Chapter 13 Filing Timeframe

Understanding the Chapter 13 Filing Timeframe

Filing for Chapter 13 bankruptcy can be a complex and time-consuming process. It’s essential to understand the timeframe involved in filing for Chapter 13 bankruptcy to ensure a smooth and successful process. In this article, we will delve into the details of the Chapter 13 filing timeframe, including the steps involved, the timeline, and the importance of meeting deadlines.

Steps Involved in Filing for Chapter 13 Bankruptcy

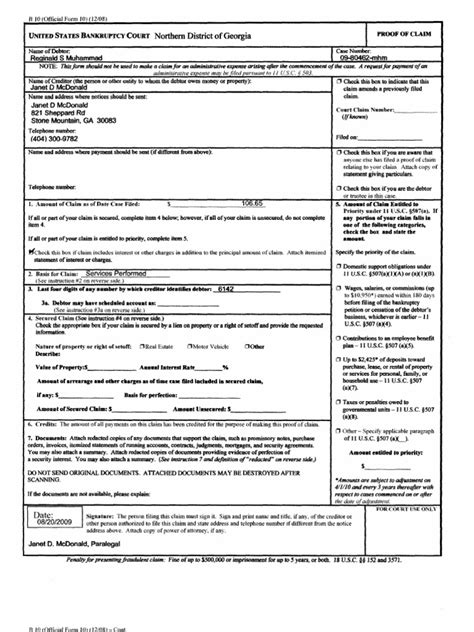

Before we dive into the timeframe, let’s take a look at the steps involved in filing for Chapter 13 bankruptcy: * Step 1: Credit Counseling: The first step in filing for Chapter 13 bankruptcy is to undergo credit counseling from a reputable credit counseling agency. This step is mandatory and must be completed within 180 days before filing for bankruptcy. * Step 2: Gather Financial Documents: The next step is to gather all financial documents, including income statements, expense reports, and debt information. * Step 3: Prepare the Bankruptcy Petition: The bankruptcy petition must be prepared and filed with the court. This includes providing detailed financial information and a plan for repaying debts. * Step 4: File the Bankruptcy Petition: The bankruptcy petition must be filed with the court, along with the required fee. * Step 5: Attend the 341 Meeting: After filing the bankruptcy petition, the debtor must attend a 341 meeting, also known as a meeting of creditors.

Chapter 13 Filing Timeframe

The timeframe for filing for Chapter 13 bankruptcy can vary depending on the individual’s circumstances. However, here is a general outline of the timeline: * 180 days before filing: Credit counseling must be completed within 180 days before filing for bankruptcy. * 1-3 months before filing: Financial documents must be gathered, and the bankruptcy petition must be prepared. * Filing day: The bankruptcy petition must be filed with the court, along with the required fee. * 20-40 days after filing: The 341 meeting must be attended. * 3-5 years after filing: The debtor must make payments according to the repayment plan.

Importance of Meeting Deadlines

Meeting deadlines is crucial when filing for Chapter 13 bankruptcy. Failure to meet deadlines can result in: * Dismissal of the bankruptcy case * Loss of assets * Wage garnishment * Other financial consequences

📝 Note: It's essential to work with a reputable bankruptcy attorney to ensure that all deadlines are met, and the bankruptcy process is completed successfully.

Table of Chapter 13 Filing Timeframe

The following table provides a summary of the Chapter 13 filing timeframe:

| Step | Timeframe |

|---|---|

| Credit Counseling | 180 days before filing |

| Gather Financial Documents | 1-3 months before filing |

| Prepare Bankruptcy Petition | 1-3 months before filing |

| File Bankruptcy Petition | Filing day |

| Attend 341 Meeting | 20-40 days after filing |

| Make Payments | 3-5 years after filing |

In summary, the Chapter 13 filing timeframe involves several steps, including credit counseling, gathering financial documents, preparing the bankruptcy petition, filing the petition, attending the 341 meeting, and making payments. Meeting deadlines is crucial to ensure a successful bankruptcy process. By working with a reputable bankruptcy attorney and understanding the timeframe involved, individuals can navigate the complex process of filing for Chapter 13 bankruptcy.

To recap, the key points to remember when filing for Chapter 13 bankruptcy are to complete credit counseling within 180 days before filing, gather financial documents and prepare the bankruptcy petition 1-3 months before filing, file the petition, attend the 341 meeting, and make payments according to the repayment plan. By following these steps and meeting deadlines, individuals can achieve a fresh financial start.

What is the purpose of credit counseling in Chapter 13 bankruptcy?

+

Credit counseling is a mandatory step in filing for Chapter 13 bankruptcy. Its purpose is to help individuals understand their financial situation, explore alternative options, and create a plan to manage their debt.

How long does the Chapter 13 bankruptcy process take?

+

The Chapter 13 bankruptcy process typically takes 3-5 years to complete. During this time, individuals must make payments according to their repayment plan.

What happens if I miss a payment in my Chapter 13 repayment plan?

+

If you miss a payment in your Chapter 13 repayment plan, you may face consequences such as dismissal of your bankruptcy case, loss of assets, or wage garnishment. It’s essential to communicate with your bankruptcy attorney and the court if you’re having trouble making payments.