7 Tips Chapter 13

Introduction to Chapter 13

When it comes to managing debt, individuals often find themselves in a precarious situation, unsure of how to navigate the complexities of financial obligations. For many, Chapter 13 bankruptcy emerges as a viable option, offering a structured approach to reorganizing debts and regaining financial stability. This form of bankruptcy is particularly appealing to those who have a steady income and are committed to repaying a portion of their debts over time. In this context, understanding the intricacies of Chapter 13 is crucial for making informed decisions about one’s financial future.

Understanding Chapter 13 Bankruptcy

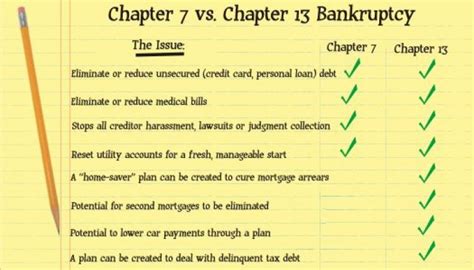

Chapter 13 bankruptcy, also known as a wage earner’s plan, allows individuals with regular income to develop a plan to repay all or part of their debts. This process is facilitated by the court and typically lasts between three to five years. The key aspect of Chapter 13 is its focus on debt repayment, making it an attractive option for those who wish to avoid the more drastic measures associated with Chapter 7 bankruptcy, such as the liquidation of assets. By opting for Chapter 13, individuals can protect their assets and consolidate their debts into a single, manageable monthly payment.

Eligibility for Chapter 13

To be eligible for Chapter 13 bankruptcy, an individual must meet specific criteria. These include having a steady income, which can come from any source, including salary, tips, or even social security benefits. Additionally, there are limits on the amount of debt an individual can have to qualify for Chapter 13. As of the last update, these limits include less than 419,275 in unsecured debts and less than 1,257,850 in secured debts. Individuals who exceed these debt limits may need to explore other bankruptcy options. Understanding these eligibility requirements is essential for determining whether Chapter 13 is the right choice for managing one’s debt.

Benefits of Chapter 13 Bankruptcy

The benefits of filing for Chapter 13 bankruptcy are numerous and can provide significant relief to individuals overwhelmed by debt. Some of the key advantages include: - Stopping Foreclosure: Chapter 13 can temporarily halt foreclosure proceedings, giving homeowners the opportunity to catch up on mortgage payments. - Protecting Assets: Unlike Chapter 7, Chapter 13 allows individuals to keep their assets, including their home, car, and personal belongings. - Consolidating Debt: By consolidating debts into a single monthly payment, individuals can simplify their financial obligations and make them more manageable. - Reducing Debt: In some cases, Chapter 13 plans may allow for the reduction of the principal amount owed on certain debts.

Steps to Filing Chapter 13

Filing for Chapter 13 bankruptcy involves several steps, each critical to the success of the process. These steps include: - Credit Counseling: Before filing, individuals must undergo credit counseling from an approved agency. - Filing the Petition: The bankruptcy petition, along with supporting documents, is filed with the bankruptcy court. - Proposing a Plan: A repayment plan outlining how debts will be paid over the next three to five years is proposed. - Confirmation Hearing: The court reviews and must confirm the repayment plan. - Making Payments: The individual begins making monthly payments according to the confirmed plan.

Common Challenges in Chapter 13

While Chapter 13 offers a structured approach to debt management, it is not without its challenges. Common issues that may arise include: - Difficulty in Making Payments: Struggling to make monthly payments can lead to plan failure. - Changes in Income: Significant changes in income can affect one’s ability to adhere to the repayment plan. - Creditor Objections: Creditors may object to the repayment plan, potentially delaying the confirmation process.

Rebuilding Credit After Chapter 13

After completing a Chapter 13 plan, individuals can begin the process of rebuilding their credit. This involves: - Obtaining a Copy of Your Credit Report: Ensuring the report accurately reflects the completion of the Chapter 13 plan. - Paying Bills on Time: Consistently making payments on time helps to improve credit scores. - Avoiding New Debt: Minimizing new debt and keeping credit utilization low can further enhance credit scores. - Considering a Secured Credit Card: Using a secured credit card responsibly can be a step towards rebuilding credit.

📝 Note: Rebuilding credit takes time and discipline, but with a consistent and responsible approach to financial management, individuals can significantly improve their credit standing over time.

In the aftermath of completing a Chapter 13 bankruptcy, individuals often find themselves in a stronger financial position, having successfully navigated the challenges of debt management. By understanding the process, benefits, and potential challenges of Chapter 13, individuals can make informed decisions about their financial futures. The key to long-term financial stability lies in maintaining disciplined financial habits and continuously working towards improving one’s credit and financial health. Ultimately, the successful completion of a Chapter 13 plan marks not the end, but a new beginning, in an individual’s journey towards financial freedom and security.

What is the primary difference between Chapter 7 and Chapter 13 bankruptcy?

+

The primary difference lies in their approach to debt management. Chapter 7 involves the liquidation of assets to repay debts, whereas Chapter 13 focuses on reorganizing debts and repaying them over time through a structured plan.

How long does a Chapter 13 bankruptcy plan typically last?

+

A Chapter 13 plan usually lasts between three to five years, during which the individual makes monthly payments according to the confirmed plan.

Can I keep my assets if I file for Chapter 13 bankruptcy?

+

Yes, one of the significant benefits of Chapter 13 is that it allows individuals to keep their assets, including their home, car, and personal belongings, as long as they adhere to the repayment plan.