- Be prepared for the time it takes: Filing probate can take several months to a year or more, depending on the complexity of the estate and the efficiency of the probate process. Be patient and plan accordingly, as this process can be lengthy and unpredictable.

- Keep detailed records: Throughout the probate process, it’s essential to keep detailed records of all transactions, communications, and decisions made. This will help ensure that the estate is managed efficiently and that all parties involved are informed and up-to-date.

📝 Note: Keeping accurate records is crucial in case of any disputes or audits that may arise during the probate process.

Additional Considerations

In addition to the tips outlined above, there are several other factors to consider when filing probate. These include:

- Tax implications: The probate process can have tax implications, such as inheritance tax or capital gains tax. It’s essential to understand these implications and plan accordingly.

- Beneficiary disputes: Disputes can arise between beneficiaries, especially if there are conflicting interests or unclear wishes outlined in the will. Seeking mediation or arbitration can help resolve these disputes.

- Asset distribution: The distribution of assets can be complex, especially if there are multiple beneficiaries or assets with significant value. Seeking professional advice can help ensure that assets are distributed fairly and in accordance with the deceased person’s wishes.

| Asset Type | Probate Requirement |

|---|---|

| Real estate | Yes, unless held in joint tenancy or trust |

| Bank accounts | Yes, unless held in joint tenancy or trust |

| Investments (e.g., stocks, bonds) | Yes, unless held in joint tenancy or trust |

| Personal property (e.g., vehicles, jewelry) | Yes, unless otherwise specified in the will |

As we can see, the probate process can be complex and time-consuming, but with the right guidance and support, it can be navigated successfully. By following these 5 tips and considering the additional factors outlined above, you can ensure that the probate process is as smooth and stress-free as possible.

In summary, filing probate requires careful planning, attention to detail, and a good understanding of the legal process. By seeking professional advice, gathering all necessary documents, understanding the costs involved, being prepared for the time it takes, and keeping detailed records, you can navigate the probate process with confidence. Additionally, considering tax implications, beneficiary disputes, and asset distribution can help ensure that the estate is managed efficiently and that all parties involved are informed and up-to-date.

What is the purpose of probate?

+

The purpose of probate is to validate a deceased person’s will and distribute their assets according to their wishes.

How long does the probate process take?

+

The probate process can take several months to a year or more, depending on the complexity of the estate and the efficiency of the probate process.

Do I need to hire a probate attorney?

+

While it’s not always necessary to hire a probate attorney, it’s highly recommended, especially if you’re not familiar with the legal system or the estate is complex.