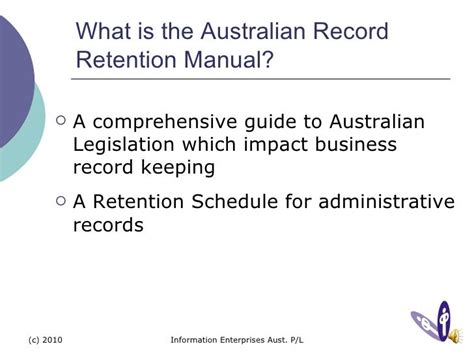

Paperwork Retention Australia

Introduction to Paperwork Retention in Australia

In Australia, paperwork retention is a critical aspect of business operations, compliance, and governance. With the increasing volume of documents and data, companies must implement effective retention strategies to manage their paperwork efficiently. This involves understanding the legal requirements, best practices, and technological solutions for storing, retrieving, and disposing of documents. In this blog post, we will delve into the world of paperwork retention in Australia, exploring the key concepts, benefits, and challenges associated with this essential business function.

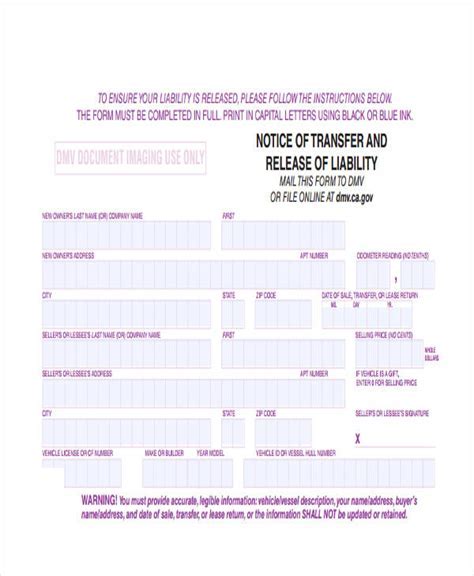

Legal Requirements for Paperwork Retention

Australian businesses must comply with various laws and regulations regarding paperwork retention. The Australian Securities and Investments Commission (ASIC) and the Australian Taxation Office (ATO) are two key regulatory bodies that govern paperwork retention. The Corporations Act 2001 and the Income Tax Assessment Act 1997 outline the minimum retention periods for financial records, tax documents, and other business papers. Companies must retain documents for a specified period, typically ranging from 5 to 7 years, depending on the type of document and the relevant legislation.

Benefits of Effective Paperwork Retention

Implementing a robust paperwork retention system offers numerous benefits to Australian businesses. Some of the advantages include: * Improved compliance: By retaining documents in accordance with legal requirements, companies can minimize the risk of non-compliance and associated penalties. * Enhanced accountability: Effective paperwork retention enables businesses to demonstrate transparency and accountability in their operations, which can lead to increased stakeholder trust. * Increased efficiency: A well-organized paperwork retention system allows companies to quickly locate and retrieve documents, reducing the time and resources spent on manual searches. * Better decision-making: By maintaining accurate and complete records, businesses can make informed decisions and identify areas for improvement.

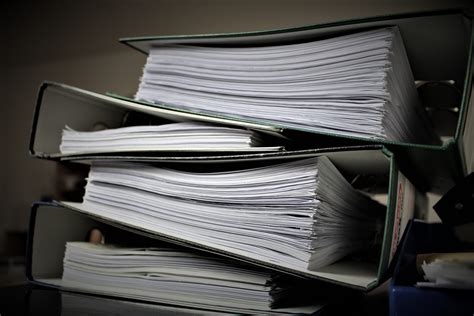

Challenges of Paperwork Retention

Despite the benefits, paperwork retention can be a challenging task for Australian businesses. Some of the common obstacles include: * Information overload: The sheer volume of documents and data can make it difficult for companies to manage their paperwork effectively. * Lack of standardization: Inconsistent filing systems and inadequate documentation can lead to confusion and errors. * Insufficient storage: Limited physical or digital storage space can hinder a company’s ability to retain documents for the required period. * Security concerns: The risk of data breaches, cyber attacks, and unauthorized access can compromise the integrity of retained documents.

Best Practices for Paperwork Retention

To overcome the challenges associated with paperwork retention, Australian businesses can adopt the following best practices: * Develop a retention policy: Establish a clear policy outlining the types of documents to be retained, the retention period, and the storage procedures. * Implement a centralized filing system: Use a standardized filing system to store and manage documents, ensuring easy access and retrieval. * Utilize digital storage solutions: Consider using cloud-based storage or digital document management systems to reduce physical storage needs and enhance security. * Train employees: Educate staff on the importance of paperwork retention, the retention policy, and the procedures for storing and retrieving documents.

Technological Solutions for Paperwork Retention

Australian businesses can leverage various technological solutions to streamline their paperwork retention processes. Some of the popular options include: * Document management software: Utilize software solutions like SharePoint, Documentum, or Alfresco to manage and store electronic documents. * Cloud-based storage: Use cloud storage services like Google Drive, Dropbox, or Microsoft OneDrive to store and access documents remotely. * Scanning and digitization: Convert physical documents to digital format using scanning and digitization technologies, reducing storage needs and enhancing accessibility.

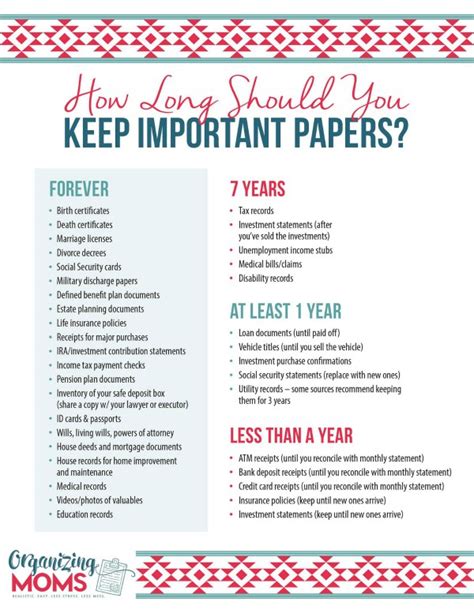

| Document Type | Retention Period |

|---|---|

| Financial records | 5-7 years |

| Tax documents | 5-7 years |

| Employee records | 7 years |

📝 Note: The retention periods outlined in the table are general guidelines and may vary depending on the specific legislation and regulatory requirements.

In summary, paperwork retention is a critical aspect of business operations in Australia, requiring companies to navigate complex legal requirements, implement effective retention strategies, and leverage technological solutions to manage their documents efficiently. By understanding the benefits, challenges, and best practices associated with paperwork retention, Australian businesses can ensure compliance, improve accountability, and make informed decisions.

What is the minimum retention period for financial records in Australia?

+

The minimum retention period for financial records in Australia is 5 years, as specified in the Corporations Act 2001.

Can Australian businesses use cloud-based storage for paperwork retention?

+

Yes, Australian businesses can use cloud-based storage solutions for paperwork retention, provided they ensure the security and integrity of the stored documents.

What are the benefits of implementing a centralized filing system for paperwork retention?

+

Implementing a centralized filing system can improve efficiency, reduce errors, and enhance accessibility, making it easier for businesses to manage their paperwork retention.