Paperwork

Keep Paperwork For How Long

Introduction to Record Keeping

When it comes to managing personal or business finances, one of the most crucial aspects is maintaining accurate and comprehensive records. This includes keeping track of various documents, receipts, invoices, and other paperwork that can serve as proof of transactions, expenses, and income. The question that often arises is how long one should keep these documents. The answer can vary depending on the type of document, its significance for tax purposes, and the potential need for future reference.

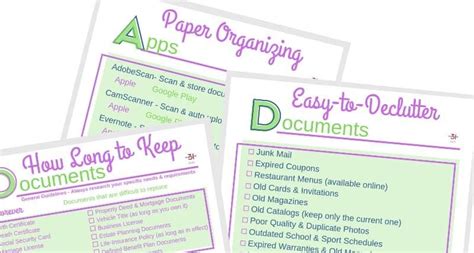

Understanding Different Types of Documents

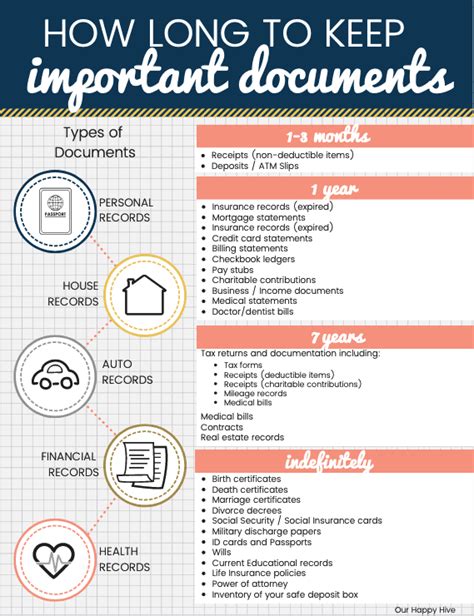

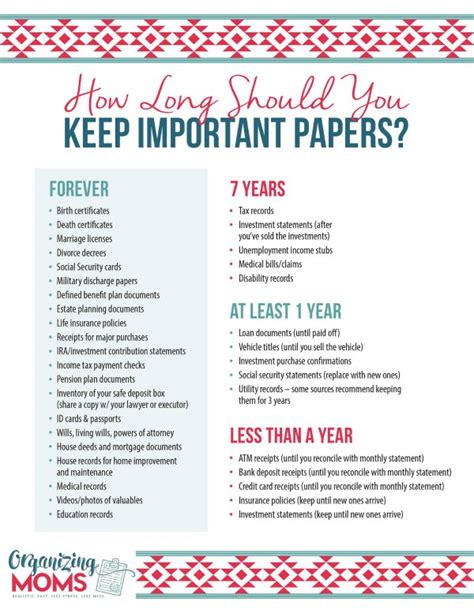

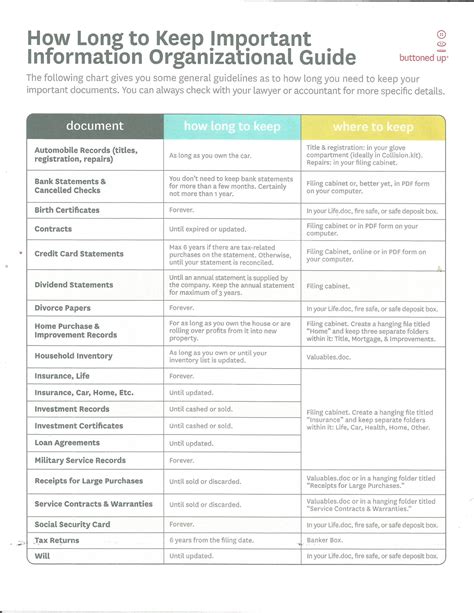

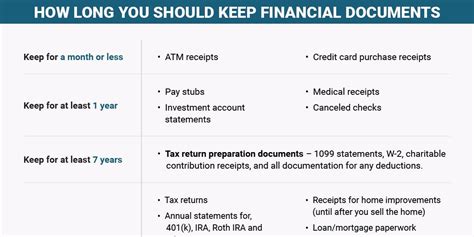

Different types of documents have different retention periods. It’s essential to categorize paperwork into groups such as financial records, tax-related documents, employment records, and personal documents. Each category has its own set of guidelines for how long the documents should be kept.

