Paperwork

Keep Tax Return Paperwork

Introduction to Tax Return Paperwork

When it comes to tax return paperwork, many individuals and businesses often find themselves overwhelmed by the sheer amount of documents required to complete the process. The importance of keeping accurate and detailed records cannot be overstated, as it can significantly impact the outcome of your tax return. In this article, we will delve into the world of tax return paperwork, exploring the necessary documents, benefits of keeping them organized, and providing tips on how to maintain a seamless and stress-free experience.

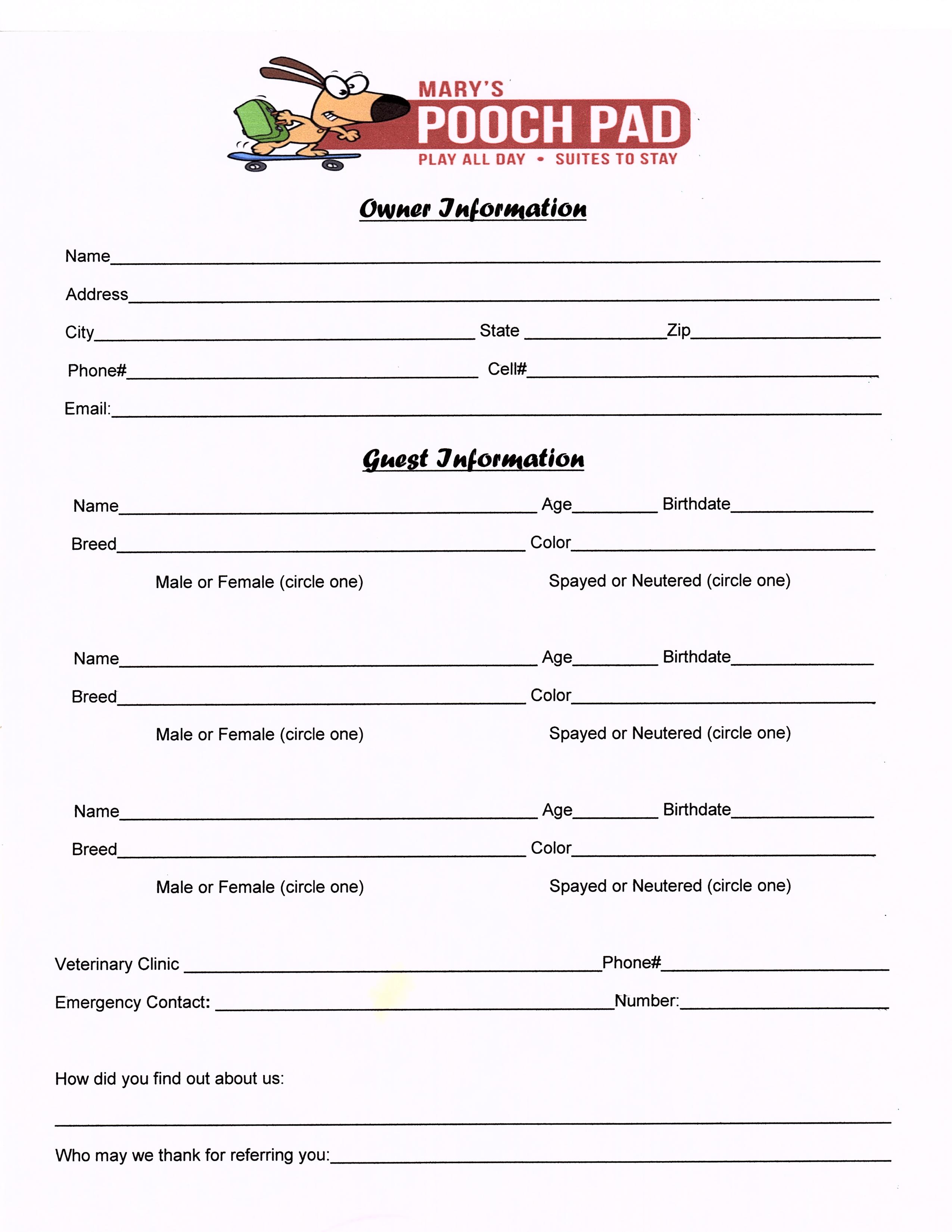

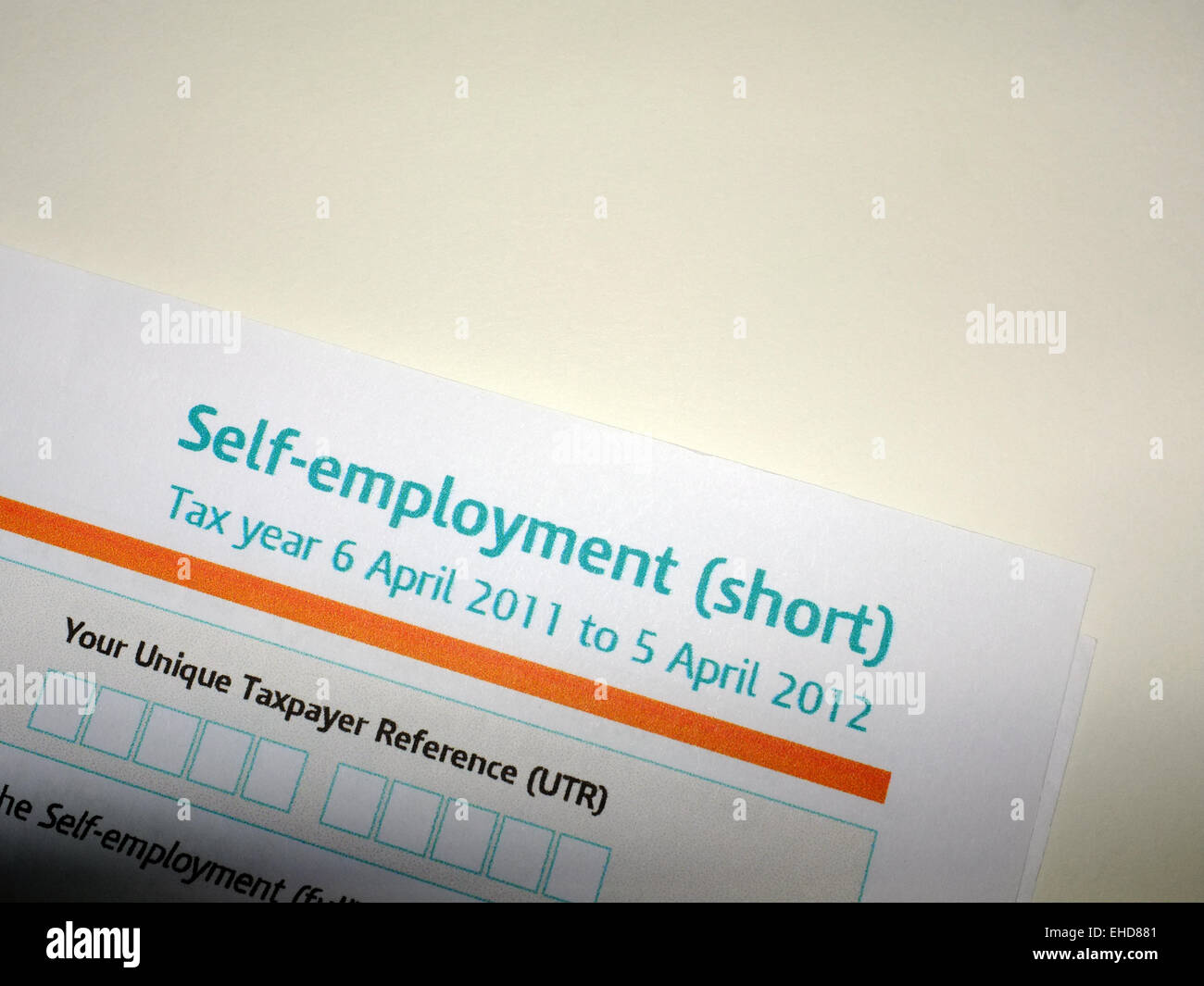

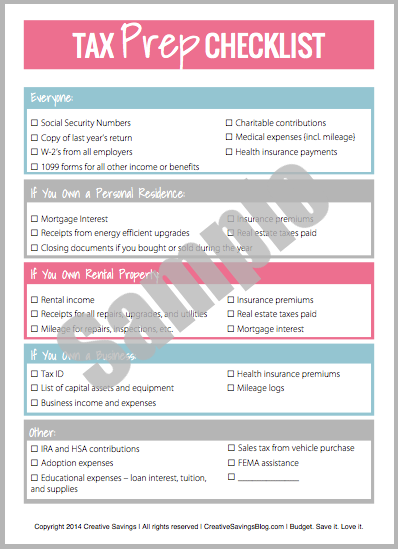

Necessary Documents for Tax Return

To begin with, it’s essential to understand what documents are required for tax return paperwork. These may include: * W-2 forms from your employer, detailing your income and taxes withheld * 1099 forms for freelance or contract work, showing your earnings and any taxes paid * Interest statements from banks and other financial institutions, reporting your interest income * Dividend statements from investments, such as stocks or mutual funds * Charitable donation receipts, which can be claimed as deductions * Medical expense receipts, which may be eligible for tax credits or deductions * Business expense records, including receipts, invoices, and bank statements

Benefits of Keeping Tax Return Paperwork Organized

