Tax Paperwork Retention Period

Understanding the Importance of Tax Paperwork Retention

When it comes to managing your finances, keeping track of tax paperwork is essential. The retention period for tax documents varies depending on the type of document and the country’s tax laws. In this blog post, we will explore the different types of tax paperwork, their retention periods, and provide tips on how to organize and maintain your tax documents.

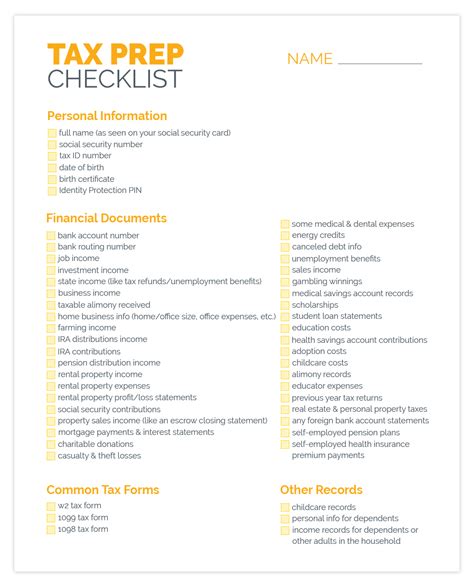

Types of Tax Paperwork and Their Retention Periods

There are several types of tax paperwork that you need to retain, including:

- Income tax returns: These should be kept for at least 3 years from the date of filing, in case of an audit.

- W-2 forms: These should be kept for at least 3 years from the date of filing, as they are used to report income and taxes withheld.

- 1099 forms: These should be kept for at least 3 years from the date of filing, as they are used to report income from freelance work or self-employment.

- Business expense records: These should be kept for at least 3 years from the date of filing, as they are used to calculate business income and expenses.

- Charitable donation receipts: These should be kept for at least 3 years from the date of filing, as they are used to claim charitable deductions.

Organizing and Maintaining Tax Documents

To ensure that you can easily access and retrieve your tax documents when needed, it’s essential to have a well-organized system in place. Here are some tips to help you get started:

- Create a centralized filing system: Designate a specific folder or file cabinet to store all your tax documents.

- Use clear and concise labels: Label each file or folder with the type of document, the year, and any other relevant information.

- Keep digital copies: Scan your tax documents and save them to a secure digital storage device, such as an external hard drive or cloud storage service.

- Shred unnecessary documents: Regularly shred any unnecessary tax documents to protect your identity and prevent clutter.

Benefits of Proper Tax Paperwork Retention

Proper tax paperwork retention can provide several benefits, including:

- Avoid penalties and fines: Keeping accurate and complete tax records can help you avoid penalties and fines in case of an audit.

- Maximize tax deductions: Retaining tax documents can help you identify and claim eligible tax deductions, which can reduce your tax liability.

- Reduce stress and anxiety: Having a well-organized tax paperwork system can reduce stress and anxiety during tax season.

📝 Note: It's essential to consult with a tax professional or accountant to ensure that you are meeting the specific tax paperwork retention requirements for your country or region.

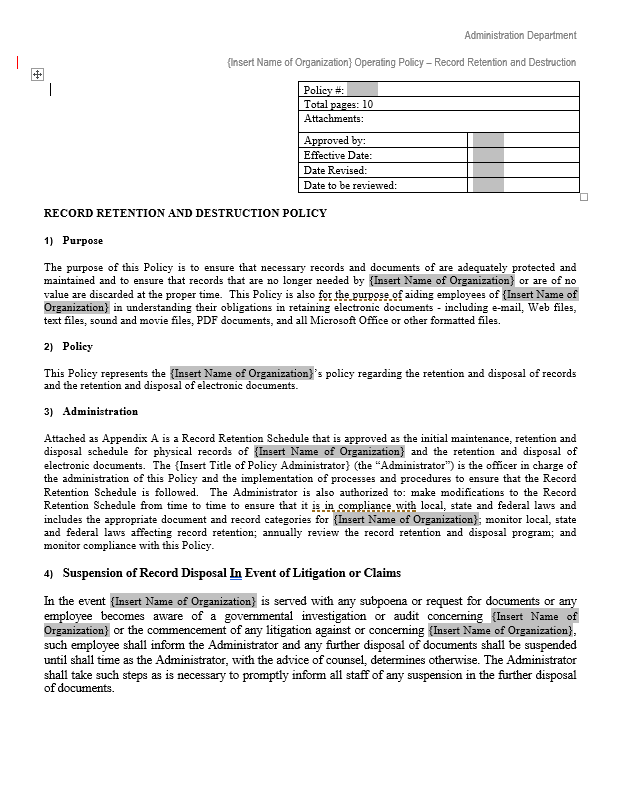

Best Practices for Tax Paperwork Retention

To ensure that you are meeting the tax paperwork retention requirements, follow these best practices:

- Keep tax documents for the required period: Retain tax documents for the specified period, as outlined in the tax laws and regulations.

- Regularly review and update tax documents: Regularly review and update your tax documents to ensure that they are accurate and complete.

- Use secure storage methods: Use secure storage methods, such as a safe or locked file cabinet, to protect your tax documents from unauthorized access.

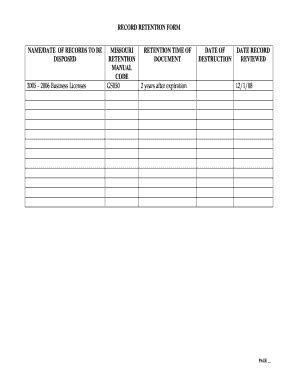

| Type of Tax Document | Retention Period |

|---|---|

| Income tax returns | At least 3 years from the date of filing |

| W-2 forms | At least 3 years from the date of filing |

| 1099 forms | At least 3 years from the date of filing |

| Business expense records | At least 3 years from the date of filing |

| Charitable donation receipts | At least 3 years from the date of filing |

In summary, retaining tax paperwork is essential for meeting tax laws and regulations, maximizing tax deductions, and reducing stress and anxiety during tax season. By understanding the different types of tax paperwork, their retention periods, and following best practices for tax paperwork retention, you can ensure that you are meeting the requirements and avoiding any potential penalties or fines.

What is the retention period for income tax returns?

+

The retention period for income tax returns is at least 3 years from the date of filing.

How long should I keep W-2 forms?

+

You should keep W-2 forms for at least 3 years from the date of filing.

What is the best way to store tax documents?

+

The best way to store tax documents is to use a centralized filing system, clear and concise labels, and secure storage methods, such as a safe or locked file cabinet.