Keep Income Tax Paperwork

Understanding the Importance of Keeping Income Tax Paperwork

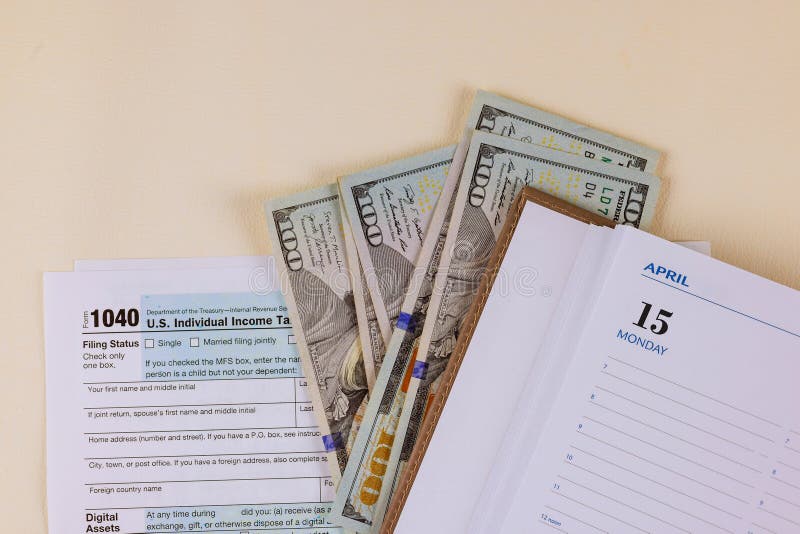

When it comes to managing finances, one of the most crucial aspects is dealing with income tax. The process of filing taxes can be complex and daunting, especially for those who are not familiar with the terminology and procedures involved. One key aspect of tax filing is maintaining accurate and detailed records of all relevant documents, collectively known as income tax paperwork. This includes receipts, invoices, bank statements, and any other documents that can support the information provided on the tax return.

Keeping thorough records is essential for several reasons. Firstly, it helps in accurately calculating tax liability, ensuring that individuals or businesses do not overpay or underpay their taxes. Secondly, it serves as proof of income and expenses, which can be crucial in the event of an audit. Lastly, maintaining detailed records can significantly reduce the stress and complexity associated with tax season, making the entire process more manageable.

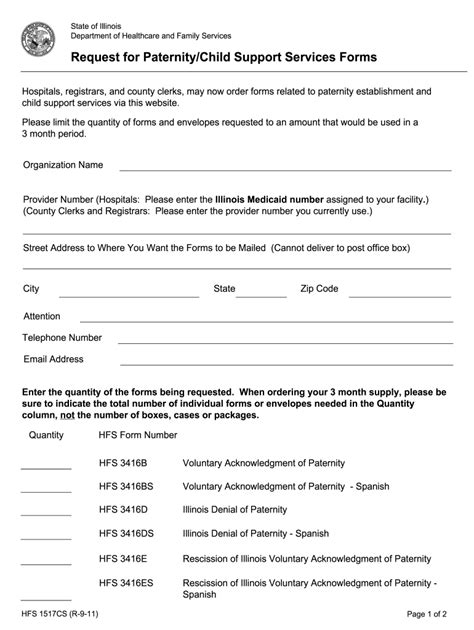

Types of Income Tax Paperwork to Keep

There are various types of documents that should be kept as part of income tax paperwork. These include: - W-2 forms from employers, which show income earned and taxes withheld. - 1099 forms for freelance or contract work, indicating income from these sources. - Bank statements, which can help track income and expenses throughout the year. - Receipts for business expenses, as these can be deducted from taxable income. - Charitable donation receipts, which can also be deductible. - Records of mortgage interest and property taxes, especially for homeowners.

It's also important to keep records of medical expenses, educational expenses, and any investments, as these may have tax implications. For businesses, additional records such as inventory logs, accounts payable and receivable, and employee payroll records are necessary.

How to Organize Income Tax Paperwork

Organizing tax-related documents efficiently is key to a smooth tax filing process. Here are some steps to consider: - Use a filing system: Whether physical or digital, a well-structured filing system can help keep all documents in one place. - Label and date documents: Clearly labeling and dating each document can make it easier to find specific records when needed. - Consider digital storage: Scanning physical documents and storing them digitally can save space and provide an easily accessible backup. - Set reminders: Regularly updating records and setting reminders for tax deadlines can help avoid last-minute rushes.

📝 Note: It's essential to ensure that digital storage methods are secure to protect sensitive financial information.

Benefits of Keeping Accurate Records

Maintaining accurate and detailed income tax paperwork offers several benefits: - Reduces the risk of audits: By having all necessary documents, individuals and businesses can demonstrate compliance with tax laws, reducing the likelihood of being audited. - Saves time and money: Accurate records can simplify the tax preparation process, potentially reducing the cost of hiring a tax professional. - Helps in planning: Detailed financial records can provide valuable insights into spending habits and income patterns, aiding in financial planning and budgeting.

Conclusion

In summary, keeping income tax paperwork is a critical aspect of financial management. It not only helps in accurately filing taxes but also provides a clear picture of one’s financial situation. By understanding the importance of these records, knowing what types of documents to keep, and organizing them efficiently, individuals and businesses can navigate the complexities of tax season with greater ease. This approach also fosters better financial planning and ensures compliance with tax regulations, ultimately leading to financial stability and peace of mind.

What are the most important documents to keep for tax purposes?

+

The most important documents include W-2 forms, 1099 forms, bank statements, receipts for business expenses, charitable donation receipts, and records of mortgage interest and property taxes.

How long should I keep my tax records?

+

It’s generally recommended to keep tax records for at least three years from the date of filing, but this can vary depending on the specific circumstances and the type of tax.

Can I store my tax documents digitally?

+

Yes, digital storage is a convenient and secure way to keep your tax documents, as long as the method used is secure and compliant with relevant data protection regulations.