5 Tips to Speed Bond Approval

Introduction to Speed Bond Approval

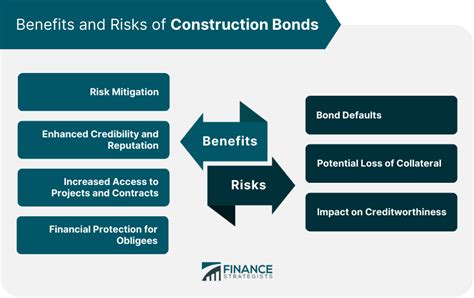

In the world of business and finance, time is of the essence. When it comes to securing a bond, the approval process can be lengthy and cumbersome, potentially hindering the progress of projects or ventures. Therefore, understanding how to expedite this process is crucial for companies and individuals looking to move forward with their plans efficiently. This article delves into the realm of bond approval, focusing on strategies and tips that can help speed up the process, ensuring that businesses can access the funds they need without unnecessary delays.

Understanding the Bond Approval Process

Before diving into the tips for speeding up bond approval, it’s essential to have a basic understanding of what the bond approval process entails. Typically, this process involves several steps, including application submission, review, underwriting, and finally, approval or denial. Each of these steps requires careful consideration and the provision of detailed information to ensure a smooth and efficient process. Knowledge of the process is key to navigating it effectively and identifying potential bottlenecks.

Tips for Speeding Up Bond Approval

Given the complexities and the time-sensitive nature of bond approvals, implementing strategies to expedite the process can be highly beneficial. Here are five tips designed to help streamline the bond approval process:

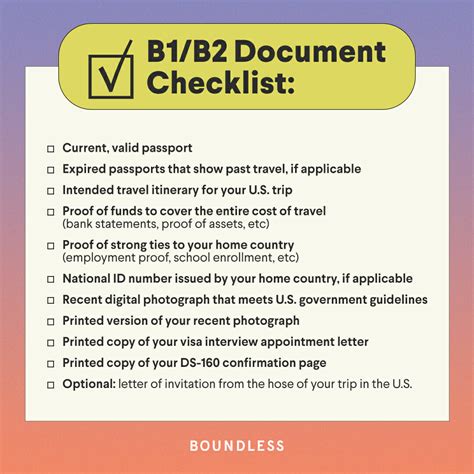

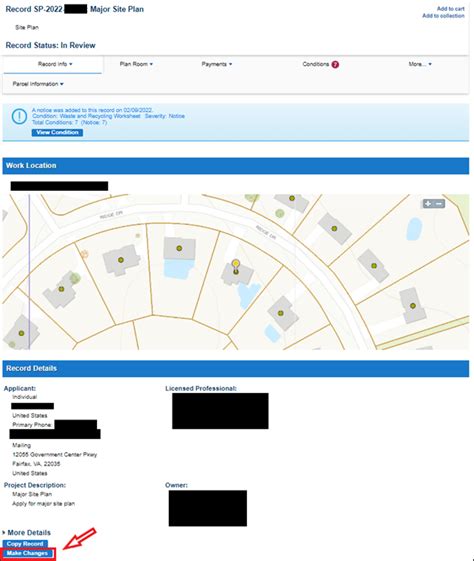

- Prepare Thoroughly: One of the most significant delays in bond approval comes from incomplete or inaccurate applications. Ensuring that all required documentation is in order and readily available can significantly reduce the time it takes for the application to be processed.

- Choose the Right Bond Type: Different bonds have different approval processes. Understanding which type of bond is most suitable for your needs and choosing accordingly can help in avoiding unnecessary complications and delays.

- Work with Experienced Professionals: Collaborating with financial advisors or bond specialists who have a deep understanding of the approval process can provide invaluable insights and help navigate potential hurdles more efficiently.

- Maintain a Good Credit Score: A good credit score can significantly influence the bond approval process. Maintaining a healthy financial profile can not only speed up the approval but also potentially lead to more favorable terms.

- Leverage Technology: Many financial institutions now offer digital platforms for bond applications, which can expedite the process by reducing paperwork and increasing the speed of communication and feedback.

Implementing Efficiency in Bond Approval

Implementing these tips requires a combination of preparation, strategic planning, and the right mindset. By approaching the bond approval process with a focus on efficiency and speed, individuals and businesses can minimize delays and maximize their chances of securing the necessary funds in a timely manner. Efficiency in this context is not just about speeding up the process but also about ensuring that every step is taken with the ultimate goal of approval in mind.

Common Challenges and Solutions

Despite the best preparations, challenges can arise during the bond approval process. Being aware of these potential issues and having strategies to address them can further contribute to a smoother and faster experience. Some common challenges include:

- Incomplete Documentation: Ensuring that all required documents are complete and accurate can prevent delays.

- Credit Issues: Maintaining a good credit score and addressing any credit issues promptly can improve the likelihood of approval.

- Lack of Experience: Working with experienced professionals can help navigate the process more effectively.

📝 Note: It's also important to stay informed about any changes in regulations or market conditions that could affect the bond approval process.

In the pursuit of speeding up bond approval, it’s crucial to balance the need for efficiency with the importance of accuracy and compliance. By doing so, individuals and businesses can ensure that they are well on their way to securing the bonds they need without unnecessary delays.

In essence, the key to a speedy bond approval lies in a combination of thorough preparation, strategic decision-making, and the ability to navigate the process with agility and precision. By embracing these strategies and maintaining a focus on efficiency, the bond approval process can be transformed from a potential hurdle into a stepping stone for success.

What are the primary factors that influence bond approval?

+

The primary factors include credit score, the type of bond applied for, and the completeness and accuracy of the application.

How can technology aid in the bond approval process?

+

Technology can aid by providing digital platforms for applications, reducing paperwork, and enhancing communication between parties involved.

What role do financial advisors play in speeding up bond approval?

+

Financial advisors can provide valuable insights, help navigate the process, and ensure that applications are complete and accurate, thereby reducing potential delays.