Financial Records

Financial records include bank statements, investment accounts, and loan documents. These are crucial for tracking financial health and can be necessary for audits or when applying for future credit. Generally, it’s recommended to keep: - Bank statements and cancelled checks for at least a year, especially if they are related to tax-deductible expenses. - Investment accounts and stock records until the asset is sold, plus a few years in case of an audit.

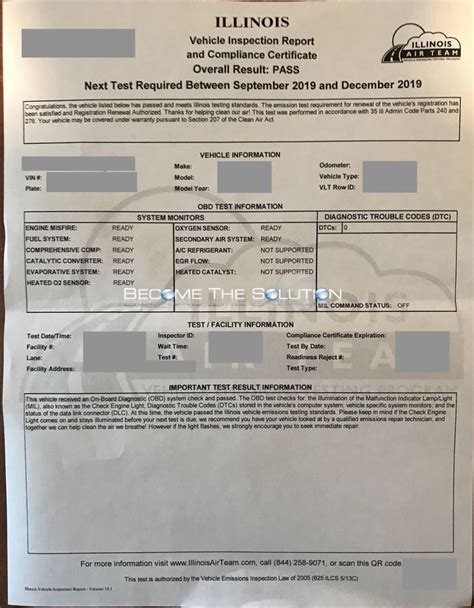

Tax-Related Documents

Tax-related documents are among the most critical papers to keep. The Internal Revenue Service (IRS) can audit returns for up to three years after filing, and in cases of fraud, there’s no time limit. It’s advisable to keep: - Tax returns and supporting documents (e.g., W-2s, 1099s, receipts for deductions) for at least three to seven years. - Records of home improvements for as long as you own the home, as these can be used to calculate capital gains when selling.

Employment Records

Employment records, including pay stubs, benefits information, and retirement accounts, should also be kept for a certain period. Consider keeping: - Pay stubs until you’ve reconciled them with your W-2 form. - Benefits information and retirement accounts documents for as long as they are relevant to your employment or retirement benefits.

Personal Documents

Personal documents such as identification, insurance policies, and wills are critical for personal and family security. These should be kept: - Identification documents (e.g., passport, driver’s license) until they expire or are updated. - Insurance policies until they expire or are replaced. - Wills and estate planning documents indefinitely, or until they are updated.

Digitizing Your Records

In today’s digital age, digitizing records can be an efficient way to store and manage paperwork. Scanning documents and saving them to a secure cloud storage or external hard drive can help declutter physical space while maintaining easy access to important files. However, it’s crucial to ensure these digital files are securely encrypted and backed up regularly.

Physical Storage

For documents that must be kept in physical form, such as original will documents or property deeds, a fireproof safe or a safe deposit box at a bank can provide secure storage. It’s also a good idea to keep these documents in a location known to a trusted individual, in case of an emergency.

Shredding Unnecessary Documents

To protect against identity theft and reduce clutter, shredding unnecessary documents is essential. Documents that contain sensitive information, such as social security numbers, account numbers, or personal identification details, should be shredded once they are no longer needed.

📝 Note: Always check local laws and regulations regarding document retention, as these can vary significantly.

Conclusion and Final Thoughts

In conclusion, maintaining accurate and comprehensive records is vital for personal and financial security. By understanding the different types of documents and their recommended retention periods, individuals can ensure they are well-prepared for audits, financial planning, and personal security. Remember, digitizing records and securely storing physical documents are key strategies in managing paperwork effectively.

How long should I keep tax returns and supporting documents?

+

It’s recommended to keep tax returns and supporting documents for at least three to seven years in case of an audit.

What’s the best way to store important documents securely?

+

Consider using a fireproof safe or a safe deposit box at a bank for physical documents, and encrypt digital files stored in secure cloud storage or external hard drives.

How often should I review and update my document retention policy?

+

It’s a good practice to review your document retention policy annually and update it as necessary to ensure compliance with changing laws and personal circumstances.