Keeping your tax return paperwork organized offers numerous benefits, including: * Reduced stress and anxiety during tax season * Increased accuracy and efficiency when completing your tax return * Improved audit preparedness, in case you’re selected for a tax audit * Enhanced financial management, by having a clear understanding of your income and expenses * Better decision-making, with access to detailed financial records and analysis

Tips for Maintaining Tax Return Paperwork

To ensure a smooth and hassle-free experience, follow these tips for maintaining your tax return paperwork: * Create a dedicated folder or digital storage system for your tax documents * Set up a regular filing system, such as monthly or quarterly, to stay on top of your paperwork * Use a tax preparation software or consult a tax professional to help with organization and preparation * Keep digital copies of your documents, in case the originals are lost or damaged * Review and update your records regularly, to ensure accuracy and completeness

Common Mistakes to Avoid

When it comes to tax return paperwork, there are several common mistakes to avoid: * Insufficient record-keeping, leading to missed deductions or credits * Inaccurate or incomplete information, resulting in delays or audits * Failure to report all income or expenses, which can lead to penalties or fines * Not keeping receipts or supporting documents, making it difficult to verify claims

📝 Note: It's essential to keep accurate and detailed records, as this can significantly impact the outcome of your tax return.

Conclusion and Final Thoughts

In summary, keeping tax return paperwork organized is crucial for a stress-free and efficient tax season. By understanding the necessary documents, benefits of keeping them organized, and following tips for maintenance, you can ensure a seamless experience. Remember to avoid common mistakes and stay on top of your paperwork to maximize your tax savings and minimize potential issues. With the right approach and mindset, you’ll be well-prepared to navigate the world of tax return paperwork with confidence.

What documents are required for tax return paperwork?

+

The necessary documents for tax return paperwork include W-2 forms, 1099 forms, interest statements, dividend statements, charitable donation receipts, medical expense receipts, and business expense records.

Why is it essential to keep tax return paperwork organized?

+

Keeping tax return paperwork organized offers numerous benefits, including reduced stress, increased accuracy, improved audit preparedness, enhanced financial management, and better decision-making.

What are some common mistakes to avoid when it comes to tax return paperwork?

+

Common mistakes to avoid include insufficient record-keeping, inaccurate or incomplete information, failure to report all income or expenses, and not keeping receipts or supporting documents.