Paperwork

Keep Old Mortgage Paperwork

Introduction to Keeping Old Mortgage Paperwork

When dealing with mortgage paperwork, it’s essential to understand the importance of keeping old documents. Many homeowners might wonder why they need to keep old mortgage paperwork, especially after they’ve paid off their mortgage. However, these documents can be crucial in various situations, and it’s vital to store them securely. In this article, we’ll explore the reasons why you should keep old mortgage paperwork and provide guidance on how to organize and maintain these documents.

Why Keep Old Mortgage Paperwork?

There are several reasons why keeping old mortgage paperwork is a good idea. Some of the key reasons include: * Proof of ownership: Old mortgage paperwork can serve as proof of ownership, which can be helpful in case of disputes or when selling the property. * Tax purposes: You may need to refer to old mortgage documents when filing taxes, especially if you’re claiming deductions or credits related to your mortgage. * Insurance and liability: In the event of a dispute or lawsuit, old mortgage paperwork can provide valuable evidence and help protect you from potential liability. * Future reference: Keeping old mortgage paperwork can be useful when applying for future loans or mortgages, as it provides a record of your payment history and creditworthiness.

What Documents Should You Keep?

When it comes to keeping old mortgage paperwork, it’s essential to know what documents are important to store. Some of the key documents include: * Mortgage deed: This document outlines the terms of your mortgage and serves as proof of ownership. * Loan agreement: This document outlines the terms of your loan, including the interest rate, repayment terms, and any fees associated with the loan. * Payment records: Keeping a record of your mortgage payments can be helpful in case of disputes or when applying for future loans. * Correspondence with your lender: It’s a good idea to keep a record of any correspondence with your lender, including letters, emails, and phone calls.

How to Organize and Store Your Documents

Once you’ve gathered all your old mortgage paperwork, it’s essential to organize and store them securely. Here are some tips: * Use a file folder or binder: Keep all your documents in a designated file folder or binder, making it easy to find what you need. * Scan and digitize: Consider scanning and digitizing your documents to create a digital copy, which can be stored on your computer or in the cloud. * Store in a safe place: Keep your documents in a safe and secure location, such as a fireproof safe or a secure online storage service. * Make copies: Consider making copies of your documents and storing them in a separate location, such as a safe deposit box or with a trusted friend or family member.

Benefits of Keeping Old Mortgage Paperwork

Keeping old mortgage paperwork can have several benefits, including: * Peace of mind: Knowing that you have all your documents in order can give you peace of mind and reduce stress. * Protection from disputes: Having a record of your mortgage payments and correspondence with your lender can help protect you from potential disputes. * Easier access to credit: Keeping a record of your payment history and creditworthiness can make it easier to access credit in the future. * Tax benefits: Keeping old mortgage paperwork can help you claim deductions and credits related to your mortgage, which can save you money on your taxes.

Common Mistakes to Avoid

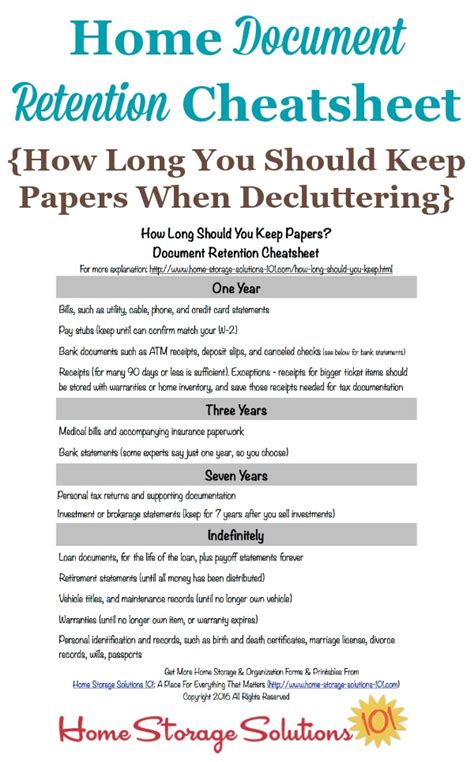

When keeping old mortgage paperwork, there are several common mistakes to avoid, including: * Not keeping documents long enough: Make sure to keep your documents for at least 7-10 years, or as long as recommended by your lender or financial advisor. * Not storing documents securely: Make sure to store your documents in a safe and secure location, such as a fireproof safe or a secure online storage service. * Not making copies: Consider making copies of your documents and storing them in a separate location, such as a safe deposit box or with a trusted friend or family member. * Not reviewing documents regularly: Make sure to review your documents regularly to ensure that they are up-to-date and accurate.

📝 Note: It's essential to review your documents regularly to ensure that they are up-to-date and accurate, and to make any necessary changes or updates.

Conclusion and Final Thoughts

In conclusion, keeping old mortgage paperwork is essential for protecting your interests and ensuring that you have access to the documents you need. By understanding the importance of keeping old mortgage paperwork, organizing and storing your documents securely, and avoiding common mistakes, you can ensure that you’re prepared for any situation that may arise. Remember to keep your documents for at least 7-10 years, store them securely, and make copies to store in a separate location.

What documents should I keep from my old mortgage paperwork?

+

You should keep documents such as your mortgage deed, loan agreement, payment records, and correspondence with your lender.

How long should I keep my old mortgage paperwork?

+

You should keep your old mortgage paperwork for at least 7-10 years, or as long as recommended by your lender or financial advisor.

What are the benefits of keeping old mortgage paperwork?

+

The benefits of keeping old mortgage paperwork include peace of mind, protection from disputes, easier access to credit, and tax benefits.